In the rapidly evolving landscape of cryptocurrency, the Bitcoin capital strategy stands as a pivotal approach for companies looking to optimize their funding channels. This innovative strategy focuses on a blend of common equity, preferred equity, and convertible debt, enabling firms to effectively navigate the complexities of digital asset investments. By prioritizing a diversified financing mix, businesses can enhance their capital formation strategies while capitalizing on the dynamics of the Bitcoin market. Many organizations are now preferring equity structures that allow for greater flexibility and institutional engagement, vital in today’s market climate. Ultimately, as Bitcoin-focused funding models expand, the strategic implementation of these financial instruments promises to reshape how companies fund their projects and accumulate assets in the cryptocurrency realm.

In the world of digital finance, a well-rounded approach to capital allocation—often referred to as a Bitcoin funding model—has emerged as an essential strategy for firms intent on enhancing their financial positions. This approach encompasses a mixture of equity arrangements and debt instruments, enabling businesses to tap into a broader range of financial resources. As companies shift towards utilizing instruments like convertible debt and structured equity offerings, the landscape of cryptocurrency funding adapts accordingly. With a strategic emphasis on adapting to changing market conditions, these capital formation strategies empower organizations to maintain their competitive edge in Bitcoin market investments. Collectively, these developments underscore the growing importance of optimized funding structures in the pursuit of cryptocurrency-driven growth.

Enhancing Bitcoin Capital Strategies

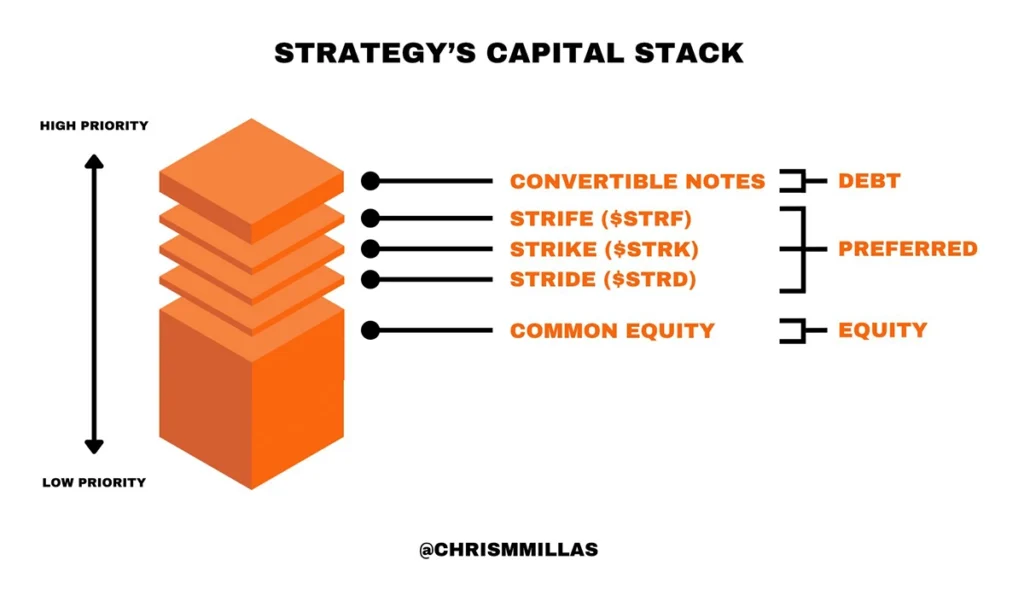

The incorporation of a Bitcoin capital strategy into its funding model is pivotal for the company’s long-term vision. By expanding its fundraising efforts beyond traditional equity structures, the firm is strategically positioning itself within the cryptocurrency ecosystem. This new approach not only reflects a shift toward a more diversified capital structure but also highlights the importance of Bitcoin as a cornerstone asset. The substantial funds raised—$20.8 billion—demonstrate a strong alignment with digital assets, showcasing the company’s commitment to leveraging Bitcoin-focused investments.

Moreover, as the company enhances its capital strategy, it places a significant emphasis on convertible debt usage alongside preferred equity. This dual approach allows for greater flexibility and resilience in navigating the volatile cryptocurrency market. With Bitcoin’s growing acceptance, the company’s investment strategy, which closely intertwines capital formation with its substantial holdings in Bitcoin, indicates a forward-thinking mindset that seeks to attract institutional investors who are eager to capitalize on the cryptocurrency boom.

The Shift towards Preferred Equity Structure

The increase in preferred equity participation marks a transformative step for the company. Previously, funding efforts primarily relied on common equity and convertible debt, but the emergence of preferred equity as a major component of capital formation signifies a strategic pivot. This shift not only fortifies the company’s financial base but also attracts a diverse set of investors who prefer the stability that preferred equity can offer, particularly in an uncertain market environment. As a result, this new equity structure may enhance investor confidence and improve access to further financing.

In 2025, the reliance on preferred equity has already accounted for a significant portion of the company’s capital mix, reported at $6.9 billion. By preferring equity structures, the firm is likely to cater to risk-averse investors seeking fixed dividends and potential upside from their investments in the increasing valuation of Bitcoin assets. As cryptocurrency funding models evolve, this strategic use of preferred equity could set a precedent in the industry, encouraging other firms to reevaluate their own capital strategies.

Structured Offerings and Capital Formation

Structured offerings such as STRF, STRC, STRE, STRK, and STRD represent innovative financing tools relevant to capital formation strategies in the current market. The firm successfully harnessed these structures to mobilize a staggering $21 billion in capital while strategically aligning its fundraising with emerging trends in digital finance. Each of these offerings plays a crucial role in diversifying the firm’s funding sources, ensuring that capital inflow remains robust even as market conditions fluctuate.

Moreover, the structured offerings cater to different investor appetites, allowing a wider array of participation in supporting the firm’s future initiatives related to cryptocurrencies, primarily Bitcoin. This aspect of capital formation enables the company to create tailored investment vehicles that respond to the unique characteristics of its audience, optimizing their involvement in the Bitcoin market. By leveraging such structures, the company positions itself strategically at the forefront of cryptocurrency innovation, opening doors for further engagement and investment opportunities.

Navigating the Cryptocurrency Market Landscape

As the cryptocurrency market undergoes turbulence and rapid changes, having a flexible funding approach is paramount for firms aiming to thrive. The company’s proactive strategy, defined by its choice of securities, equips it to manage treasury positioning more effectively in a competitive landscape. By closely analyzing market trends and investor preferences, the company is prepared to adapt its capital formation strategies to meet demand and capitalize on new opportunities within the Bitcoin sphere.

This strategic agility also plays a vital role in attracting institutional interest in Bitcoin investments. The company’s ability to present a diversified capital mix cultivates trust among potential investors who are becoming increasingly discerning about the risks associated with cryptocurrency funding. By establishing a solid foundation supported by various funding structures, the company not only mitigates risk but also positions itself as a leader in the evolving landscape of Bitcoin and digital assets.

The Rise of Institutional Interest in Bitcoin

Institutional interest in Bitcoin has surged as more firms recognize its potential as a viable asset class. This trend is reflected in the company’s successful fundraising strategies that have drawn significant capital from institutional investors this year. With the firm’s transparent Bitcoin capital strategy and substantial market holdings, investors are not merely looking for returns but are also interested in the long-term stability that Bitcoin represents in a diversified portfolio.

The firm’s ability to maintain a strong position in the corporate Bitcoin market further solidifies its appeal to institutional participants. The strategic pivot towards a more varied funding model, including preferred equity and convertible debt, aligns with institutions’ preferences for secure investment vehicles, thereby enhancing the likelihood of continued engagement. This deepening trust in the Bitcoin market fuels a virtuous cycle of investment and growth for the company.

Future-Proofing Capital Formation Strategies

As the company advances into future markets, the focus will undeniably shift towards future-proof capital formation strategies. The current emphasis on a diversified funding structure highlights a commitment to sustainability and resilience in face of market volatility. By diversifying its investment vehicle and adeptly integrating Bitcoin-focused funding models, the company is not only achieving immediate capital needs but also ensuring long-term growth potential.

Looking ahead, maintaining a keen awareness of market fluctuations and adjusting funding approaches will be imperative. The continued integration of diverse funding methods, such as convertible debt usage and preferred equity structure, will not only cater to various investor interests but also bolster the company’s overall financial agility. Future-proofing its capital formation strategies via adaptability and innovation aligns with the broader trends in cryptocurrency funding, positioning the company well for continued and sustained success in the Bitcoin market.

Institutional Participation Through Diverse Securities

Institutional participation is crucial as it provides the necessary capital inflows to sustain growth in the Bitcoin landscape. The company’s approach, which includes employing a combination of common and preferred equity alongside convertible debt, addresses varying risk profiles of institutional investors. This strategic diversity ensures that the firm can attract institutional players who are gradually increasing their footprint in the cryptocurrency sector.

Moreover, by structuring offerings that resonate with institutional requirements, the company reinforces its position as a trusted entity in the Bitcoin market. The cumulative effect of this multi-faceted capital formation strategy not only draws investment but also fosters deeper, more meaningful engagements with institutional clients. As a result, the firm is likely to build lasting relationships that extend beyond mere financing, contributing to the overall advancement of the cryptocurrency market.

The Impact of Market Dynamics on Capital Mix

Market dynamics inevitably influence how companies approach their capital mix strategies, especially within the volatile cryptocurrency sector. The firm’s recent adaptability in its funding mix—shifting towards preferred equity and convertible debt—reflects a deep understanding of these changing conditions. A strategic capital formation that can respond to market fluctuations will keep the company competitive and relevant in the Bitcoin sphere.

As the firm navigates through these market dynamics, it becomes essential for it to leverage its advantageous position as one of the largest corporate Bitcoin holders. This ensures that capital mix shifts encourage not only immediate growth but are also sustainable in the long term. By effectively managing its currency risk and capital strategies, the company is uniquely positioned to thrive while fostering positive engagement in the cryptocurrency marketplace.

Frequently Asked Questions

What is a Bitcoin capital strategy and why is it important for cryptocurrency funding?

A Bitcoin capital strategy encompasses the methods and securities that companies employ to finance their Bitcoin market investments. This strategy is crucial for cryptocurrency funding because it optimizes capital formation through diverse instruments such as common equity, preferred equity, and convertible debt, allowing firms to leverage their holdings effectively for growth.

How does preferred equity fit into Bitcoin capital strategies?

Preferred equity is a significant element of a Bitcoin capital strategy as it provides companies with flexible funding options while maintaining control over the equity structure. In 2025, for example, the incorporation of preferred equity into Strategy’s funding model has allowed them to raise substantial amounts while diversifying their capital sourcing, enhancing their position in the corporate Bitcoin market.

What role does convertible debt usage play in a Bitcoin capital strategy?

Convertible debt usage is a pivotal aspect of a Bitcoin capital strategy, enabling firms to raise funds while retaining the ability to convert debt to equity in the future. This provides financial flexibility, especially in fluctuating cryptocurrency markets, and supports capital formation alongside increasing Bitcoin allocations within the portfolio.

What are the benefits of utilizing a mixed capital approach in Bitcoin market investments?

A mixed capital approach in Bitcoin market investments allows firms to harness the strengths of various funding types, such as common equity, preferred equity, and convertible debt. This diversification enhances liquidity, attracts institutional investors, and supports sustained capital inflows, as seen in Strategy’s rapid fundraising growth in 2025.

How does the capital formation strategy of a Bitcoin-focused company influence its market position?

The capital formation strategy of a Bitcoin-focused company greatly influences its market position by determining how effectively it can access and utilize funds. By leveraging distinct capital sources like preferred equity and convertible debt, the firm can enhance its Bitcoin holdings, thus positioning itself as a major player in the Bitcoin market and attracting institutional participation.

What trends are emerging in Bitcoin capital strategies for 2025?

Emerging trends in Bitcoin capital strategies for 2025 include a significant shift towards preferred equity and increased reliance on structured offerings. Companies are diversifying their capital mix to adapt to market dynamics, which helps in rapid accumulation of funds and supports ongoing digital asset acquisition, ultimately reinforcing their competitive edge in the cryptocurrency landscape.

Why is capital strategy vital for the growth of corporations involved in Bitcoin investments?

Capital strategy is vital for the growth of corporations involved in Bitcoin investments as it ensures they have the necessary financial backing to seize opportunities in a volatile market. A well-defined capital structure that includes common and preferred equity along with convertible debt enables firms to maintain liquidity and investor interest, facilitating sustained expansion in Bitcoin holdings.

How can a company optimize its capital mix for Bitcoin funding?

A company can optimize its capital mix for Bitcoin funding by integrating multiple securities such as common equity, preferred equity, and convertible debt into its capital strategy. This allows the firm to strategically align its funding methods with market conditions and investor preferences, ultimately enhancing its ability to grow its cryptocurrency portfolio.

| Funding Component | Amount Raised (in billion USD) | Funding Method |

|---|---|---|

| Common Equity | 11.9 | Equity Financing – primary source of funds. |

| Preferred Equity | 6.9 | Equity Financing – new significant component. |

| Convertible Debt | 2.0 | Debt Financing – maintains leverage and access to capital. |

| Structured Offerings Total | 21.0 | Various securities for diversified capital strategy. |

Summary

The Bitcoin capital strategy is characterized by its strategic diversification in funding sources aimed at enhancing liquidity and attracting institutional investors. By incorporating common equity, preferred equity, and convertible debt, the company has established a robust framework to capitalize on its significant position in the Bitcoin market. This thoughtful approach allows the firm to not only optimize its capital inflows but also ensure flexibility in a rapidly evolving market. With $20.8 billion raised in a short period in 2025, the strategy positions itself to potentially exceed past performance, demonstrating a proactive stance towards cryptocurrency investments and market engagement.