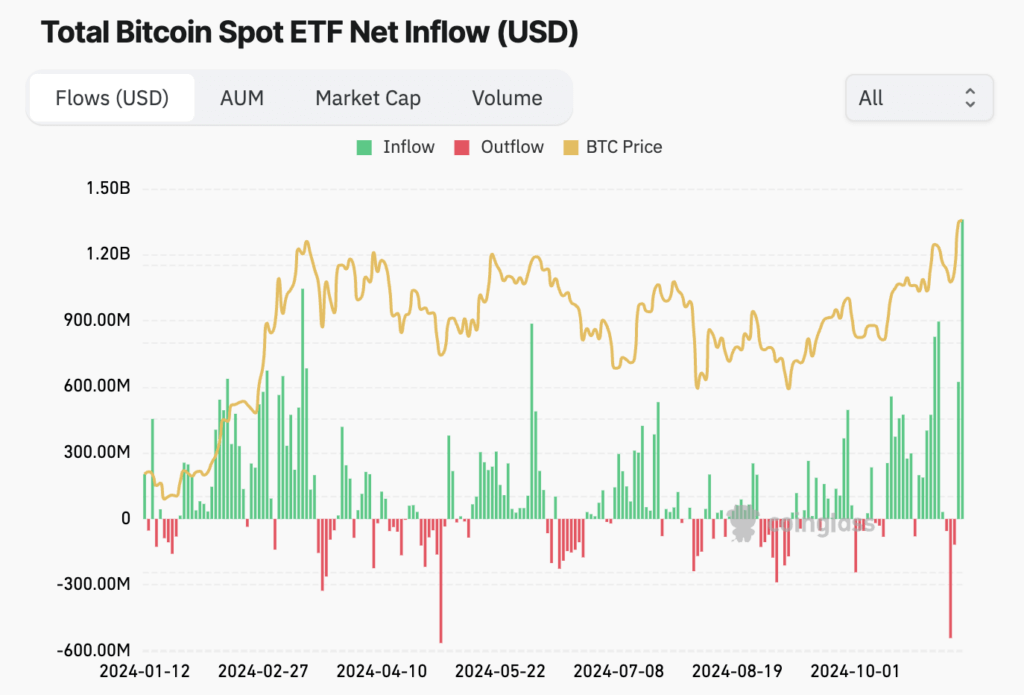

Bitcoin spot ETF inflows have continued to impress, as evidenced by a recent net inflow of $8.4792 million reported yesterday, marking a remarkable four-day streak of positive inflows. This momentum brings hope to cryptocurrency investors who keenly track the performance of ETFs tied to this digital asset. Notably, the Fidelity Bitcoin ETF (FBTC) led the charge with an impressive net inflow of $67.0227 million, contributing to a staggering total historical net inflow of $12.096 billion. In contrast, the BlackRock ETF faced challenges with a significant outflow of $65.9206 million, highlighting the volatile nature of the Bitcoin ETF market value. As the total net asset value of Bitcoin spot ETFs stands at an impressive $111.942 billion, analysts are closely monitoring these trends for future investment opportunities.

The recent activity surrounding Bitcoin exchange-traded funds (ETFs) has sparked a wave of interest among savvy investors. The latest figures showcase substantial net inflows into these financial instruments, drawing attention to various offerings like the Fidelity Bitcoin ETF and the ARK Invest Bitcoin ETF. While some funds experience robust growth, others, such as the BlackRock ETF, have not fared as well, showcasing the fluctuating dynamics of the ETF landscape. With the Bitcoin ETF market value currently reaching $111.942 billion, the stage is set for both challenges and opportunities within this evolving sector. As trends unfold and new data emerges, understanding the intricacies of Bitcoin ETF net inflows will be crucial for navigating investments.

Analyzing Bitcoin Spot ETF Inflows

The total net inflow for Bitcoin spot ETFs recently reached $8.4792 million, solidifying a positive trend over the last four days. With an increasing appetite for Bitcoin investment instruments, these inflows signify growing confidence among institutional and retail investors alike. The continual rise in investment through Bitcoin ETFs indicates a robust market, demonstrating that investors are increasingly opting for managed products to gain exposure to Bitcoin rather than purchasing the digital asset directly.

Furthermore, the persistent inflows are supported by strategic players such as Fidelity and ARK Invest, taking the lead in innovation and product offerings within the Bitcoin ETF space. This suggests a confidence boost among investors considering Bitcoin as a legitimate asset class. As other financial institutions follow suit, the potential for sustained growth in Bitcoin’s adoption through ETFs looks promising.

Key Players in Bitcoin ETFs

Fidelity’s Bitcoin ETF (FBTC) has made headlines with its impressive net inflow of $67.0227 million, marking it as the standout performer in terms of investor interest. This substantial inflow has added to Fidelity’s historical total, which now sits at approximately $12.096 billion. The remarkable performance of FBTC highlights Fidelity’s strong distribution network and marketing efforts, establishing it as a preferred choice among Bitcoin investors.

On the other side of the spectrum, ARK Invest’s ETF (ARKB) has also cemented its place in the Bitcoin market, showing a net inflow of $7.3771 million. This brings ARKB’s cumulative historical net inflow to $1.836 billion, showcasing ARK Invest’s commitment to fostering innovation in cryptocurrency investing. Such developments from leading financial entities enhance the credibility of Bitcoin spot ETFs and signal to the market that digital currencies are gaining traction among institutional investors.

Impact of BlackRock ETF Outflows

In contrast, the BlackRock ETF (IBIT) faced notable challenges, experiencing a net outflow of $65.9206 million. This situation is quite significant considering its vast historical net inflow of $62.501 billion. Such volatility can send mixed signals to market participants regarding investor sentiment toward Bitcoin ETFs, especially in light of competitive offerings from firms like Fidelity and ARK Invest.

The outflow experienced by IBIT also reflects potential market corrections, whereby investors are strategically reallocating their portfolios to capitalize on more favorable market conditions or to adjust to changing regulatory landscapes. Understanding these dynamics is crucial for prospective Bitcoin ETF investors as they navigate the complexities of market trends and institutional impacts.

The Growing Market Value of Bitcoin ETFs

Currently, the total net asset value of Bitcoin spot ETFs stands at an impressive $111.942 billion. This significant figure underscores the prevailing interest among traders and investors aiming to tap into the advantages that Bitcoin ETFs offer, such as liquidity and price transparency. The market performance of Bitcoin ETFs is increasingly becoming a focal point for analysts observing the cryptocurrency market.

Moreover, the ETF net asset ratio, which currently is around 6.56%, relative to the total market value of Bitcoin indicates a healthy investment climate, balancing the interest between direct Bitcoin purchases and ETF-based investments. As this ratio evolves, it provides insight into investor confidence and market conditions, potentially guiding future investments in Bitcoin and its associated financial products.

Cumulative Historical Net Inflows in Bitcoin ETFs

The cumulative historical net inflow for Bitcoin ETFs has now reached a staggering $57.714 billion. This figure signifies not just the aggregate benefit of the inflows but also reflects a structural change in how investors are perceiving Bitcoin as a valid investment avenue. The increasing total inflow is indicative of a maturation phase in the marketplace, where Bitcoin is given more legitimacy.

These cumulative numbers not only highlight past investor behavior but also set the stage for future expectations. As more institutions gain exposure to Bitcoin ETFs and educate higher numbers of retail investors, these inflow figures could inspire confidence in cryptocurrency investing, leading to further growth and relevancy of Bitcoin ETFs in the broader financial landscape.

Frequently Asked Questions

What were the Bitcoin spot ETF inflows reported yesterday?

Yesterday, the total Bitcoin spot ETF inflows amounted to $8.4792 million, continuing a streak of positive inflow over the past four days.

Which Bitcoin ETF recorded the highest net inflow yesterday?

The Fidelity Bitcoin ETF (FBTC) recorded the highest net inflow yesterday, totaling $67.0227 million. This brings FBTC’s historical net inflow to $12.096 billion.

How did the ARK Invest Bitcoin ETF perform in terms of net inflow?

The ARK Invest and 21Shares Bitcoin ETF (ARKB) saw a net inflow of $7.3771 million yesterday, enhancing its total historical net inflow to $1.836 billion.

What was the status of the BlackRock Bitcoin ETF regarding inflows and outflows?

The BlackRock Bitcoin ETF (IBIT) experienced the highest net outflow yesterday, with a total of $65.9206 million, while its historical net inflow stands at $62.501 billion.

What is the current total net asset value of Bitcoin spot ETFs?

As of the latest report, the total net asset value of all Bitcoin spot ETFs is $111.942 billion.

How does the ETF net asset ratio for Bitcoin compare to the total Bitcoin market value?

The ETF net asset ratio, which measures the market value of Bitcoin spot ETFs against the total Bitcoin market value, is currently at 6.56%.

What is the cumulative historical net inflow for Bitcoin spot ETFs?

The cumulative historical net inflow for Bitcoin spot ETFs has reached $57.714 billion.

| Metric | Value |

|---|---|

| Total Net Inflow (Yesterday) | $8.4792 million |

| Days of Continuous Inflow | 4 days |

| Highest Net Inflow ETF | Fidelity ETF (FBTC) – $67.0227 million |

| FBTC Total Historical Net Inflow | $12.096 billion |

| Second Highest Net Inflow ETF | ARK Invest and 21Shares ETF (ARKB) – $7.3771 million |

| ARKB Total Historical Net Inflow | $1.836 billion |

| Highest Net Outflow ETF | BlackRock ETF (IBIT) – $65.9206 million |

| IBIT Total Historical Net Inflow | $62.501 billion |

| Total Net Asset Value of Bitcoin Spot ETFs | $111.942 billion |

| ETF Net Asset Ratio | 6.56% |

| Cumulative Historical Net Inflow | $57.714 billion |

Summary

Bitcoin spot ETF inflows have demonstrated a strong trend with another significant inflow recorded yesterday of $8.4792 million, continuing a streak of four consecutive days of net inflows. This trend underscores the increasing interest in Bitcoin ETFs as investors look for ways to gain exposure to the cryptocurrency through regulated financial products. The performance of the Fidelity ETF (FBTC) highlights this shift, as it achieved the highest net inflow recently, adding to its total historical inflow which has now surpassed $12 billion. On the other hand, the BlackRock ETF (IBIT) experienced a notable net outflow, reflecting market fluctuations. Overall, with Bitcoin spot ETFs now holding assets worth $111.942 billion and boasting a cumulative historical net inflow of $57.714 billion, the landscape remains dynamic and is likely to evolve as investor sentiment shifts.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support