The Federal Reserve rate cut is generating considerable anticipation as we approach December, following recent comments from influential figures such as New York Fed President Williams. After his hints at possible monetary easing, market expectations have shifted dramatically, with traders now pricing in a 70% likelihood of a rate reduction. This potential December rate cut might serve as a critical pivot point for the economy, reflecting ongoing concerns over the economic outlook and its implications for growth. As the Federal Reserve enters its quiet period, the focus turns to how these predictions will influence financial markets and consumer confidence. With the stakes high, December’s decisions carry significant weight, especially in light of pressure from fluctuating market dynamics and evolving fiscal policies.

As we navigate the intricate landscape shaped by the anticipated monetary policy adjustments, discussions around the upcoming rate reduction have intensified. The possibility of a December interest rate rollback, spurred by comments from key officials, has led to a reassessment of economic forecasts among investors. These developments are closely monitored, as they resonate through various financial sectors and influence overall market sentiment. Additionally, the ongoing dialogues about shifts in economic strategies reflect broader implications for both consumer behavior and institutional investments. By closely examining these factors, we can better understand the collective economic narrative that unfolds as decisions loom in the coming weeks.

The Probability of a December Rate Cut

The Federal Reserve’s upcoming decisions are under the spotlight, especially with market expectations gearing up for a potential rate cut in December. Recent insights from New York Fed President John Williams indicate a significant possibility of this move, as he hinted at adjustments that reflect the evolving economic outlook. Currently, the sentiment among traders is infused with optimism, with a staggering 70% likelihood assigned to the Fed lowering rates in December. This aligns with broader market-sentiment shifts that have gained traction following Williams’ commentary.

As we approach the quiet period commencing on November 29, the absence of public remarks from Chairman Powell may contribute to a more speculative trading environment. Given that Williams is considered a close ally of Powell, his statements might hold considerable weight in shaping market expectations. Investors are keenly observing these developments, interpreting them as signs from the Fed that could lead to substantial implications for borrowing costs and ultimately influence economic growth.

New York Fed President Williams’ Impact on Rate Cut Predictions

New York Fed President John Williams has emerged as a key figure in the ongoing discussions about potential monetary policy adjustments. His recent remarks have stirred significant dialogue around the Federal Reserve’s next moves, reinforcing the market’s anticipation of a December rate cut. With his proactive stance, Williams has played an integral role in framing the narrative on rate cut predictions, influencing both market analysts and investors. The focus on his insights reflects the weight his position carries in the Federal Reserve hierarchy.

As analysts dissect Williams’ comments, it’s crucial to recognize the interconnectedness of such remarks with broader economic indicators and market sentiment. The potential shift signaled by Williams does not exist in a vacuum but is closely monitored by stakeholders who factor in the economic outlook, labor market trends, and inflation expectations. This convergence of factors is critical, as they collectively inform the anticipated timing and magnitude of any rate changes, making Williams’ influence pivotal in the current environment.

Market Reactions to Federal Reserve Rate Cut Speculations

The market dynamics surrounding speculations of a Federal Reserve rate cut reflect a broader narrative of adaptation and strategy among investors. In light of expecting a December rate cut, stakeholders are recalibrating their positions, anticipating how changes in monetary policy will reverberate throughout various sectors. Notably, the implications of rate cuts are multifaceted, with potential benefits for sectors sensitive to borrowing costs, such as real estate and consumer finance.

Further exacerbating this situation is the presence of macroeconomic considerations that shape market behaviors. The interplay between rate cut predictions and innovative trends, such as AI companies entering the bond market and the fluctuating cryptocurrency sectors, illustrates how investors are diversifying their focus. As speculation intensifies, the market is not solely fixated on Federal Reserve policies but is also responsive to evolving economic landscapes.

Economic Outlook Amid Federal Reserve’s Policy Decisions

As we consider the economic outlook, it is essential to assess how the Federal Reserve’s potential rate cut in December might influence broader economic conditions. Speculation surrounding a 25 basis point cut indicates a cautious yet proactive approach to monetary policy amidst fluctuating economic indicators. This economic landscape is shaped by variable data points, including labor market stability and inflation rates, which dictate the Fed’s ability to maneuver effectively.

The advent of a rate cut could serve as a catalyst for economic growth, spurring consumer spending and business investment. However, this anticipated move must also balance against risks such as the ongoing geopolitical tensions and their potential impact on U.S. economic interests. As the Federal Reserve navigates this intricate tapestry of factors, market participants remain vigilant, prepared to respond to both the immediate effects of rate changes and long-term economic ramifications.

Navigating Market Expectations During Quiet Period

Entering a quiet period allows the Federal Reserve to maintain a semblance of stability as it avoids any abrupt communications that could disrupt market expectations. This strategy underscores the importance of clear messaging from Fed officials, as uncertainty can lead to volatile market reactions. As investors brace for the upcoming December rate cut speculation, maintaining an informed perspective is essential in navigating various economic narratives.

The quiet period creates an opportunity for stakeholders to digest existing information, particularly remarks from influential figures such as Williams. This pause gives market analysts a chance to refine their forecasts and adjust their strategies accordingly. Understanding these dynamics will be crucial in the days leading up to the Fed’s next announcement, as the market sensibilities will largely hinge on how it weighs the implications of a potential rate cut against other macroeconomic signals.

Anticipating the Impact of a Rate Cut on Investments

As investors anticipate the Federal Reserve’s rate cut in December, strategic positioning within portfolios becomes crucial. The effect of such a monetary policy change can ripple through various asset classes, prompting traders to rethink their allocations depending on projected benefits from lower borrowing costs. Sectors such as consumer discretionary and financial services are often seen as immediate beneficiaries in a declining rate environment.

Further considerations regarding the effects of rate cuts on bond yields and overall market liquidity must also be made. As markets adapt to new realities, having a forward-looking investment strategy that accounts for shifts in economic indicators will be paramount. Investors are likely to explore opportunities beyond traditional equities, considering emerging sectors such as technology and renewable energy that stand to gain substantially from favorable rate policies.

The Role of Federal Reserve in Shaping Economic Policy

The Federal Reserve plays a crucial role in shaping economic policy and its effects reverberate throughout the economy. Its decisions concerning interest rates directly impact borrowing costs for businesses and consumers alike, thereby influencing overall economic activity. In light of potential rate cuts in December, the Fed is delicately balancing the objectives of stimulating growth while managing inflationary pressures.

As we observe the Fed’s approach, it’s essential to recognize how administrator perspectives, such as those presented by President Williams, can inform public and market perception. The conversations surrounding rate cuts and economic forecasts create not only market reactions but also entrepreneurial expectations. By analyzing the Fed’s strategy, investors can position themselves more favorably in anticipation of the Fed’s next moves, particularly if they signal a shift toward a more accommodative monetary stance.

Understanding the 28-Point Plan and Rate Cut Dynamics

The recent developments concerning the ’28-point’ economic plan introduced by the Trump administration also play a significant role in the discourse around the Federal Reserve’s rate cut strategies. This proposal, amidst mounting trade relations with China, introduces macroeconomic factors that feed into investor risk assessments and the economic outlook. Such ambitious plans have the potential to influence market sentiment positively if they lead to tangible growth.

As the market digest these various layers of information, the interplay between cutting rates and implementing the 28-point plan will determine the short-term trading dynamics. Investors must weigh the implications of both the rate cut expectations and the potential outcomes of economic strategies in their investment decisions. Recognizing how these two dimensions intersect can offer valuable insights into market shifts and guide investment actions during a time of uncertainty.

The Future of the Federal Reserve’s Monetary Policy

Looking beyond the immediate forecast of the anticipated December rate cut, the Federal Reserve’s broader monetary policy trajectory raises critical considerations for investors. The ongoing development of economic indicators will ultimately dictate the effectiveness and timing of further financial adjustments. The dialogue surrounding new priorities in economic policy suggests a proactive Fed that is responsive to changing market conditions.

This period of uncertainty regarding the Fed’s future actions necessitates a keen awareness among investors who must remain vigilant in their strategies. As the economic landscape evolves, so too should the assessments of potential rate adjustments. By integrating a comprehensive understanding of both current market sentiments and future Fed strategies, market participants can better navigate the complexities of economic forecasting and investment planning.

Frequently Asked Questions

What is the likelihood of a Federal Reserve rate cut in December 2025?

As of now, the market anticipates a 70% chance of a Federal Reserve rate cut in December 2025, following hints from New York Fed President Williams regarding a potential cut.

What did New York Fed President Williams say about the December rate cut?

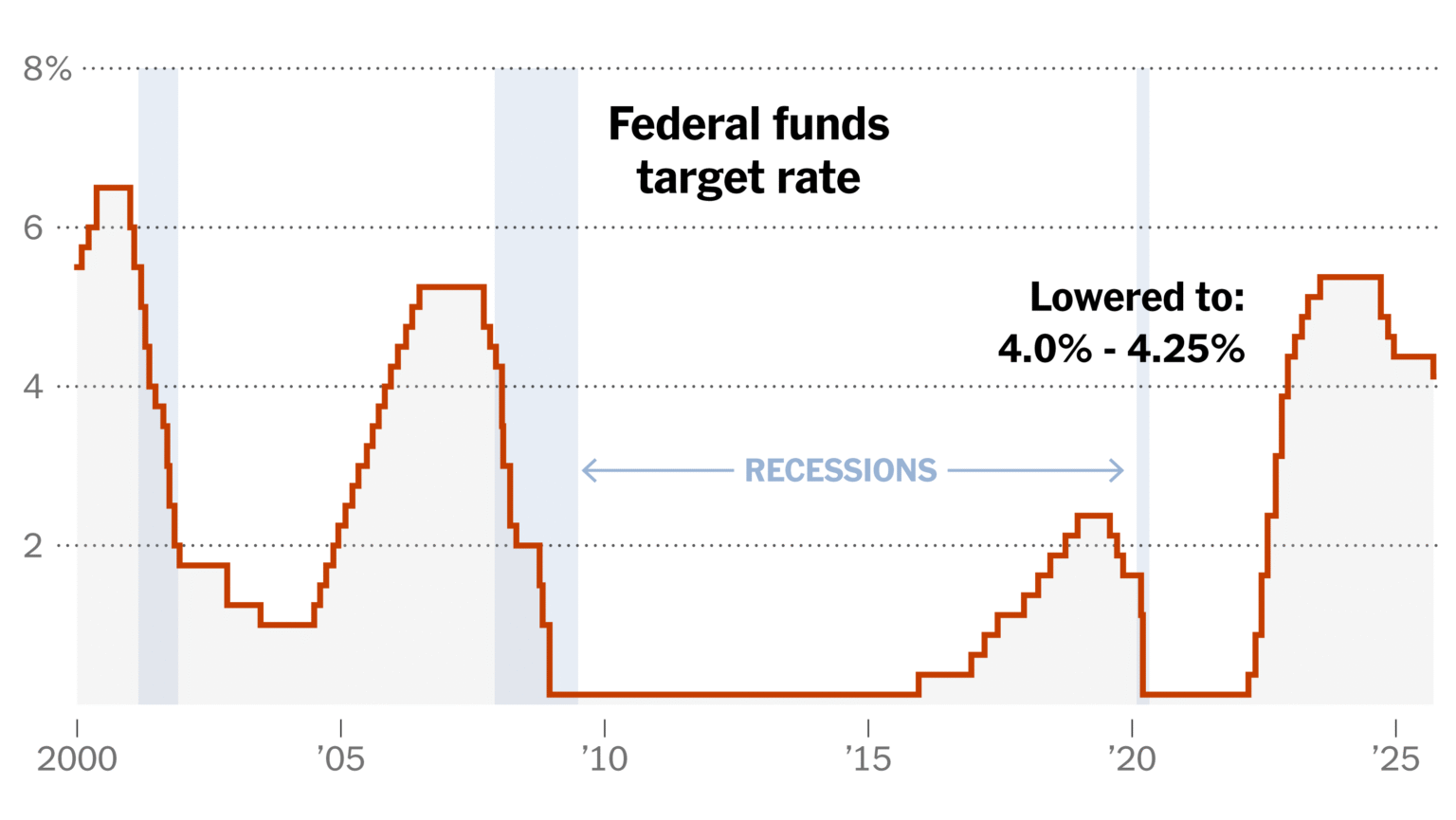

New York Fed President Williams suggested that a further Federal Reserve rate cut in December is likely, aligning with market expectations of a possible 25 basis point reduction.

How do market expectations influence the Federal Reserve rate cut predictions?

Market expectations, such as those indicated by Fed officials like New York Fed President Williams, significantly influence Federal Reserve rate cut predictions by shaping investors’ perceptions of future monetary policy.

What does the economic outlook suggest for the upcoming Federal Reserve rate cut?

The economic outlook suggests that while there may be a rate cut in December, it will be a close call, as various macro factors are currently stabilizing and shifting market focus towards other emerging sectors.

What factors could impact the Federal Reserve’s decision on a rate cut in December?

Factors impacting the Federal Reserve’s decision on a December rate cut include the economic outlook, the potential reversal in rate cut expectations, and ongoing macroeconomic developments.

| Key Points | Details |

|---|---|

| Upcoming Federal Reserve Quiet Period | The Federal Reserve will enter a quiet period starting November 29, 2025. |

| Expectations for Rate Cut | CITIC Securities expects a rate cut in December 2025. |

| Market Sentiment | Currently, there is a 70% chance perceived by the market for a December rate cut. |

| Comments from Fed Officials | New York Fed President Williams hinted at further rate cuts. |

| Magnitude of Expected Cut | A rate cut of 25 basis points is expected if it occurs. |

| Market Focus Shift | Post rate cut expectations, there is a shift in focus towards AI company bonds and cryptocurrency trends. |

Summary

The Federal Reserve rate cut is highly anticipated in the financial markets, with expectations leaning towards a decision in December. As the Fed enters a quiet period, market analysts, including CITIC Securities, have reinforced their prediction of a 25 basis point cut, driven by recent comments from Fed officials and shifting market dynamics. This potential rate cut could reshape investment strategies towards emerging technologies and cryptocurrency, indicating a significant moment for the economy as stakeholders recalibrate their expectations.