Headline: Markets Lift December Rate-Cut Bets Above 50% After Williams’ Dovish Signal

Key Takeaways

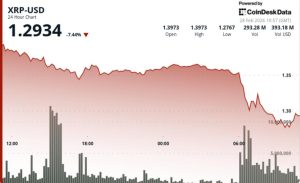

Investors ramped up expectations for a Federal Reserve rate cut in December after New York Fed President John Williams indicated policy remains modestly restrictive and rate reductions are still possible in the near term. The shift in the monetary policy outlook sparked a broad risk-on move, with U.S. equities and bitcoin advancing on the headlines.

Futures now imply roughly a 60% chance of a December rate cut, reflecting traders’ view that the Fed could begin easing if inflation and growth continue to moderate. The prospect of lower borrowing costs buoyed sentiment across risk assets, as markets interpreted Williams’ comments as a dovish cue from a key policymaker.

Williams is among the most influential voices at the central bank: he leads the New York Fed, is a permanent voter on the FOMC, and is part of the leadership trio alongside the Chair and Vice Chair. Communications from this group often carry additional weight and are used to fine-tune market expectations when policy guidance risks being misread.

Key Points – Market-implied odds of a December Fed rate cut climbed to about 60%. – New York Fed President John Williams said rate cuts remain possible with policy still modestly restrictive. – U.S. equities and bitcoin rose on the dovish shift in rate expectations. – Williams is a permanent FOMC voter and part of the Fed’s core leadership trio. – Leadership remarks are often used to recalibrate market expectations on monetary policy.