The Nvidia trading strategy has emerged as a compelling approach for investors looking to capitalize on the tech giant’s recent market momentum. Recently, traders have been increasingly drawn to combining this strategy with other tactics, such as shorting Google to hedge their positions effectively. Utilizing platforms like Hyperliquid for executing these trades has added a new layer of efficiency, especially with high liquidity facilitated by transactions using USDC. As traders refine their strategies for better performance, focusing on Nvidia provides significant opportunities for growth. The intersection of these trader strategies reflects a dynamic market landscape, highlighting the importance of informed decision-making in today’s volatile financial environment.

In the realm of stock trading, the strategy centered on Nvidia stocks has become a focal point for many market participants. This approach, often integrated with various trader strategies, enables individuals to align their investments with the tech sector’s rapid innovations. The practice of shorting competitors, like Google, while going long on prominent companies can help in mitigating risks and enhancing profitability. Furthermore, with increased adoption of advanced platforms such as Hyperliquid, executing trades with USDC for enhanced liquidity has become more common. Such strategic maneuvers not only optimize trading outcomes but also underscore the significance of adaptive methods in navigating the complexities of the stock market.

Understanding Nvidia Trading Strategy

The Nvidia trading strategy has captivated investors in recent years as the company continues to dominate the semiconductor market, particularly due to its advancements in AI and cloud computing. Traders are increasingly deploying strategies centered around Nvidia to capitalize on its stock’s volatility and growth potential. A common approach is to leverage platforms like Hyperliquid, where traders can easily deposit assets, such as USDC, to execute their strategies effectively.

When employing a Nvidia trading strategy, it’s essential for traders to analyze market trends and the broader tech sector’s performance. Utilizing tools and resources provided by platforms such as Lookonchain, traders can track real-time transactions and identify lucrative opportunities. This strategy not only requires a deep understanding of Nvidia’s business model and market position but also the ability to hedge through short-selling other stocks, such as Google, to mitigate potential losses.

Utilizing Hyperliquid Transactions for Effective Trading

Hyperliquid transactions offer traders an innovative way to execute trades swiftly and at minimal costs, making it an advantageous choice for those looking to optimize their trading strategies. By depositing funds, such as USDC, traders can engage in market-making or automated trading strategies that capitalize on price discrepancies. This flexibility allows traders to go long on promising stocks like Nvidia, while simultaneously shorting less performing stocks like Google.

The fluidity of Hyperliquid transactions provides critical advantages in fast-paced trading environments. For example, a trader may deposit a large sum, such as one million USDC, into the platform to execute a comprehensive strategy that includes both long and short positions. This ability to maneuver between assets minimizes waiting times for trade execution and maximizes profit potential through strategic leverage.”}]},{

Frequently Asked Questions

What is the Nvidia trading strategy and how can it benefit traders?

The Nvidia trading strategy involves going long on Nvidia stocks to capitalize on the company’s growth potential, especially in the areas of AI and gaming. By strategically investing in Nvidia, traders can benefit from price appreciation, particularly during bullish market trends.

How does shorting Google fit into the Nvidia trading strategy?

Shorting Google as part of the Nvidia trading strategy allows traders to hedge their positions. By shorting Google, traders can potentially profit from declines in its stock price, balancing their long positions in Nvidia and managing overall risk.

What are Hyperliquid transactions and how can they enhance Nvidia trading strategies?

Hyperliquid transactions allow for high-speed, low-latency trading, which is crucial for executing Nvidia trading strategies effectively. This trading environment enables traders to react quickly to market fluctuations, maximizing potential gains when going long on Nvidia.

Why is USDC trading significant for implementing a Nvidia trading strategy?

USDC trading is significant for Nvidia trading strategies as it offers a stablecoin that maintains a 1:1 value with the US dollar. This stability is essential for traders looking to deposit large sums, like 1 million USDC, to execute long positions on Nvidia without exposure to currency fluctuations.

What typical trader strategies can be combined with a Nvidia trading strategy?

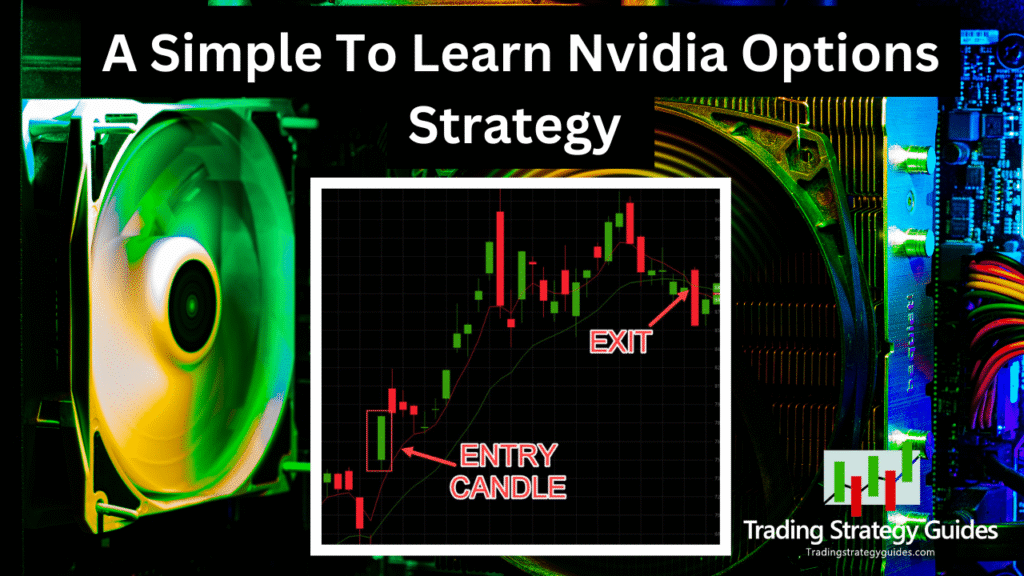

Typical trader strategies that can be combined with a Nvidia trading strategy include swing trading, day trading, and using technical analysis to identify entry and exit points. By integrating these strategies, traders can enhance their chances of success when trading Nvidia.

| Key Points |

|---|

| A trader deposited 1 million USDC into Hyperliquid to implement a trading strategy. |

| The strategy involved going long on Nvidia and shorting Google. |

| The transaction was monitored by Lookonchain, indicating it was recently executed. |

Summary

The Nvidia trading strategy involves leveraging significant capital, as seen with the trader’s 1 million USDC stake in Hyperliquid. By going long on Nvidia and short on Google, this strategy aims to capitalize on potential upward movements in Nvidia’s stock while hedging against declines in Google’s value. This dual approach could provide a balanced risk management framework, showcasing a tactical method for navigating the market.