In recent times, a new trend has emerged among Debt Acquisition Companies (DATs), where these firms have taken to selling off their cryptocurrency holdings in an attempt to shore up their stumbling stock prices. This move, aimed at quickly bolstering financial reports and reassuring investors, raises questions about the sustainability of such strategies in the tumultuous world of digital assets and high finance.

Key Takeaways

The Context: DAT Firms and Their Crypto Involvement

Debt Acquisition Companies typically specialize in purchasing debt at a discounted rate and later collecting it at a profit. Over the last few years, with the meteoric rise of cryptocurrencies, some of these firms have diversified their investment portfolios to include substantial holdings in various digital currencies. They considered these assets both as a hedge against inflation and a high-reward investment, given the rapid price appreciations witnessed in the past decade.

The Current Scenario: Selling Crypto to Rescue Stocks

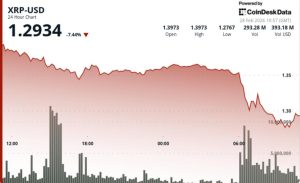

The crypto market has been nothing short of volatile. With the recent downturns in the market, driven by regulatory pressures, technical challenges, and shifts in investor sentiment, DAT firms have found their crypto investments losing value. Concurrently, their primary business of debt acquisition has been under strain due to economic uncertainties influencing the ability to collect debts efficiently.

As a result, some DAT firms have resorted to liquidating their cryptocurrency holdings to improve liquidity and mitigate the impacts of falling stock prices. This move is primarily aimed at creating a more attractive financial sheet that could please investors and analysts, maintaining a favorable market perception and potentially raising stock prices in the short term.

Analysis: The Sustainability of This Strategy

The decision to sell off cryptocurrency holdings for immediate fiscal relief poses several considerations regarding sustainability:

1. Short-term Relief vs. Long-term Gain

Selling assets in a bear market means locking in losses and potentially forfeiting future gains. Cryptocurrencies, for their part, are known for their dramatic recoveries. Companies must weigh immediate financial relief against the possibility of losing out on future upswings in crypto valuations.

2. Investor Confidence

While improving quarterly financial results can boost investor confidence in the short run, sophisticated investors are likely examining the company’s ability to manage its investment portfolio wisely. Frequent shifts in investment strategy could signal poor planning and risk management, thereby hurting credibility.

3. Market Dynamics

The cryptocurrency market is influenced by a wide range of factors including technological advancements, geopolitical events, and macroeconomic trends. Liquidating crypto assets may not only result in a loss due to unfavorable market conditions but could also mean missing out on potential positive market shifts.

4. Regulatory Environment

With the increasing focus on cryptocurrencies from a regulatory perspective, companies need to navigate the compliance and legal implications of rapidly changing their investment stances, which can complicate or hinder quick liquidations.

Conclusion: Need for a Balanced Approach

For DAT firms, the decision to sell off cryptocurrencies to support their stock prices is not without its pitfalls. It could provide a temporary fix to financial woes but might undermine potential future gains and investor trust. A more balanced approach, perhaps involving a strategic combination of asset retention for long-term growth, alongside measured asset liquidation to manage immediate needs, might serve better.

Critical to the success of such strategies will be the firms’ ability to clearly communicate their financial strategies to stakeholders, maintaining transparency about investment decisions and their implications. In the long run, sustainability will likely hinge more on sound financial management and market acumen than on reactive selling based on market fluctuations.