Cryptomixer, a prominent crypto mixing service, has recently come under the spotlight following a significant crackdown by Europol, the EU law enforcement agency. This operation, executed in Zurich, targeted the platform alleged to have facilitated cryptocurrency laundering for cybercriminals by obscuring the origins of illicit bitcoins. Between November 24 and 28, authorities seized multiple servers and the domain Cryptomixer.io, effectively dismantling a service linked to over 1.3 billion euros in laundered funds since its inception in 2016. The fallout from this operation underscores the challenges law enforcement faces regarding crypto crime, particularly as platforms like Cryptomixer provide a facade of anonymity for illicit activities. With Europol taking decisive action against such services, the message is clear: the fight against cryptocurrency-related crime is intensifying.

In the evolving landscape of digital currency, the recent takedown of a popular cryptocurrency mixing platform highlights the ongoing battle against money laundering within the crypto space. Known for its role in obscuring transactions, this mixing service operated under the radar, assisting individuals in concealing the true origins of their digital assets. The coordinated efforts of various law enforcement agencies, particularly in Europe, reflect a growing awareness and response to the intricacies of virtual currency operations. As regulators and authorities ramp up efforts to combat illegal activities associated with decentralized currencies, the implications for users and service providers alike become increasingly significant. This operation serves as a stark reminder of the scrutiny facing platforms that facilitate the exchange of digital assets.

Europol’s Major Operation Against Cryptocurrency Laundering

In a significant move to combat crypto crime, Europol executed a major operation targeting the notorious Cryptomixer service, responsible for laundering vast amounts of illegal funds. The operation, which took place in Zurich, involved the coordination of law enforcement authorities from Switzerland and Germany. By dismantling this crypto mixing service, Europol has not only halted the flow of illicit funds but also demonstrated the international collaborative effort required to tackle the complexities of cryptocurrency-related crime.

The operation was meticulously planned and executed over a five-day period, highlighting the urgency and seriousness of the threat posed by services like Cryptomixer. According to Europol, since its inception, this mixing service has facilitated over 1.3 billion euros in transactions, many of which are linked to serious criminal activities. The successful seizure of assets, including three servers and substantial amounts of bitcoin, underscores the agency’s commitment to disrupting the mechanisms that enable cryptocurrency laundering.

Understanding the Role of Crypto Mixing Services

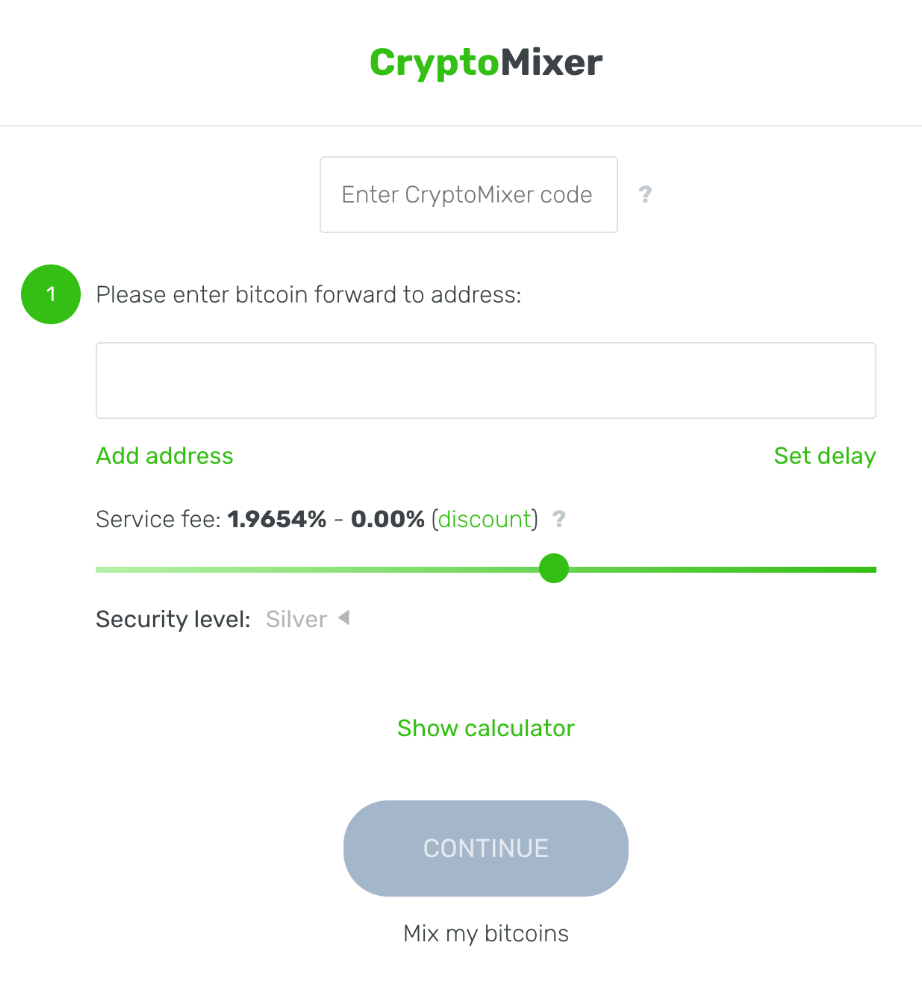

Crypto mixing services, such as Cryptomixer, play a pivotal role in the cryptocurrency ecosystem by providing anonymity to transactions. These platforms allow users to obscure the origins of their cryptocurrency, making it difficult for law enforcement agencies to trace illicit funds. With law enforcement crackdowns increasing, awareness around the functionalities and risks of these mixing services is critical for both users and regulatory bodies. Understanding how these services operate can enhance global efforts in combating crypto crime.

Despite being legal in certain jurisdictions, the rise of crypto mixing services has sparked concerns among regulators and law enforcement agencies like Europol. As users seek to hide their tracks, these platforms have become a haven for criminal activity, including money laundering and financing of illegal enterprises. The urgency of addressing this issue has led to increased scrutiny and measures aimed at regulating such services to prevent their misuse.

The Implications of the Dismantling of Cryptomixer

The shutdown of Cryptomixer signifies a crucial turning point in the ongoing fight against cryptocurrency-related crime. The seizure of over 25 million euros in bitcoin reveals the scale of illicit transactions facilitated through this service. This successful operation serves as a stern warning to other crypto mixing services and emphasizes the nefarious activities often hidden within the crypto landscape. As more operations like this unfold, the hope is to cultivate a safer and more transparent cryptocurrency market.

Moreover, the dismantling of Cryptomixer raises pertinent questions about the future of cryptocurrency anonymity and privacy. As law enforcement agencies continue to enhance their capabilities to trace and monitor transactions, a delicate balance must be struck between the rights of users seeking privacy and the need for regulation. Experts predict that future developments in policy will focus more on compliance and transparency, which may reshape how mixing services operate in the financial ecosystem.

How Law Enforcement Agencies Tackle Crypto Crime

Law enforcement agencies face a formidable challenge in battling crypto crime, especially when dealing with sophisticated mechanisms like cryptocurrency mixers. The complex nature of blockchain technology makes it arduous to trace illicit transactions, necessitating collaboration among international agencies to share intelligence and resources. Operations like the one led by Europol demonstrate the critical approach required to dismantle networks that facilitate money laundering through cryptocurrencies like bitcoin.

These agencies employ advanced analytical tools and blockchain forensics to track the flow of funds. By identifying patterns and addresses linked to illegal activities, they can piece together the puzzle of suspicious cryptocurrency movement. As a result, the recent dismantling of Cryptomixer showcases the effectiveness of these strategies and the potential for even greater successes as law enforcement enhances its capabilities in the evolving landscape of digital currencies.

The Evolution of Cryptocurrency Regulations

As the cryptocurrency landscape evolves, so too do the regulations governing it. The recent operations against services like Cryptomixer reflect a growing consensus that regulatory frameworks must adapt to combat emerging threats effectively. Policymakers and regulators are recognizing the need for stringent measures that can deter illicit activities while still fostering innovation in the cryptocurrency sector.

The EU’s proactive approach toward cryptocurrency regulation is indicative of a broader global trend. Countries around the world are reevaluating their stance towards digital currencies and exploring ways to implement oversight. This evolution of regulations is crucial not only for preventing laundering activities like those facilitated by Cryptomixer but also for ensuring that cryptocurrencies can be safely integrated into the mainstream financial system.

The Future of Cryptocurrency Mixing Services

With the recent crackdowns on crypto mixing services like Cryptomixer, the future of such platforms is uncertain. As law enforcement agencies ramp up their efforts, it’s likely that many of these mixing services will either shut down or significantly alter their operational practices to comply with impending regulations. The landscape might shift toward services that focus on transparency and can demonstrate compliance with the law, thereby retaining user trust while distancing themselves from criminal activities.

However, the demand for privacy in cryptocurrency transactions persists, which may lead to the emergence of new, perhaps more sophisticated, mixing services that operate within the legal confines. These adaptations could foster innovation in privacy technologies, but also present ongoing challenges for regulators tasked with monitoring the use of cryptocurrency for illicit purposes. The outcomes of these developments will significantly shape the dynamics of user privacy versus regulatory compliance in the crypto space.

Challenges Faced by Law Enforcement in Cryptocurrency Crime

The rapid pace of innovation in cryptocurrency technology presents significant challenges to law enforcement agencies working to combat crypto crime. Traditional investigative methods are often insufficient in navigating the decentralized and pseudonymous nature of cryptocurrencies. The complexity of technology, coupled with the continually evolving tactics of cybercriminals, requires ongoing training and adaptation of techniques for law enforcement personnel.

Moreover, the lack of global regulations and the varying legal frameworks across jurisdictions complicate the process of investigating and prosecuting crypto-related cases. Law enforcement must work collaboratively across borders while sharing insights and information to effectively dismantle crypto laundering networks like Cryptomixer. Fostering international cooperation is vital to overcoming these challenges and ensuring that perpetrators of cryptocurrency crime are brought to justice.

The Importance of User Awareness in the Crypto Space

User awareness is critical in the cryptocurrency space, especially with the threats posed by mixing services such as Cryptomixer. As individuals increasingly use digital currencies, understanding the risks associated with using mixing services becomes paramount. Educating users about how these platforms work, the potential legal implications, and the ethical considerations surrounding their use can significantly reduce involvement in crypto crime.

Moreover, enhancing user awareness can empower individuals to make informed decisions and steer clear of risky platforms that jeopardize their assets and compliance with the law. Initiatives aimed at informing the public about safe practices in cryptocurrency will not only foster a more informed user base but also contribute to the broader goal of reducing the impact of illicit activities on the digital economy.

Conclusion: The Fight Against Crypto Crime

The decisive action taken against Cryptomixer serves as a testament to the growing resolve of law enforcement agencies worldwide. This operation highlights not only the significant resources being deployed to combat cryptocurrency crime but also the importance of international collaboration in overcoming the challenges posed by digital currency regulation. As more investigations lead to successful outcomes, there is hope for a more secure and trustworthy cryptocurrency ecosystem.

The road ahead will require continued diligence from authorities, alongside a proactive approach from the crypto community to embrace compliance and ethical practices. As the fight against crypto laundering evolves, fostering an environment of trust will be essential for the adoption and success of cryptocurrencies in legitimate markets.

Frequently Asked Questions

What is a Cryptomixer and how does it work?

Cryptomixer is a crypto mixing service that blends various cryptocurrencies to enhance privacy and anonymity for users. By mixing funds from multiple sources, it obscures transaction trails, making it harder for law enforcement agencies to trace illicit funds. This service has been frequently utilized by cybercriminals for activities such as cryptocurrency laundering.

Why did Europol target the Cryptomixer service?

Europol targeted Cryptomixer due to its involvement in facilitating cryptocurrency laundering. The service was implicated in the movement of illicit bitcoins worth over 1.3 billion euros, making it a prime target for law enforcement efforts to combat crypto crime and illegal activities.

How did the dismantling of Cryptomixer impact the cryptocurrency community?

The dismantling of Cryptomixer by Europol is expected to enhance regulatory scrutiny in the cryptocurrency community. While it aims to curb crypto crime and laundering, it could result in stricter laws and regulations affecting legitimate users of crypto mixing services and their anonymity.

What are the legal implications for using a service like Cryptomixer?

Using a service like Cryptomixer can lead to significant legal implications as it has been associated with cryptocurrency laundering. Law enforcement agencies, such as Europol, are cracking down on such services, as they are often exploited by criminals to hide the origins of illicit funds, raising concerns over compliance and legality.

What evidence did Europol find against Cryptomixer during the operation?

During the operation against Cryptomixer, Europol seized three servers, the domain Cryptomixer.io, and over 25 million euros worth of stolen bitcoins. Additionally, more than 12 terabytes of data were collected, providing strong evidence of the service’s involvement in cryptocurrency laundering activities.

Can individuals still use crypto mixing services after the Cryptomixer crackdown?

While individuals can still find crypto mixing services, the crackdown on Cryptomixer emphasizes the risks involved. Users should be aware that engaging with such services may alert law enforcement agencies and could lead to legal repercussions associated with cryptocurrency laundering.

What are the risks associated with cryptocurrency laundering through services like Cryptomixer?

The risks associated with cryptocurrency laundering through services like Cryptomixer include potential legal action from law enforcement agencies, loss of funds, and involvement in criminal activity. Law enforcement operations against such services can lead to asset seizures and criminal charges for users.

What alternatives to Cryptomixer exist for users seeking anonymity in cryptocurrency transactions?

Alternatives to Cryptomixer include other crypto mixing services, decentralized mixers, and privacy-focused cryptocurrencies. However, each has its own implications regarding legality and security. Users must conduct thorough research to understand the risks involved, especially in the context of law enforcement scrutiny.

| Key Point | Details |

|---|---|

| Agency Involved | Europol and law enforcement from Switzerland and Germany |

| Operation Dates | November 24 to November 28, 2025 |

| Results of the Operation | Seizure of servers, domain, bitcoins valued at over 25 million euros, and over 12 terabytes of data |

| Total Bitcoins Laundered | Over 1.3 billion euros since 2016 |

| Method Used | Longer settlement windows and random fund allocation patterns |

Summary

Cryptomixer has been at the center of attention with the recent dismantling carried out by Europol and collaborating law enforcement agencies. This operation emphasizes the ongoing battle against cryptocurrency-related crimes, with Cryptomixer identified as a significant tool for laundering illicit bitcoins. The seizure of substantial assets and data not only marks a pivotal victory in law enforcement efforts but also highlights the importance of regulating cryptocurrency services to prevent misuse. As digital currencies continue to grow in popularity, the crackdown on operations like Cryptomixer serves as a reminder of the risks and legal ramifications associated with such tools.

Related: More from Regulation & Policy | Anthropic Founder Critiques Pentagons Choice as Unprecedented in Crypto Regulation | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation