Recently, the cryptocurrency community has been abuzz with activity surrounding ETH deposits to Binance, as a notable address made headlines by depositing 5000 ETH worth $15.36 million. This significant transaction is part of a larger trend of large ETH deposits, where the same address has accumulated over 13,400 ETH in just two weeks. With such high Binance ETH transactions, many are analyzing the implications for Ethereum’s market dynamics through on-chain analysis. Investors are keenly observing this accumulation pattern, as it may signal bullish sentiment for the cryptocurrency investment space. As ETH continues to flow into one of the largest exchanges, the broader cryptocurrency landscape is watching closely for potential price impacts and market movements.

In recent weeks, large transfers of Ethereum to major exchanges have attracted substantial attention, especially as a wallet address offloaded 5000 ETH onto Binance, amounting to over $15 million. This influx contributes to a broader trend of increased ETH accumulation observed across various platforms, enhancing the landscape of cryptocurrency exchanges. As savvy investors engage in strategic ETH transactions, understanding the underlying on-chain dynamics becomes essential for informed trading and investment decisions. Furthermore, this development hints at a potentially bullish shift in the cryptocurrency market, inviting further scrutiny from analysts and market enthusiasts alike. Overall, the continued movement of ETH underscores the growing importance of Ethereum within the digital asset ecosystem.

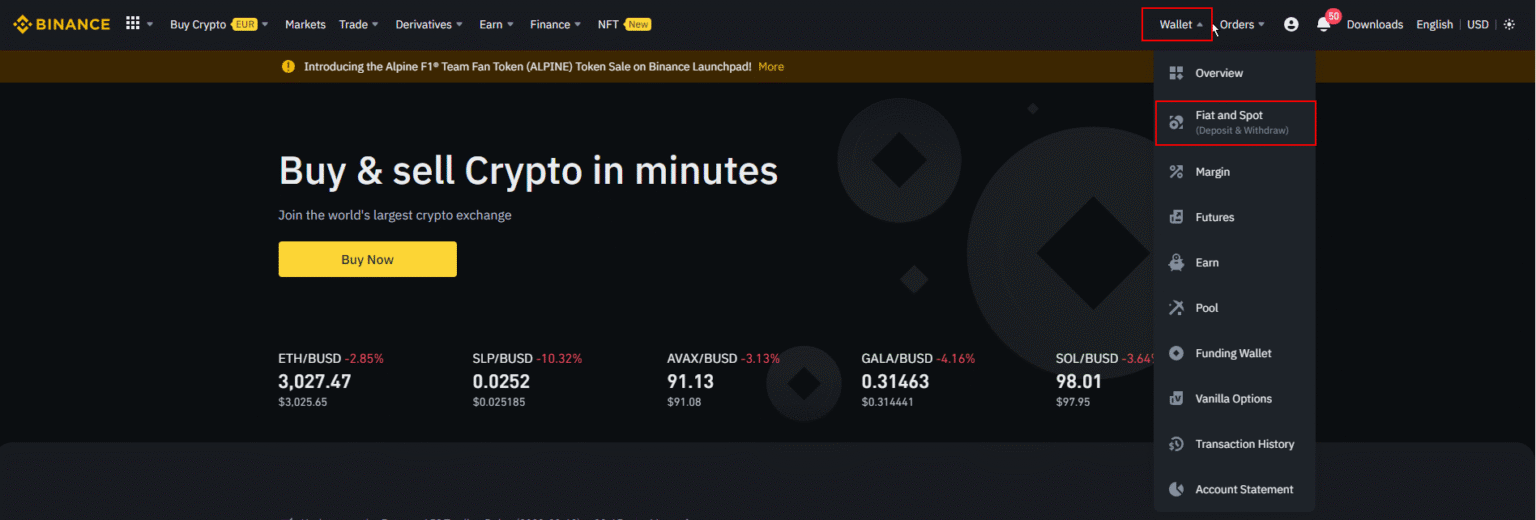

Significant ETH Deposits to Binance

In a striking transaction, an address recently deposited 5,000 ETH to Binance, which reflects an active interest in the cryptocurrency market. This deposit is not merely a single transaction; rather, it is part of a series of large ETH deposits that the address has made over the past two weeks. Overall, the address has contributed a staggering 13,403.28 ETH to Binance, demonstrating significant accumulation behavior. This kind of large movement in cryptocurrency often reflects strategic actions rather than random trading, indicating possible future activities such as sales or conversions.

The continuous flow of ETH to exchanges like Binance can suggest increased confidence in the market or a preparation for further investment moves. On-chain analysis reveals that significant deposits can be correlated with market trends and potential price shifts. For investors, tracking such large ETH transactions can provide valuable insights into market sentiment and future price movements, helping them make informed decisions regarding their cryptocurrency investments.

Understanding ETH Accumulation Patterns

The recent deposit of over 13,400 ETH highlights important patterns in ETH accumulation. Such deposits typically indicate that holders are either anticipating market opportunities or reallocating assets for strategic reasons. Analyzing the on-chain data of this specific address reveals a history of smart trading strategies—acquiring assets like Wrapped Bitcoin (WBTC) at low prices and capitalizing on high market valuations. As holders accelerate their ETH accumulation, they might be positioning themselves to take advantage of anticipated price increases.

Furthermore, these ETH accumulation patterns can be elucidated through on-chain analytics, which provides a comprehensive view of transaction histories and wallet behaviors. The accumulation of ETH can signify bullish sentiment in the market, which can further incentivize retail and institutional investors to enter the market. Hence, keeping an eye on these trends can provide keen insights into future movements within the ETH ecosystem.

Current trends in ETH accumulation are promising for the overall health of the cryptocurrency market. As large holders move significant amounts of ETH to centralized exchanges like Binance, it might indicate a potential catalyst for bullish price actions in the near future. For traders and investors, scrutinizing these patterns could result in identifying lucrative opportunities.

On-Chain Analysis: Insights from Recent Transactions

On-chain analysis has become increasingly critical for understanding cryptocurrency transactions, especially with the recent significant deposits to exchanges like Binance. The technical ability to trace transactions and assess wallet activities gives investors powerful insights into market dynamics. The recent 5,000 ETH deposit, followed by extensive deposits totaling over 13,400 ETH, underscores the importance of leveraging on-chain data. Analysts like Ai Yi provide essential context by connecting historical trading patterns with current market actions, helping investors anticipate shifts and trends.

Utilizing on-chain metrics, investors can better understand the motivations behind large deposits and withdrawals on exchanges. For instance, transactions associated with known entities like Galaxy Digital can signal greater market intentions. When analyzing on-chain data, insights such as trading volumes and frequency of transactions can inform investment strategies and risk management approaches, giving traders a pronounced edge in navigating the volatile cryptocurrency landscape.

The Role of Large ETH Transactions in Market Sentiment

Large ETH transactions serve as significant indicators of market sentiment. When substantial amounts of ETH are deposited to platforms such as Binance, it can create a ripple effect throughout the cryptocurrency market. Such movements often reflect the sentiment of large traders or institutions, who might anticipate and react to price shifts. The recent deposit of 13,403.28 ETH within a short period serves as a barometer reflecting potential bullish sentiment or a strategic repositioning of assets.

Moreover, these massive transactions can influence investor behavior, potentially leading to increased trading volumes and market engagement. The sentiment conveyed by such moves often prompts smaller investors to adjust their strategies—sometimes mimicking the behaviors of large players. Keeping a pulse on these trends is essential for understanding how significant deposit activities can sway overall market dynamics and future price trajectories.

Cryptocurrency Investment Strategies for ETH Holders

As blockchain and cryptocurrency investment strategies evolve, understanding the implications of large ETH deposits becomes crucial for holders and traders alike. The recent deposit of 5,000 ETH to Binance offers insights into how savvy investors manage their holdings. Strategies may vary, but investment approaches that embrace trend analysis, market sentiment, and on-chain data can enhance the decision-making process. By closely monitoring significant transactions, ETH holders can optimize their investment strategies in response to market movements.

Additionally, examining accumulated ETH and the timing of deposits can help identify potential entry or exit points. Investors can develop risk management strategies tailored to these insights while concurrently evaluating market conditions. The dynamic environment of cryptocurrency necessitates a flexible approach, enabling ETH holders to align their strategies with evolving trends, ensuring their investment remains adaptable and informed.

Monitoring ETH Accumulation through Blockchain Trends

Monitoring ETH accumulation through blockchain trends has become essential for anyone invested in the cryptocurrency space. The recent deposits by an address accumulating over 13,400 ETH highlight the importance of tracking blockchain activities. By analyzing these patterns, investors can extrapolate crucial insights about market trends, individual trader behaviors, and broader sentiments in the cryptocurrency landscape. These insights offer predictive capabilities that could shape future trading decisions.

Moreover, blockchain analytics tools provide comprehensive visibility into wallet activities and accumulated amounts, allowing stakeholders to assess the behavior of significant holders. Such analyses can signify impending market shifts or stabilization periods, leading other investors to inform their own trading strategies. As the crypto market continues to evolve, maintaining a keen observation of ETH accumulation patterns will remain vital in leveraging investment opportunities.

Capitalizing on ETH Market Dynamics with Strategic Deposits

The dynamic interplay of cryptocurrency markets makes it imperative for investors to capitalize on strategic deposits of ETH. The recent transaction of depositing 5,000 ETH to Binance emphasizes a conscious investment strategy presenting opportunities for both large holders and retail investors. Utilizing platforms like Binance for trading large volumes can enhance liquidity and create a favorable environment for executing trades effectively—crucial for navigating volatile market conditions.

Furthermore, understanding when and why to make such deposits can provide a competitive advantage. Factors such as market sentiment, external news, and historical trading patterns can influence decision-making processes. For investors willing to analyze these components, strategic deposits might unlock pathways to lucrative investment outcomes, reinforcing the importance of aligning market actions with informed strategies.

Emerging Trends in Cryptocurrency Investment and ETH Trading

Emerging trends in cryptocurrency investment are increasingly influenced by on-chain analysis and real-time market movements. The substantial deposits of ETH to exchanges like Binance signify growing interest and participation among entities looking to leverage market conditions. Understanding these trends is essential for investors wishing to stay ahead of the curve in the rapidly changing landscape of cryptocurrency.

Additionally, as more investors enter the crypto space, the strategies for accumulating ETH evolve. Keeping an eye on trading volumes and large transactions can provide critical entry points, allowing traders to capitalize on market fluctuations. The continuous evolution of capital movement, like the recent 13,403.28 ETH influx, showcases the need for adaptive investment strategies and a proactive approach to navigating the cryptocurrency market.

Frequently Asked Questions

What are the implications of large ETH deposits to Binance on market trends?

Large ETH deposits to Binance can indicate increased buy pressure and investor confidence in Ethereum. This accumulation of ETH generally reflects a bullish sentiment, potentially leading to price increases as more users deposit cryptocurrency into this major exchange.

How do large ETH transactions affect cryptocurrency investment strategies?

Large ETH transactions, such as those deposited to Binance, can greatly influence cryptocurrency investment strategies. Investors often watch these movements closely using on-chain analysis to gauge market sentiment and make informed decisions on whether to buy or sell Ethereum.

Can on-chain analysis provide insights into ETH accumulation trends?

Yes, on-chain analysis can reveal significant ETH accumulation trends. By tracking large deposits to exchanges like Binance, analysts can identify patterns that may indicate future price movements and investor behaviors within the ETH market.

What can we learn from the recent deposit of 5,000 ETH to Binance?

The recent deposit of 5,000 ETH to Binance, part of a larger accumulation of over 13,400 ETH, suggests that the investor took strategic positions in Ethereum. Analyzing such transactions can offer insights into the investor’s confidence in ETH and broader market trends.

Why are Binance ETH transactions significant for traders?

Binance ETH transactions are significant for traders because they often reflect larger market movements. Tracking these transactions allows traders to make educated guesses about potential shifts in Ethereum’s price, driven by increased trading volume or investor sentiment.

How does ETH accumulation on exchanges like Binance impact liquidity?

ETH accumulation on exchanges like Binance can influence liquidity levels significantly. As more ETH is held on exchanges, it may reduce the circulating supply in the market, potentially leading to increased volatility and price fluctuations in response to buying or selling pressure.

What should I consider when analyzing large ETH deposits to Binance?

When analyzing large ETH deposits to Binance, consider the context of the transaction, the historical trading patterns of the depositing address, and any relationships with known entities, like Galaxy Digital. This comprehensive approach may provide deeper insights into potential market movements.

Are large deposits to Binance a signal of upcoming market shifts for Ethereum?

Yes, large deposits to Binance can serve as a signal of potential upcoming market shifts for Ethereum. They may indicate that significant investors are positioning themselves for price changes, which can be critical information for traders and analysts monitoring the market.

| Key Point | Details |

|---|---|

| Recent Deposit | An address deposited 5000 ETH to Binance, valued at approximately $15.36 million. |

| Total Deposits in Last Two Weeks | Total of 13,403.28 ETH has been deposited to Binance, worth about $41.06 million. |

| Current Holdings | The address holds a total of 15,000 ETH. |

| Previous Investments | The same address previously profited $107 million from WBTC investments. |

| Associated Wallets | Has interacted with addresses tied to Galaxy Digital. |

Summary

ETH deposits to Binance have seen significant activity recently, with one address depositing a total of 13,403.28 ETH over the past two weeks. This surge in deposits, particularly the recent transaction of 5000 ETH worth $15.36 million, highlights the growing interest in moving Ethereum assets onto exchanges like Binance. Such movements often signal potential market shifts, possibly influenced by substantial prior profits from other investments.