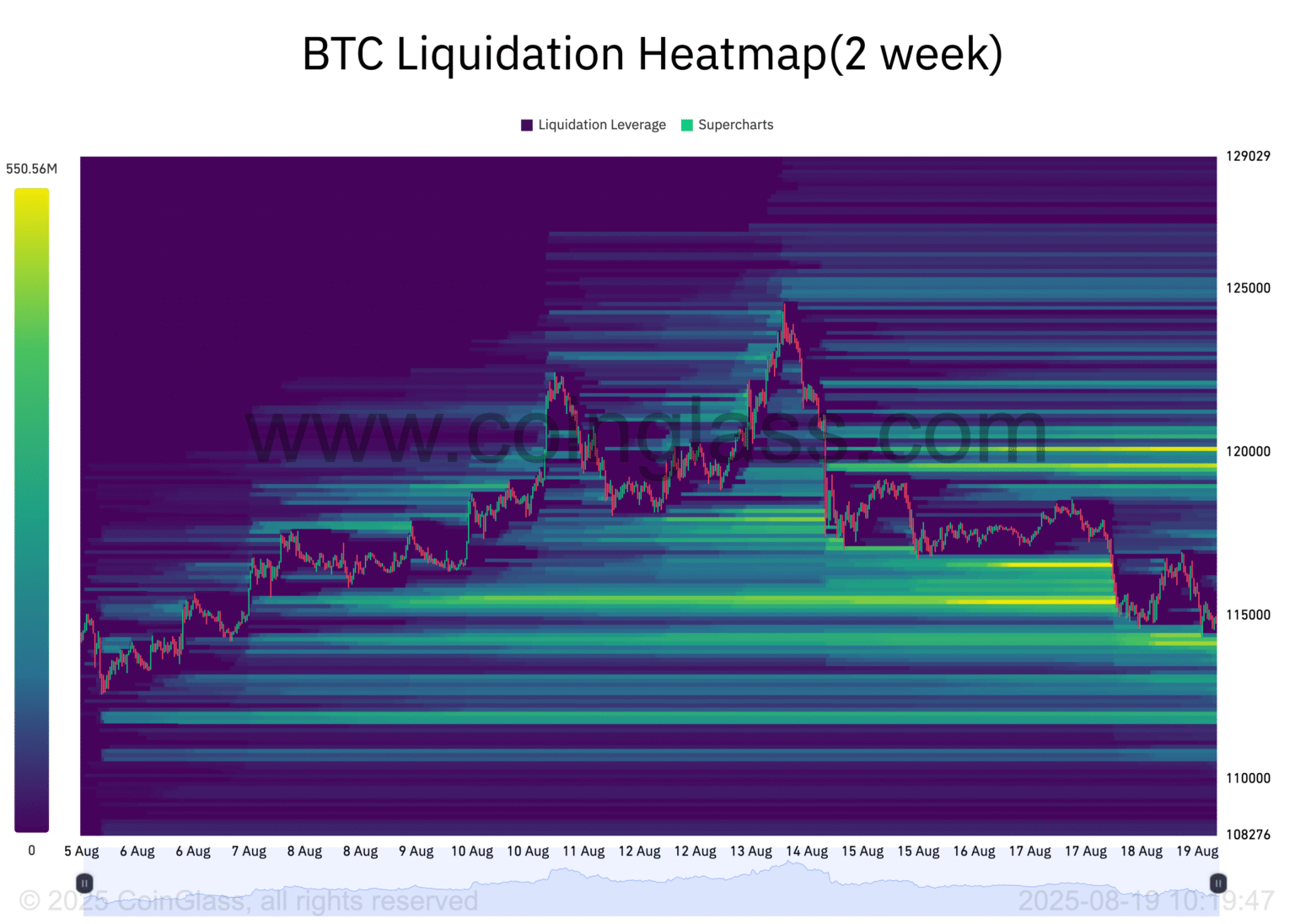

BTC liquidations have surged in recent trading sessions, highlighting the volatility inherent in the cryptocurrency market. Recently, Coinglass data revealed that the total liquidations across the network surpassed a staggering 36.3 million dollars, with a significant 18.14 million dollars accounted for by BTC liquidated. This spike primarily stemmed from the unwinding of long positions, as traders reacted to shifting market dynamics and recent news that has driven investors to reevaluate their strategies. In addition to Bitcoin, Ethereum ETH liquidated also contributed to the overall total, illustrating a broader trend affecting multiple cryptocurrencies. Keeping an eye on these liquidations is crucial for anyone involved in crypto trading, as they can signal sentiment shifts and potential market corrections.

When discussing the liquidations in the cryptocurrency market, particularly those involving Bitcoin, it becomes essential to understand the broader implications of such events. The liquidation of positions, especially long positions, can indicate sudden shifts in investor sentiment and market volatility. Recent data from sources like Coinglass highlights significant liquidations, providing insight into the dynamics of crypto trading. Tracking the amount of Bitcoin and Ethereum that gets liquidated can help traders manage risk effectively and navigate through the tumultuous landscape of digital assets. Overall, keeping tabs on liquidation trends is important for anyone seeking to engage with cryptocurrencies strategically.

Understanding Recent BTC Liquidations

In the volatile world of cryptocurrency, liquidations often serve as a barometer of market sentiment. Recently, we observed a staggering total of 36.3 million dollars in liquidations within just one hour. This figure highlights the intense market activity and the significant shift in investor positions, particularly focusing on BTC liquidations that accounted for 18.14 million dollars. Such large-scale liquidations typically suggest a bearish trend, causing panic among long traders who are forcibly exited from their leveraged positions.

BTC liquidations, as indicated by Coinglass data, reflect not just individual investor turmoil but also broader market dynamics. With 18.14 million dollars worth of BTC liquidated, it’s evident that numerous traders felt the sting of rapidly fluctuating prices. This trend can lead to a cascade effect, where liquidations escalate further as market participants rush to minimize losses, ultimately contributing to price volatility across the crypto landscape.

Analyzing Ethereum ETH Liquidations

While BTC liquidations have predominantly captured headlines, Ethereum has also experienced significant liquidations recently, totaling 8.5 million dollars. Analyzing these figures sheds light on the precarious nature of positions held by ETH traders. Liquidations in Ethereum indicate that traders were either highly leveraged or overly optimistic about price movements, which can quickly backfire in a turbulent market environment.

As we delve deeper into the impact of Ethereum liquidations, it becomes clear that they can instigate a ripple effect across other cryptocurrencies. The Coinglass data reveals a concerning trend: when long positions in Ethereum get liquidated, it can create a downward pressure on the entire crypto market. This interconnectivity underscores the importance of monitoring ETH liquidations alongside BTC data for a comprehensive view of market health.

The Role of Long Positions Liquidated in Market Sentiment

Long positions liquidated represent a critical metric for understanding the psychology of traders during market upheaval. The recent data indicating that 36.33 million dollars were liquidated primarily from long positions suggests that many traders believed in a bullish continuation before the sudden downturn. This disconnect between trader sentiment and actual price movements can lead to widespread panic selling, further exacerbating the situation.

The strategy of taking long positions in a destabilizing market is inherently risky, and the liquidations witnessed recently serve as a stark reminder of these risks. As traders face forced sell-offs, the liquidation of long positions not only results in significant financial losses but can also destabilize the market further, driving prices down as more and more traders capitulate.

Insights from Coinglass Data

Coinglass data provides invaluable insights into market behaviors and trends, particularly regarding liquidations in the cryptocurrency space. With recent reports showing a total of 36.33 million dollars liquidated within a single hour, traders have the opportunity to analyze the underlying shifts in market sentiment. Such data not only tracks the amount liquidated but can also reflect the larger narrative of market supply and demand.

Utilizing tools like Coinglass allows traders and investors to gauge market conditions effectively. The insights drawn from analyses of BTC and ETH liquidations can guide decision-making, providing a clearer understanding of when to enter or exit trades. In this context, Coinglass data serves as a crucial compass for navigating the turbulent seas of the cryptocurrency market.

The Impact of Total Liquidations on Market Trends

The impact of total liquidations cannot be overstated, as seen with the recent liquidation figures exceeding 36.3 million dollars across the network. Large-scale liquidations often set the tone for upcoming market trends, leading to increased volatility that can last for days or even weeks. Such events trigger reactions from traders who may decide to adjust their strategies based on fears of further drops in price.

Furthermore, high total liquidation amounts indicate that many participants are using significant leverage, which tends to heighten risk within the market. A pattern of repeated liquidations can erode confidence and discourage new investment, resulting in a prolonged slump in prices. Therefore, understanding the dynamics of total liquidations is vital for any trader looking to thrive in the crypto markets.

Crypto Liquidations: A Market Overview

As the market for cryptocurrencies continues to evolve, the concept of liquidations plays a crucial role in shaping overall market dynamics. Recent reports indicate that the liquidated amount across various cryptocurrencies has reached significant levels, with BTC and ETH making up a considerable portion. This overview of crypto liquidations enables investors to better understand market pressures and trader behaviors during pivotal moments.

Investors keen to navigate the complex landscape of cryptocurrencies must heed the signals sent by large-scale liquidations. By keeping an eye on trends, such as the reported 36.33 million dollars in liquidations, traders can adjust their strategies accordingly, potentially avoiding the pitfalls that come with forced liquidations. In this respect, a thorough understanding of crypto liquidations can be a key factor in achieving success in this rapidly changing market.

Market Sentiment Through Liquidations

Monitoring market sentiment is essential for anyone involved in trading cryptocurrencies, and liquidations are among the most telling indicators of sentiments. The recent spike in total liquidations, particularly 18.14 million dollars in BTC and 8.5 million dollars in ETH, suggests a bearish shift among traders who were previously optimistic. Understanding this sentiment can give traders a strategic advantage when navigating market fluctuations.

Moreover, as data from Coinglass illustrates that liquidations heavily originate from long positions, it’s imperative for traders to reevaluate their strategies during times of heightened volatility. Recognizing the overall market sentiment—whether it’s optimistic or bearish—becomes foundational for making informed trading decisions and potentially weathering the storms that come with high liquidity events.

Leveraged Positions and Liquidation Risks

Leverage can magnify gains in cryptocurrency trading, but it also drastically increases the risk of liquidation. Recently, with total liquidations surpassing 36.3 million dollars, many traders learned this lesson the hard way. The high volume of liquidated BTC underscores the dangers associated with taking on substantial leverage, especially in a market known for its unpredictability.

When leveraged positions get liquidated, the adverse effects reach beyond the individual trader, impacting overall market stability and contributing to larger sell-offs. This cycle of forced sales exacerbates downward trends and can lead to panic among remaining traders. Therefore, carefully managing leverage and understanding liquidation risks are crucial for anyone engaged in crypto trading.

Future Predictions Based on Liquidation Trends

Analyzing liquidation trends can offer critical insights into future price movements and market conditions. The recent data reflecting total liquidations over 36.33 million dollars, with substantial amounts in BTC and ETH, might foreshadow an impending market correction or shift in sentiment. As traders exit positions in fear of further declines, it opens the door to potential recovery opportunities for astute investors.

Overall, the ability to predict market trends from liquidation data can be beneficial for developing informed trading strategies. By observing liquidations, traders can anticipate buying opportunities when prices stabilize after a liquidation wave. Thus, understanding the implications of BTC and ETH liquidations can significantly enhance decision-making in the ever-changing crypto marketplace.

Frequently Asked Questions

What are the current BTC liquidations reported by Coinglass data?

According to Coinglass data, BTC liquidations in the past hour have reached approximately 18.14 million dollars. This figure is part of a total liquidation amount across the network of about 36.33 million dollars.

How do BTC liquidations affect the cryptocurrency market?

BTC liquidations, particularly from long positions, can exert significant pressure on the cryptocurrency market. When traders’ long positions are liquidated, it often leads to increased selling pressure, which can drive prices down in the short term.

What does it mean when long positions are liquidated in BTC?

When long positions in BTC are liquidated, it means that traders betting on price increases have been forced to close their positions due to price declines. This usually occurs when the market reaches a certain liquidation price, resulting in losses for those traders.

What impact does the total liquidations recent news have on BTC trading?

Recent news indicating high total liquidations, such as the reported 36.33 million dollars, alerts traders to increased market volatility and potential price movements. Such news can influence trading strategies and investor sentiment in the BTC market.

How are ETH liquidations related to BTC liquidations?

ETH liquidations often accompany BTC liquidations as both cryptocurrencies can be affected by similar market conditions. In the latest report, there were also 8.5 million dollars in ETH liquidated, highlighting concurrent sell-offs in both assets.

Where can I find detailed statistics on crypto liquidations?

Detailed statistics on crypto liquidations, including BTC and ETH data, can be found on Coinglass or similar platforms that provide real-time liquidation data and analytics for various cryptocurrencies.

Why are BTC liquidations significant for cryptocurrency traders?

BTC liquidations are significant for cryptocurrency traders as they signal market trends, potential reversals, and the overall health of the market. Keeping an eye on liquidation data can help traders make informed decisions.

What trends can be observed from recent BTC liquidations?

Recent trends in BTC liquidations, particularly the high levels seen in the past hour, indicate a prevailing bearish sentiment among traders, especially those holding long positions. Awareness of these trends can assist traders in adjusting their strategies accordingly.

| Key Points |

|---|

| Total Liquidations (Past Hour): 36.33 million dollars |

| BTC Liquidations: 18.14 million dollars |

| ETH Liquidations: 8.5 million dollars |

| Predominant Direction: Long Positions |

Summary

BTC liquidations reached a significant level in the past hour, totaling 18.14 million dollars as part of an overall liquidation of 36.33 million dollars. This surge, primarily from long positions, highlights the volatility and risk in the cryptocurrency market. Understanding BTC liquidations is crucial for investors as it emphasizes the market’s conditions and the potential for rapid price movements.

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend