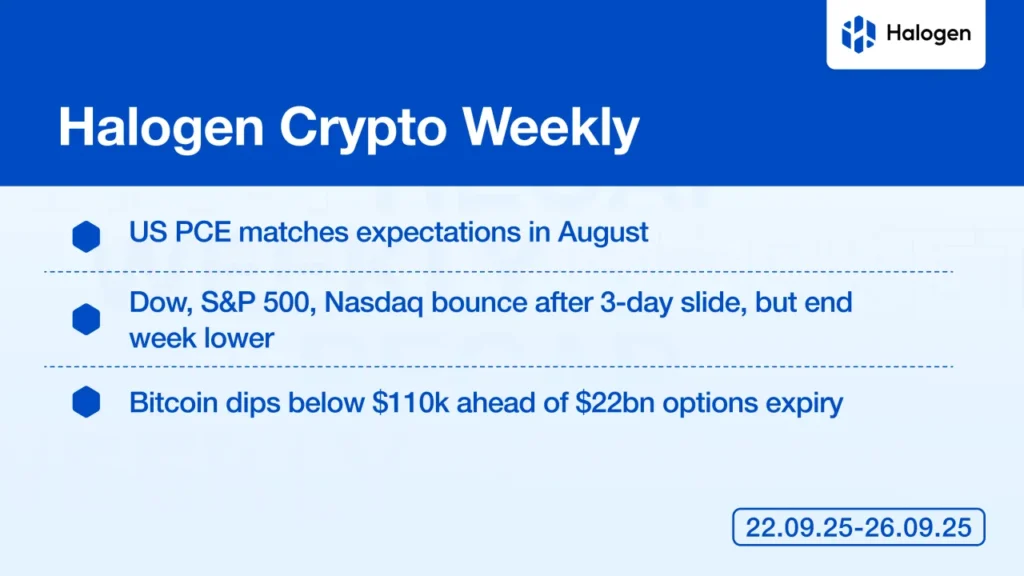

In a notable turn of events, Bitcoin, the leading cryptocurrency, briefly fell below the $119,000 mark, marking a 0.44% decrease in value over the past hour. This fluctuation is part of a broader trend observed in the cryptocurrency market, which has been characterized by volatility and rapid price changes.

Bitcoin, often seen as a barometer for the entire cryptocurrency market, has experienced significant price swings in recent months. Investors and analysts closely monitor these movements, as they can indicate shifts in market sentiment and investor confidence. The recent dip below 9,000 has raised eyebrows, particularly among traders who are always on the lookout for potential buying opportunities or signs of a market correction.

Several factors contribute to Bitcoin’s price volatility, including regulatory news, macroeconomic trends, and shifts in investor behavior. As more institutional investors enter the cryptocurrency space, the dynamics of supply and demand continue to evolve, leading to unpredictable price movements. Additionally, external factors such as economic indicators and geopolitical events can also influence Bitcoin’s performance.

Despite the recent decline, many experts remain optimistic about Bitcoin’s long-term potential, citing its growing adoption and the increasing interest from both retail and institutional investors. As the cryptocurrency market continues to mature, investors are advised to stay informed and consider the inherent risks associated with trading digital assets.