Recently, the world of crypto trading saw an exciting development with a significant transaction involving a HyperLiquid USDC deposit. A newly created wallet deposited an impressive 3 million USDC into HyperLiquid, strategically placing a short order on HYPE within the price range of $35.7 to $36.7. This move highlights the growing interest in leveraging USDC for trading opportunities on decentralized platforms. According to Onchain Lens, such actions reflect a dynamic approach to navigating the fluctuating crypto landscape. With HyperLiquid’s unique offerings and robust price range functions, traders are increasingly drawn to the potential for profit in this innovative ecosystem.

In the realm of cryptocurrency, substantial actions like the recent USDC deposit into HyperLiquid signify a noteworthy trend. The infusion of 3 million USDC into this trading platform, marked by a short position on HYPE, showcases a strategic maneuver within a specified price corridor. As more investors seek agility in their trading strategies, platforms like HyperLiquid provide the necessary tools for success. Insights from Onchain Lens reveal how these developments are reshaping the landscape of digital asset trading. Engaging with features such as price range trading and stablecoin utilization, traders are now equipped to optimize their investments in this ever-evolving market.

Understanding HyperLiquid USDC Deposits

HyperLiquid is revolutionizing crypto trading by providing users with innovative options for managing their digital assets. Recently, a newly created wallet deposited a significant amount of 3 million USDC into the platform. This high-profile deposit reflects the growing confidence among investors in utilizing HyperLiquid for their trading strategies. It’s essential to understand how USDC deposits can enhance liquidity and facilitate trading activities in the volatile cryptocurrency markets.

Utilizing USDC on HyperLiquid allows traders to engage more efficiently in the crypto market with a stablecoin that minimizes exposure to price volatility. When deposits of this magnitude occur, they signal to the market potential bullish or bearish momentum, depending on the accompanying trading strategies. In this case, the deposit was followed by a short order on HYPE, indicating a strategic move taking advantage of the anticipated price decline.

The Strategy Behind Short Orders on HYPE

Placing short orders, such as the one executed on HYPE, is a common strategy among experienced crypto traders. By placing a short order in the price range of $35.7 to $36.7, the trader is betting that the price of HYPE will drop below this threshold. Such tactical moves are often backed by in-depth market analysis and projections from platforms like Onchain Lens, which track significant wallet movements and price fluctuations.

Shorting a cryptocurrency requires a keen understanding of market trends and dynamics. By depositing 3 million USDC and executing a short order, this trader is demonstrating a calculated approach to capitalizing on market inefficiencies. This strategy can lead to significant profits if the price of HYPE declines as predicted, reflecting the trader’s confidence in their market assessment.

Impact of HYPE Short Orders on Market Dynamics

Short orders, particularly on major assets like HYPE, can reverberate through the market, influencing prices and trader sentiment. When large sums are involved, such as the recent 3 million USDC deposit, other traders may respond by adjusting their positions, creating a ripple effect in the trading community. This behavior can lead to increased volatility and price fluctuations as the market reacts to the perceived movements of influential traders.

Incorporating data from Onchain Lens can provide valuable insights into how these short orders are likely to affect market trends. Traders often monitor such large transactions to gauge sentiment and forecast potential price movements. As HYPE’s price approaches the specified short order range, other traders may begin to initiate their own strategies based on anticipated trends, thus amplifying the overall impact on the cryptocurrency market.

Analyzing the Price Range for HYPE

The price range of $35.7 to $36.7, where the short order was placed, raises important considerations for traders. This range can act as a psychological barrier, as many traders cluster their orders around key price levels. Such positioning can result in increased selling pressure if the price starts to approach the lower end of this range, validating the short strategy put forth by the investor with the 3 million USDC deposit.

Moreover, technical analysis tools can be employed to predict potential breakout or breakdown scenarios around the determined price range. Factors like trading volume, market sentiment, and trend indicators all play into whether HYPE will follow through on the bearish expectations embedded in the short order. Analyzing these aspects can empower traders and investors to make educated decisions in their crypto trading endeavors.

Leveraging Onchain Lens for Market Insights

Onchain Lens is a powerful tool for those involved in crypto trading, providing real-time data and analytics that can shape trading strategies. The recent deposit of 3 million USDC into HyperLiquid and the subsequent short order on HYPE exemplify how on-chain insights can guide trading decisions. Tools like Onchain Lens allow users to track significant transactions and market activities that might otherwise go unnoticed, giving them an edge in volatile market conditions.

By using Onchain Lens, traders can analyze the behaviors and strategies of others in the market, potentially imitating or countering these strategies with their trading choices. Insights gleaned from such data can lead to improved risk management and more informed trading tactics, especially in a fast-paced environment where cryptocurrency prices can shift rapidly.

Crypto Trading Dynamics with USDC

USDC, as a stablecoin, serves a unique role in the realm of crypto trading. It allows traders to hedge against volatility while still participating in the market. The recent deposit of 3 million USDC into HyperLiquid illustrates the importance of stablecoins in facilitating larger transactions without the risk of price depreciation that comes with traditional cryptocurrencies.

In the context of trading strategies, having USDC on hand enables traders to act swiftly in response to market conditions. Whether it’s entering a long position or pursuing a short order, the liquidity provided by USDC can significantly enhance a trader’s ability to capitalize on fleeting opportunities. This flexibility is particularly advantageous in a market that is very dynamic and often unpredictable.

Key Takeaways from the 3 Million USDC Deposit

The recent deposit of 3 million USDC into HyperLiquid serves as a pivotal case study for both new and seasoned traders in the cryptocurrency space. This event underscores the importance of liquidity and the strategic placement of trades in response to market signals. It highlights the potential rewards that can be reaped from informed trading decisions supported by robust analysis.

Additionally, the execution of a short order on HYPE reinforces the necessity of understanding market positions and the psychological factors that drive trader behavior. It serves as a reminder that in crypto trading, insight and strategy can create pathways to success, especially when backed by sound data analytics.

Exploring the Future of HYPE Trading

As the cryptocurrency market continues to evolve, trading assets like HYPE will be subject to fluctuating dynamics reflective of broader market trends. The recent movements prompted by a substantial deposit of USDC may signal a shift in how investors perceive HYPE’s value. Engaging with on-chain analytics will be critical for traders looking to navigate these changes effectively.

Traders should remain vigilant about market updates and continually refine their strategies based on evolving data. Whether through implementing short orders or leveraging insights from tools like Onchain Lens, the future of HYPE trading remains closely tied to the strategic choices made today.

Innovative Approaches to Crypto Trading

Innovation pervades the crypto trading landscape, as tools and strategies are developed to respond effectively to market changes. The deposit of 3 million USDC into HyperLiquid is not just a transaction; it signals a broader trend toward employing advanced trading strategies. Investors are increasingly leveraging technology and data to make better-informed decisions—a reality that is reshaping the trading environment.

By embracing innovation—whether through market analysis or advanced trading tactics—crypto traders can enhance their positions in the market significantly. Short orders on assets like HYPE highlight the growing sophistication of trading strategies and underscore the competitive edge that informed decision-making can provide in an ever-evolving space.

Frequently Asked Questions

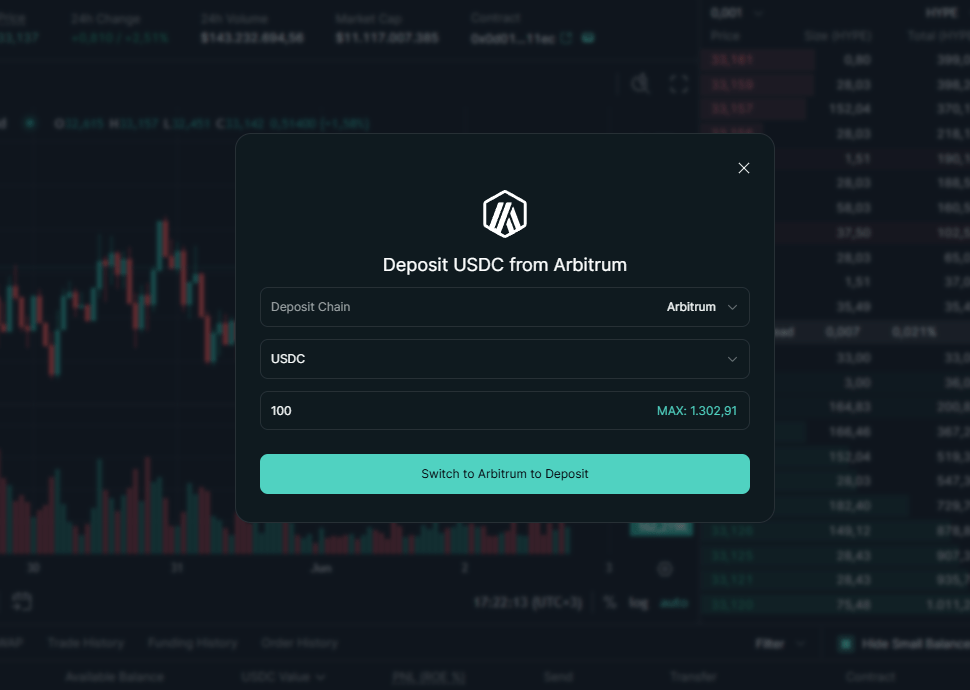

What is the procedure for making a HyperLiquid USDC deposit?

To make a HyperLiquid USDC deposit, first create and verify your wallet on HyperLiquid. Once your wallet is set up, transfer your desired amount of USDC, like the recent deposit of 3 million USDC, into your HyperLiquid account. Ensure to check the current fee structures and transaction limits.

How does a 3 million USDC deposit impact my trading on HyperLiquid?

A deposit of 3 million USDC into your HyperLiquid account provides you with significant liquidity for crypto trading. This capital can be used to place trades such as short orders on various assets, including HYPE, potentially enhancing your trading strategies.

What is the significance of the HyperLiquid price range for HYPE?

The HyperLiquid price range for HYPE, specifically between $35.7 and $36.7, indicates the current market trading range. Traders utilizing this information can better place informed orders, such as a short order after a substantial deposit like 3 million USDC.

How can I analyze the impact of my HyperLiquid USDC deposit on market trends?

You can use Onchain Lens to track market trends and analyze the impact of your HyperLiquid USDC deposit. Observing other trading patterns, such as a significant short order on HYPE, can give insights into potential price movements.

What are the risks associated with placing a short order on HYPE after a USDC deposit?

While placing a short order on HYPE after a 3 million USDC deposit can be lucrative, it involves risks such as market volatility and potential losses if the price moves against your position. It’s essential to perform thorough market analysis before executing trades.

What trading options are available on HyperLiquid after depositing USDC?

After depositing USDC on HyperLiquid, you have various trading options including spot trading, margin trading, and placing orders like short orders on different assets, including HYPE within specific price ranges.

What benefits does HyperLiquid offer for crypto trading with USDC deposits?

HyperLiquid offers advanced trading features, including high liquidity due to substantial USDC deposits, competitive fees, and the ability to execute various order types like short orders on assets like HYPE, enhancing overall trading efficiency.

| Key Points | |

|---|---|

| Wallet Activity | A new wallet was created to engage in trading. |

| Deposit Amount | 3 million USDC was deposited into HyperLiquid. |

| Action Taken | A short order was placed on HYPE. |

| Order Price Range | The short order was specified in the range of $35.7 to $36.7. |

Summary

The recent activity regarding the HyperLiquid USDC deposit showcases a significant step in trading dynamics. A newly created wallet has deposited a substantial amount of 3 million USDC into HyperLiquid, highlighting investor confidence and strategic trading decisions. The decision to place a short order on HYPE within the price range of $35.7 to $36.7 signifies proactive management of potential price fluctuations. This indicates a robust market movement that observers and participants in the cryptocurrency space should monitor closely.

Related: More from DeFi & Stablecoins | Stablecoin Payments Focus Shifts to User Networks | ETH Bounces Back: Why TradFi Favors ETH Rise in Stablecoin