The yuan exchange rate plays a crucial role in the global financial landscape, particularly in the context of the USD to yuan conversion. As of today, the central exchange rate of the yuan against the US dollar has risen by 30 points, landing at 7.0759, marking its highest level since October 14, 2024. This significant shift not only reflects the strength of the Chinese yuan but also influences various economic sectors by altering the dynamics of currency comparisons and trade balances. Understanding the yuan exchange rate history can provide insights into this currency’s market behavior and future projections. With the ongoing fluctuations, both investors and exporters closely monitor the yuan to dollar movements to make informed decisions in this pivotal market.

In recent discussions regarding international finance, the valuation of the Chinese currency has gained attention, particularly in relation to the dollar. The current rate at which the yuan trades against the greenback signifies important trends in trade and economic health. As we explore the dynamics of the yuan’s standing in the forex market, the implications of its strength on trade balances and investor sentiment become evident. Additionally, the historical context of the yuan exchange rate provides essential insights into how it compares to the US dollar over time. Analysing the factors influencing the yuan versus USD can illuminate the broader impacts on global economic stability.

Understanding the Yuan Exchange Rate Today

The recent fluctuation in the yuan exchange rate highlights its strength and growing influence as a global currency. As of today, the central exchange rate of the yuan against the US dollar has increased by 30 points, reaching 7.0759. This marks a significant rise and places the yuan at its strongest against the dollar since mid-October 2024. Such movements are crucial for investors and businesses as they indicate the yuan’s performance in the international market and its potential impact on trade and investment strategies.

For those involved in international trade or currency conversion, understanding the yuan’s current standing is vital. The USD to yuan conversion rate not only affects the pricing of goods and services between China and the U.S. but also influences various financial decisions. A stronger yuan might mean more expensive products for American consumers, while also potentially benefiting Chinese exporters by making their goods cheaper for foreign markets.

The Historical Context of Yuan Exchange Rate

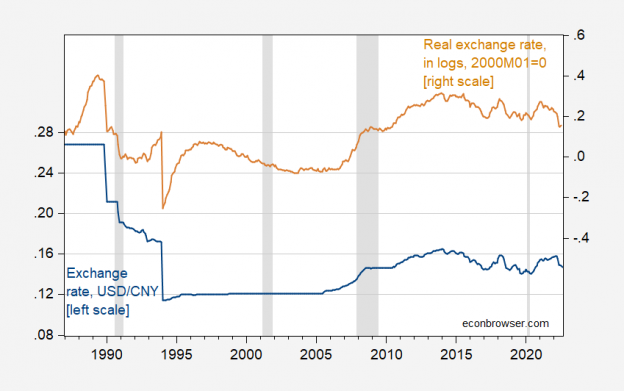

Examining the yuan exchange rate history provides insight into how the currency has evolved over the years. The yuan has experienced fluctuations due to various economic factors including trade policies, inflation rates, and overall economic growth in China. Understanding these historical trends can give stakeholders a clearer picture of the currency’s behavior and anticipated future movements. In recent months, the yuan’s consistent strengthening signals a robust Chinese economy, which could sway the dynamics of international trade significantly.

Additionally, reviewing the history of the yuan against major currencies like the US dollar can help in forecasting potential currency trends. For instance, significant shifts in the yuan exchange rate often correlate with pivotal economic events or policy changes from the Chinese government. This historical perspective is invaluable for traders, investors, and economists aiming to predict future behaviors of the yuan and its impact on global markets.

Analyzing the Chinese Yuan Strength

The strength of the Chinese yuan plays a pivotal role in global finance and trade. With the recent increase in the yuan exchange rate against the US dollar, analysts are observing how this surge will affect China’s economic landscape and its trade relationships. The improvement in the yuan’s valuation indicates confidence in China’s economy and potentially enhances its competitiveness in international markets.

Moreover, as the Chinese yuan takes on more strength, it may lead to increased discussions among global nations regarding the diversification of currency reserves. A stronger yuan could encourage more countries to engage in yuan-denominated trade, providing a viable alternative for conducting international business outside of the US dollar’s dominance. This shift could reshape the global financial system in the coming years.

Comparison Between USD and Yuan

The ongoing comparison between the US dollar and the Chinese yuan is an important area of focus for economists and investors alike. With the yuan currently at 7.0759 against the dollar, the relationship between these two currencies highlights broader economic strategies. Understanding this comparison becomes crucial for businesses engaged in import and export, as shifts in this exchange rate can directly impact profit margins and cost structures.

Additionally, the US dollar often serves as a benchmark for global finance. A strengthening yuan may challenge the dollar’s historical position, leading to discussions on strategies used by policy-makers. For instance, if the yuan continues to strengthen against the dollar, it could encourage foreign trade contracts to be denominated in yuan, thereby slowly eroding the dollar’s supremacy in global markets.

The Impact of Yuan Exchange Rate on International Trade

The recent rise in the yuan exchange rate has significant implications for international trade practices. As the yuan strengthens, it affects the pricing of Chinese exports, which could become relatively more expensive for foreign buyers. This scenario could cause a reevaluation of pricing strategies among Chinese manufacturers and exporters looking to maintain competitiveness in dollars.

On the other hand, a strong yuan also means cheaper imports for China, which may benefit consumers with lower prices on foreign goods. Companies operating within China must adapt their strategies accordingly, balancing the cost of imports and the price competitiveness of their exports. Thus, the yuan’s exchange rate serves as a critical indicator of the health of China’s overall trade balance.

Future Projections for the Yuan Exchange Rate

Looking ahead, projections for the yuan exchange rate against the dollar are compelling for investors seeking opportunities in currency markets. Economists suggest that if the trend of the yuan’s strength continues, it may lead to sustained improvements, influencing capital flows and investment in China. Such predictions are essential for strategizing future investments that capitalize on favorable exchange rates.

Additionally, monitoring geopolitical events and economic reforms within China will be crucial in understanding the yuan’s future value. Factors such as shifts in trade agreements, monetary policies, and global economic conditions will play significant roles. Keeping an eye on these developments will help market participants make informed decisions

Factors Influencing Yuan to Dollar Exchange

Several factors contribute to the ongoing fluctuations in the yuan-to-dollar exchange rate. These include domestic economic indicators, governmental policies, and global economic stability. For instance, if China decides to implement measures to stabilize the yuan or control inflation, it may lead to changes in its strength against the US dollar. Furthermore, geopolitical tensions can also play a role, as investor confidence often sways currency strength.

Moreover, external factors such as changes in US monetary policy and trade relations will inevitably influence how the yuan performs against the dollar. For example, adjustments in interest rates by the Federal Reserve can attract foreign investors towards the US dollar, causing shifts in the yuan’s valuation. Understanding these interconnected factors can provide deeper insights into currency exchange dynamics and investment strategies.

Yuan Exchange Rate’s Influence on Global Currency Trends

The yuan exchange rate doesn’t just influence bilateral trade but also sends ripples across global currency trends. As the yuan strengthens against the dollar, it prompts a reconsideration of how other currencies are valued. The relationship between the yuan and its counterparts can delineate significant trends within the foreign exchange market, affecting hedge funds, banks, and investors globally.

As currencies fluctuate, many markets begin to respond accordingly. For instance, a strong yuan can often lead to pressure on other currencies within the Asia-Pacific region, as economic exchanges influence relative strength. Monitoring these correlations can yield insights into macroeconomic conditions and market expectations in both emerging and established markets.

Practical Considerations for Yuan to Dollar Conversion

For individuals and businesses involved in the conversion of yuan to dollars, understanding the current exchange rate is crucial. With the latest figures reflecting a strengthened yuan, consumers and traders are encouraged to consider optimal timing for their currency exchanges. Utilizing various conversion platforms and financial advisor insights can maximize the benefits of favorable rates in the market.

Additionally, awareness of the fees involved in conversion and the various methods available—such as online exchanges, banks, or currency exchange services—can affect overall costs. By staying informed about the yuan exchange rate and associated financial practices, one can prevent unnecessary expenditures and enhance savings during currency exchanges.

Frequently Asked Questions

What is the current yuan exchange rate against the US dollar?

As of recent updates, the yuan exchange rate against the US dollar is 7.0759, reflecting a rise of 30 points from the previous day and marking the highest rate since October 14, 2024.

How do I convert yuan to dollars using the current yuan exchange rate?

To convert yuan to dollars, you can multiply the amount in yuan by the current yuan exchange rate of 7.0759. For example, if you have 100 yuan, dividing it by the exchange rate will give you the equivalent in US dollars.

What does the yuan exchange rate history reveal about its strength?

The yuan exchange rate history shows fluctuations that indicate the strength of the Chinese yuan over time. Recent records indicate a strengthening trend, with the current exchange rate of 7.0759 being one of its strongest positions since October 2024.

How does the Chinese yuan’s strength affect the USD to yuan conversion?

The strength of the Chinese yuan directly influences USD to yuan conversions. A stronger yuan typically means that it takes fewer yuan to equal one dollar, as evidenced by the recent yuan exchange rate of 7.0759.

What factors influence the yuan exchange rate against the US dollar?

Factors influencing the yuan exchange rate include economic indicators, trade balances, interest rates, and political stability in China and the US. The recent rise to 7.0759 shows how these elements can significantly impact the currency comparison.

| Key Point | Details |

|---|---|

| Central Exchange Rate | The yuan’s exchange rate against the US dollar increased by 30 points. |

| Current Rate | The current exchange rate is 7.0759 yuan per US dollar. |

| Previous Rate | The previous day’s exchange rate was slightly lower, indicating a rise. |

| Highest Level | This is the highest exchange rate since October 14, 2024. |

Summary

The yuan exchange rate has shown significant movement recently, increasing by 30 points to reach a value of 7.0759 yuan per US dollar. This rise marks the highest exchange rate level since mid-October 2024, illustrating the yuan’s strengthening position against the US dollar amidst fluctuating market conditions. Tracking such changes in the yuan exchange rate is crucial for investors and businesses involved in international trade.

Related: More from Exchange News | Irans Crypto Shadow Economy Evades Sanctions in Crypto Exchange | BSP Proposes Stablecoin Yield Rules: Will It Impact Coinbase? in Crypto Exchange