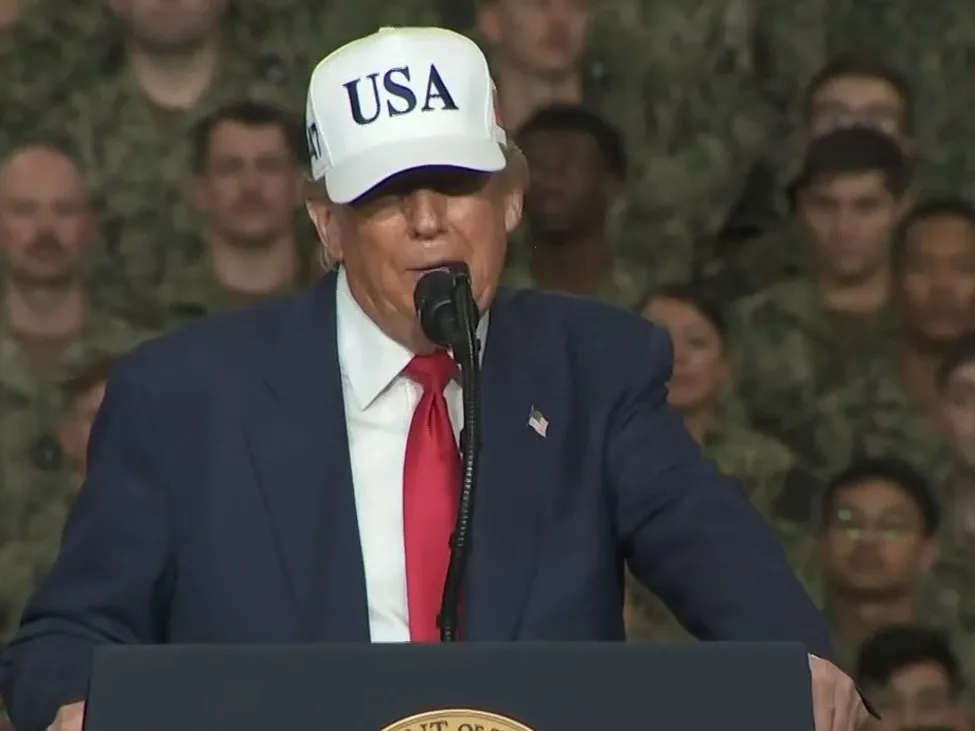

Trump drops Thanksgiving deadline for Ukraine peace talks, signaling open-ended timeline

Markets parsed mixed geopolitical signals after President Donald Trump scrapped his previously floated Thanksgiving target for a U.S.-backed Ukraine peace deal, saying negotiations will take “as long as it takes.” The shift tempers near-term hopes for de-escalation while keeping a potential risk-premium reset on the table for energy, grains and European FX.

Trump softens timeline as Washington pushes multi-track talks

Trump told reporters aboard Air Force One en route to Florida that U.S. negotiators are making headway with Kyiv and Moscow and that Russia has agreed to unspecified concessions. He confirmed envoy Steve Witkoff will travel to Moscow soon to meet President Vladimir Putin and said Jared Kushner, credited with facilitating a Gaza ceasefire, is involved in the talks.

While last week’s emerging framework sparked concern Washington might pressure Kyiv into terms favorable to Moscow, Trump and senior officials now say the aim is simply a deal “as soon as possible,” without a firm deadline. He also cautioned that Russia currently holds a battlefield edge and warned Ukraine could lose additional territory absent a settlement. Discussions with European partners on potential security guarantees for Kyiv are underway, he added.

Why FX and commodities care

For markets, the removal of a near-term deadline prolongs uncertainty but preserves the chance of a negotiated outcome that could reprice geopolitical risk. The balance of probabilities matters for:

– FX risk appetite: A credible peace track would support the euro and European equities while trimming safe-haven demand for the Swiss franc and Japanese yen. Protracted or worsening conflict typically does the opposite.

– Energy: Any durable de-escalation could shave the geopolitical premium in crude and European natural gas. Lingering conflict risk keeps upside optionality in Brent and TTF.

– Grains: Ukraine’s export reliability is pivotal for wheat and corn. Improved security corridors are bearish for prices; renewed disruption risk remains supportive.

– Rates and credit: A clearer path to peace may ease European sovereign spreads and bolster high-beta credit, while open-ended conflict sustains caution.

Key points

- Trump says there is no firm deadline for a Ukraine peace deal; “the deadline for me is when it’s over.”

- U.S. negotiators claim progress with Kyiv and Moscow; Russia has agreed to unspecified concessions.

- Envoy Steve Witkoff will travel to Moscow to meet President Vladimir Putin; Jared Kushner involved in talks.

- Washington’s emerging framework has raised concerns it could tilt toward Moscow’s interests.

- Trump warns Russia holds a battlefield advantage and Ukraine risks further territorial losses.

- U.S. and European partners are discussing potential security guarantees for Kyiv as part of any settlement.

Market implications and scenarios

De-escalation baseline

– EUR could firm on reduced European risk premium; CHF and JPY may underperform as safe-haven demand fades.

– Brent and European gas prices would likely drift lower as supply risks ease.

– Wheat and corn could soften on improved Black Sea export prospects.

– European credit and cyclicals outperform; volatility moderates.

Stalemate or escalation

– Risk-off bias supports USD, CHF, and JPY; EUR underperforms alongside Eastern European FX.

– Energy and grains retain or rebuild a geopolitical premium.

– European indices lag; haven flows favor high-quality duration.

What traders are watching next

– Timing and readout of Witkoff’s Moscow trip.

– Signals from Kyiv, Moscow and European capitals on security guarantees.

– Any detail on “concessions” referenced by Trump.

– Logistics and corridor arrangements that affect Black Sea exports.

FAQ

How could this affect EUR/USD in the near term?

Absent concrete breakthroughs, EUR/USD will likely trade headline-driven. Constructive signs from talks would reduce Europe’s geopolitical discount and support the euro, while setbacks or signs of battlefield deterioration would favor USD safe-haven flows.

What does this mean for oil and European gas?

A credible move toward de-escalation would trim the geopolitical premium in Brent and European gas by lowering perceived supply and infrastructure risks. If talks stall or the conflict intensifies, upside risk in energy remains.

Why do grain markets care about Ukraine peace efforts?

Ukraine is a key exporter of wheat and corn. Secure export routes lower disruption risk and typically pressure prices, while uncertainty about Black Sea logistics supports grains as buyers price in supply volatility.

Does the shift in timeline signal changes to sanctions?

No changes were announced. Trump referenced progress and potential concessions but provided no details on sanctions. Markets will watch for any policy specifics before repricing sanctions risk.

What should risk managers focus on now?

Headline risk and path-dependent scenarios. Maintain flexibility around energy and grain exposures, keep optionality in EUR and CHF positions, and monitor cross-asset volatility as diplomatic milestones approach.

This article was produced by BPayNews for professional market participants.