Bitcoin mining profitability is facing unprecedented challenges as market conditions shift and operating costs rise. With Bitcoin’s hashrate reaching record highs, miners are grappling with a stark decline in BTC revenue, making it increasingly difficult to sustain operations. The current mining difficulty reduction has only highlighted the struggles of many miners, as they fight to stay afloat amid harsh economics. Consequently, while the infrastructure of the Bitcoin mining sector may appear resilient, the realities of diminishing profit margins are leading to significant exits from the industry. Understanding the intricacies of profitability in such a volatile landscape is essential for miners, investors, and enthusiasts alike as they navigate these tumultuous waters.

The realm of cryptocurrency mining is undergoing a critical transformation, with Bitcoin’s profitability and operational viability increasingly under scrutiny. As the efficiency of Bitcoin’s computing network rises, the economic incentives for mining activities are evolving, prompting a re-evaluation of traditional mining operations. In this essential sector, miners must adapt to fluctuating revenue streams and a competitive landscape shaped by escalating energy costs and intricate regulatory challenges. The intricate dynamics of Bitcoin mining, encompassing metrics such as hashrate and mining difficulty, play a crucial role in determining the sustainability of operations. As the industry strives for adaptation and innovation, the ongoing fiscal pressures underline the necessity for miners to forge new pathways to profitability.

Understanding Bitcoin Mining Profitability

Bitcoin mining profitability plays a crucial role in the sustainability of the network, especially as miners face challenging economic conditions. As the Bitcoin hashrate reaches unprecedented highs, generating revenue has become increasingly difficult. Miners are now dealing with a stark reality where the revenue per unit of computing power has plummeted, marking this era as one of ‘high security, low profitability.’ Despite the robust security offered by a high hashrate, the underlying issue of profitability remains problematic, compelling many miners to reassess their operational strategies and determine whether they can remain viable under current conditions.

As the Bitcoin mining sector evolves, the significant decrease in miner revenue highlights the complex interplay between market conditions and operational efficiency. With hashprice dropping nearly 50% to about $34.20 per petahash in recent weeks, many operators are struggling to break even. The landscape has shifted, leaving smaller miners, particularly those without access to affordable power, vulnerable to market pressures. These economic shifts challenge the notion of sustainability within the mining ecosystem and prompt the need for miners to seek innovative solutions or diversify their operations to stay afloat in a challenging market.

The Impact of Bitcoin Hashrate on Mining Difficulty

The relationship between Bitcoin hashrate and mining difficulty is vital for understanding the operational dynamics within the mining ecosystem. As the hashrate approaches all-time highs, the mining difficulty adjusts accordingly, often making it progressively harder for miners to earn BTC. Recently, we observed a decrease in mining difficulty by approximately 2%, linked to a notable contraction in miner revenue. This adjustment highlights how the network is attempting to balance itself during tumultuous economic times, emphasizing the need for miners to maximize efficiency to remain competitive.

While a high hashrate signifies network security, it can also indicate an oversaturated market, where too many miners compete for diminishing rewards. As such, the increase in mining difficulty can pose significant challenges. The continual balance between hashrate and difficulty necessitates strategic planning, enabling miners to optimize their hardware and negotiate better energy contracts, ultimately affecting profitability. The ability to adapt to these changes will be vital for miners hoping to thrive amid fluctuating conditions in the Bitcoin mining sector.

Challenges Facing the Bitcoin Mining Sector

The Bitcoin mining sector is currently navigating a landscape filled with challenges that threaten its stability and growth. High energy prices and the tightening of capital markets have led many operations to reevaluate their strategies. As noted, companies like Tether have ceased their mining operations due to unmanageable costs, illustrating the precarious nature of the current market sustainability. Additionally, the increasing regulations and shifts in financing dynamics signal that miners must adapt quickly or risk being left behind.

Smaller mining operators, in particular, are facing harsh realities, as those without access to affordable electricity are at a significant disadvantage in a consolidating market. As larger firms with infrastructural advantages continue to expand, many smaller entities struggle to maintain their operational foothold, leading to widespread exits from the market. This ongoing shake-up emphasizes the need for miners to innovate and potentially transition towards more sustainable energy sources or diversified business models to ensure long-term viability.

The Economics of Bitcoin Mining Difficulty Reductions

Bitcoin mining difficulty reductions may seem indicative of a failing protocol; however, they primarily reflect shifts in the network’s competitive landscape. In recent weeks, the protocol has experienced two consecutive reductions, which could suggest that high-cost operations are exiting the market. This adjustment process is vital as it recalibrates the network, ensuring that remaining miners can operate more effectively in achieving profitability under newly adjusted conditions.

These difficulty reductions serve as a mechanism to stabilize the network amidst a backdrop of declining miner revenue, allowing efficient operations to capitalize on stranded capacity. In turn, operational fleets that can survive these tumultuous times are likely to emerge stronger, with the potential for reinvestment and growth as conditions improve. Observing these fluctuations in difficulty not only highlights the state of the mining economy but also aids in forecasting future trends and the overall health of the Bitcoin mining sector.

The Role of Hashrate in Bitcoin Mining Resilience

While a robust Bitcoin hashrate symbolizes network security and resilience, it also unveils deeper structural issues within the mining sector. The high hashrate may suggest that the Bitcoin network is in good health; however, this robustness could mask the dwindling number of miners capable of sustaining achievements. As operations consolidate and the market favors larger, more capitalized entities, the diversity necessary for a resilient ecosystem is at risk. Moreover, these changes underscore the emerging reality that while the protocol remains resilient, the sustainability of its foundational layer – the miners – is becoming increasingly precarious.

Additionally, the consolidation of mining operations raises the stakes regarding vulnerability. With fewer players dominating the landscape, the ramifications of potential disruptions – whether they arise from regulatory changes or operational failures – become amplified. As the mining pool shrinks, the sector’s capacity to withstand shocks diminishes, highlighting the need for diversification within the mining community. Addressing this growing concern will be essential for ensuring long-term stability and security in the Bitcoin network.

Geopolitical Influences on Bitcoin Mining Dynamics

The geopolitical climate plays a significant role in shaping the dynamics of the Bitcoin mining landscape. Following China’s ban on cryptocurrency mining in 2021, we have observed a resurgence of operations in Chinese regions, contributing around 14% to the global hashrate. This shift highlights the complexities within the mining sector, where underground operations exploit regions with abundant energy resources, often circumventing regulatory scrutiny. Such dynamics can create imbalances within compliant markets, pressuring Western miners to innovate and adapt to remain competitive amidst a changing geopolitical backdrop.

Western Bitcoin miners now face a complicated environment, grappling with more stringent regulations and rising operational costs that threaten their profitability. The increasing difficulty in securing favorable energy contracts has forced many operators to seek alternative solutions, from sharing resources with data center clients to exploring renegotiated electricity agreements. As these geopolitical influences continue to evolve, the landscape of Bitcoin mining will remain uncertain, requiring miners to remain vigilant and adaptive to external factors that significantly impact their operational viability.

The Future Outlook for Bitcoin Miners

Looking ahead, the future for Bitcoin miners appears fraught with uncertainty yet filled with potential for evolution. As capital markets adjust their perspectives toward mining, viewing it less as direct Bitcoin proxies and more as data center operations, miners must navigate this transformative landscape. The successful integration of high-performance computing projects alongside traditional mining could provide a buffer for operators seeking consistent revenue streams in a volatile environment. This diversification may enable them to hedge against potential downturns in BTC prices and hashprice, ultimately stabilizing profitability.

At the same time, the need for miners to secure long-term energy contracts and maintain efficient operations remains critical for survival. As financial pressures mount, a growing number of miners are likely to consolidate into fewer, larger entities with the capacity to endure market volatilities. While this transition may strengthen the operational backbone of the mining sector, it also creates new risks that must be addressed to ensure a robust and resilient Bitcoin ecosystem moving forward.

The Interplay Between Capital Markets and Bitcoin Mining

Capital markets are currently redefining their relationship with the Bitcoin mining sector, shifting from viewing miners solely as producers of cryptocurrency to acknowledging their roles as data center services providers. This perspective change is driven largely by the current economic climate, where profitability is at risk, and operational efficiency is paramount. Investors are evaluating mining businesses through a lens that considers both their cryptocurrency components and their data center functionalities, leading to a need for miners to adopt strategies that highlight their broader business models.

As this shift unfolds, miners that can leverage high-performance computing capabilities might find themselves in a stronger position to survive market fluctuations. By expanding into areas outside of purely Bitcoin mining, they create alternate revenue streams that can help stabilize business operations. Nonetheless, the transition may require significant investments in technology and expertise, which could prove challenging for many miners struggling with cash flow. Navigating the complexities of capital markets will be essential for miners hoping to maintain profitability and facilitate growth in an ever-evolving landscape.

Strategic Adaptations in the Bitcoin Mining Industry

As the Bitcoin mining industry faces unprecedented challenges, miners are compelled to strategically adapt in order to ensure their survival. The rising operational costs associated with energy and equipment replacements necessitate a reevaluation of existing practices. Many miners are rebranding themselves as data infrastructure firms, leveraging their expertise in computing resources to attract alternative clients for more stable revenue streams. This pivot not only positions them to withstand the downturn in BTC revenue but also opens new opportunities for long-term growth.

Furthermore, diversifying into areas such as artificial intelligence and high-performance computing has emerged as a viable strategy for miners seeking consistent cash flows. By aligning business strategies with industries experiencing growth, miners can buffer themselves against volatility inherent in the cryptocurrency markets. However, while these adaptations can strengthen operational viability, they can also affect the allocation of limited energy resources, highlighting a need for careful planning to ensure a balanced approach in leveraging Bitcoin mining alongside new ventures.

Frequently Asked Questions

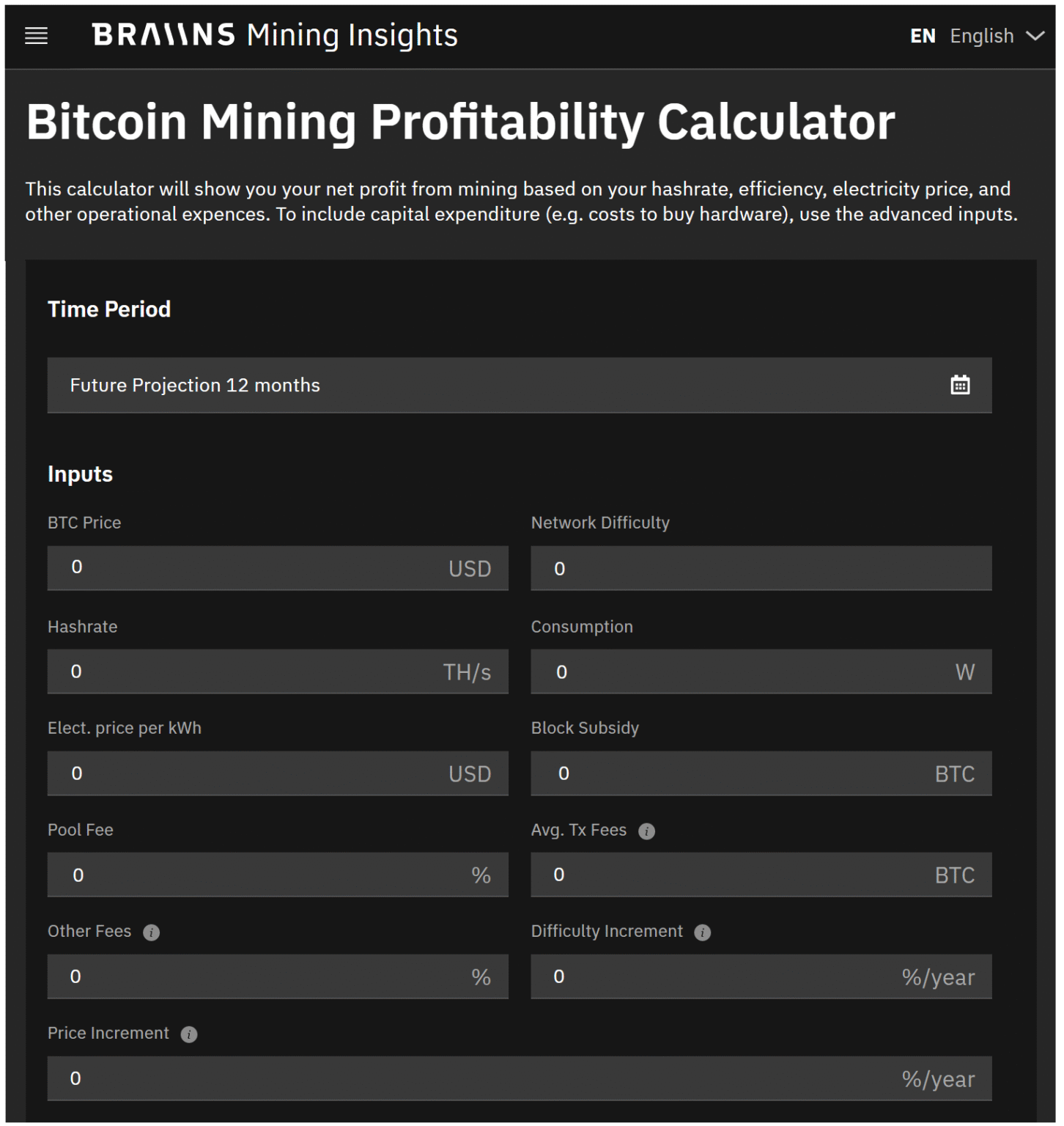

What factors affect Bitcoin mining profitability today?

Bitcoin mining profitability is influenced by several key factors, including Bitcoin’s hashrate, mining difficulty, operating costs, and BTC revenue. As the hashrate reaches record highs, the mining difficulty adjusts accordingly, which may reduce profitability for miners, especially those using less efficient hardware.

How does Bitcoin’s hashrate impact mining profitability?

Bitcoin’s hashrate directly affects mining profitability. While a higher hashrate strengthens network security, it can lead to increased mining difficulty, resulting in lower profits for individual miners. As competition grows, only the most efficient operations can maintain profitability in the Bitcoin mining sector.

What is the current state of Bitcoin mining difficulty and profitability?

The Bitcoin mining difficulty has recently decreased, with a drop of approximately 2%. This adjustment aims to maintain block times but occurs during a period of declining BTC revenue, making profitability harder for many miners. The balance between mining difficulty and hashrate plays a crucial role in determining overall mining profitability.

What challenges are miners facing regarding Bitcoin mining profitability?

Miners are facing significant challenges, including falling Bitcoin revenue due to a decline in hashprice and high operational costs. Many smaller miners are shutting down, unable to sustain operations. The transition to a phase of high security but low profitability in the Bitcoin mining sector raises concerns for future mining operations.

How does BTC revenue relate to mining profitability in the current market?

BTC revenue has decreased significantly, impacting mining profitability across the board. As the price of Bitcoin fluctuates and mining difficulty adjusts, miners need to optimize their operations to remain profitable. The recent downturn in transaction fees further complicates the revenue landscape for miners.

Are all miners equally affected by Bitcoin mining profitability challenges?

No, not all miners are equally affected. Larger, well-capitalized miners with access to affordable energy and efficient hardware are better positioned to sustain profitability. In contrast, smaller miners and those with high energy costs face greater challenges and are more likely to exit the market.

What does the future hold for Bitcoin mining profitability?

The future of Bitcoin mining profitability depends on various factors, including energy prices, mining difficulty adjustments, and overall market conditions. As mining operations adapt by diversifying their revenue streams and seeking operational efficiencies, the landscape may shift. However, consolidation in the sector could pose risks to stability.

How can miners improve their Bitcoin mining profitability?

To improve Bitcoin mining profitability, miners can optimize energy costs, invest in more efficient hardware, diversify into high-performance computing services, and secure long-term energy contracts. Adapting business models to generate stable revenue while waiting for favorable Bitcoin price movements can also help sustain operations.

What role do geopolitical factors play in Bitcoin mining profitability?

Geopolitical factors significantly impact Bitcoin mining profitability. Changes in regulations, energy availability, and operational constraints can influence the hashrate distribution globally. Miners in politically stable regions with favorable energy costs may have a competitive advantage over those facing uncertainties.

How can Bitcoin mining profitability metrics guide investment decisions?

Investors should monitor key metrics like mining difficulty, hashprice, and BTC revenue to evaluate Bitcoin mining profitability. Understanding these dynamics helps in identifying robust mining operations versus those struggling to remain profitable, guiding informed investment choices in the cryptocurrency mining sector.

| Key Point | Details |

|---|---|

| Current Mining Landscape | Bitcoin hashrate at record highs, miner revenue at historical lows. |

| Hashrate and Mining Difficulty | Hashrate remains above one zettahash; recent difficulty decreased due to harsh economic conditions. |

| Operational Challenges | Operators with inefficient rigs face difficulties; only well-capitalized operators survive. |

| Market Consolidation | As weaker players exit, the mining landscape is consolidating, which could increase risks. |

| Adaptation Strategies | Miners diversifying into high-performance computing to sustain cash flows. |

| Geopolitical Factors | China recovering a significant share of global hashrate through underground operations. |

| Financial and Regulatory Pressures | Western miners experiencing higher costs, affecting public mining stock values. |

Summary

Bitcoin mining profitability is under significant strain as the mining sector grapples with declining revenues and high operational costs. The current landscape reveals that, despite record highs in hashrate and security, miner profits have reached unprecedented lows, making sustainability challenging for many operators. The consolidation of mining operations indicates that while Bitcoin’s overall security appears robust, the diminishing number of participants poses risks for the future of the network.

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend