As the world of cryptocurrency continues to evolve, one important aspect investors closely monitor is the funding rates displayed by centralized exchanges (CEX) and decentralized exchanges (DEX). Recently, the consensus from these platforms signals a neutral market state, indicating that traders are neither overwhelmingly bullish nor bearish in their sentiment.

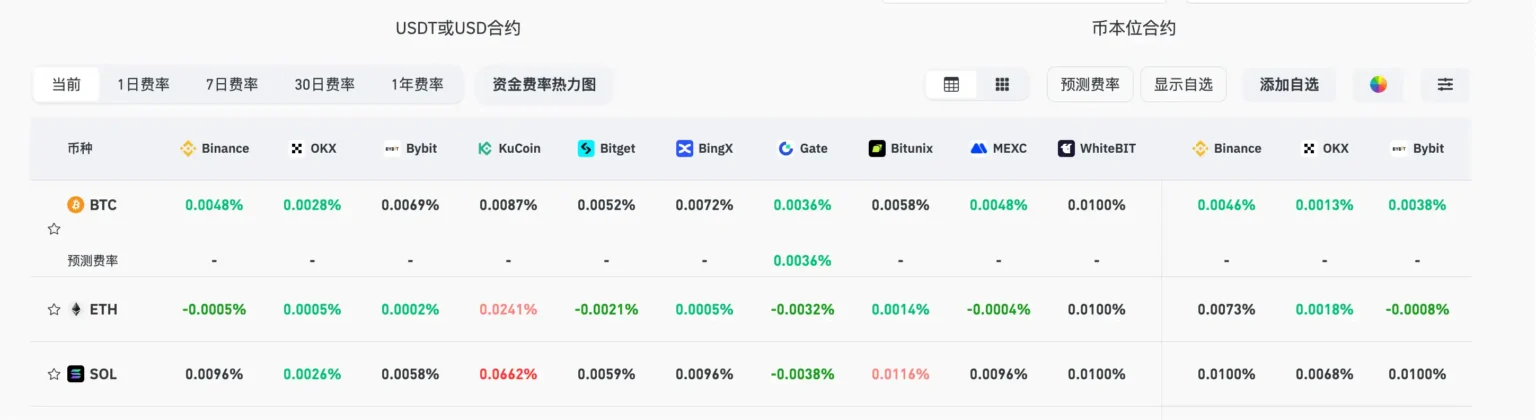

Funding rates play a crucial role in determining the cost of holding leveraged positions in the crypto market. They essentially reflect the balance between buyers and sellers: when there are more longs than shorts, the funding rate tends to increase, and vice versa. A neutral funding rate suggests that the market is currently balanced, with neither side dominating the other significantly.

This equilibrium is essential for traders as it offers an opportunity to assess potential market movements without the pressure of extreme volatility. In times of high funding rates, traders might feel compelled to take positions based on fear of missing out or panic selling, but a neutral environment allows for more rational, strategic decision-making.

Moreover, the presence of a neutral market state could indicate a period of consolidation, where traders are waiting for new information or market catalysts before deciding on their next moves. Whether it’s regulatory news, technological advancements, or macroeconomic factors, external influences can quickly shift the market from neutrality to bullish or bearish.

In conclusion, the current neutral funding rates in CEX and DEX markets highlight a moment of pause for traders, allowing for thoughtful strategy development amid an ever-changing landscape.