FG Nexus Is the Latest Ethereum Treasury Firm to Sell ETH as Its Stock Craters

In a surprising turn of events in the crypto industry, FG Nexus, a prominent treasury management firm that holds a significant portion of its reserves in Ethereum (ETH), has begun liquidating its holdings as its stock price faces a steep decline. This move marks a notable shift in strategy for the firm amidst turbulence in the cryptocurrency market and broader economic uncertainties.

Key Takeaways

The Pressure of Market Dynamics

FG Nexus, like many firms operating within the cryptocurrency space, traditionally maintained a major portion of its treasury in Ethereum, betting on the long-term growth and stability of the platform. ETH, known for its role in facilitating decentralized finance (DeFi) and other applications through its smart contract capabilities, has been a favorite among many enterprise-level investors.

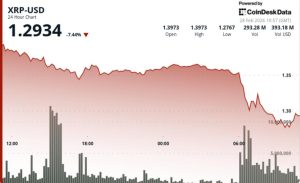

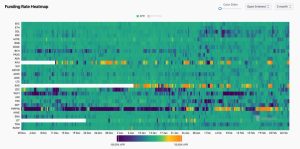

However, recent months have witnessed a volatile crypto market, exacerbated by fluctuating regulatory stances, geopolitical tensions, and macroeconomic factors like inflation fears and changes in fiscal policies by governments around the world. Ethereum has not been immune to these challenges, seeing significant price swings that have instilled a sense of caution among investors.

FG Nexus’s Strategic Shift

FG Nexus’s decision to sell off a portion of its ETH reserves comes at a time when its share prices have noticeably plummeted. The firm seems to be transitioning towards a more conservative approach, possibly aiming to stabilize its financial posture by reducing exposure to crypto-assets, which, despite their potential, carry a significant risk due to their volatility.

The decision is particularly notable, given that it could signal a broader trend among institutional investors who have traditionally supported Ethereum and other major cryptocurrencies. If other firms follow suit, there could be a larger impact on the market, possibly leading to a bearish phase for Ethereum, at least in the short term.

Implications for Ethereum and the Crypto Landscape

The move by FG Nexus raises several questions about the future of Ethereum as a treasury asset for large firms. While ETH remains a cornerstone of the crypto economy, its fortunes are closely tied to the broader acceptance and integration of cryptocurrencies into mainstream financial and economic systems.

For Ethereum’s developers and community, these developments could serve as a critical juncture to fortify the platform and increase its appeal to institutional investors. Enhancements in scalability, security, and regulatory compliance could be key factors that might reassure wary investors and stabilize Ethereum’s position as a preferred investment asset.

Moreover, the situation highlights the inherent risks and volatility associated with cryptocurrencies. Institutional investors, who manage large portfolios often comprising a mix of traditional and newer asset classes, are particularly sensitive to shifts in market sentiment and regulatory landscapes. As such, their investment strategies can provide valuable signals about the perceived maturity and stability of digital assets like Ethereum.

The Road Ahead

As FG Nexus adjusts its investment strategy, the ripple effects may prompt other firms with similar profiles to reevaluate their positions in Ethereum and the crypto market at large. This could either lead to a wave of sell-offs, which might drive prices down, or encourage a reconsolidation around newly perceived strengths and opportunities within the Ethereum ecosystem.

Investors and market watchers will be keenly observing these developments, as they could set the tone for the next phase of growth or retracement in the crypto market. Regardless of the direction, the moves by FG Nexus underscore the dynamic and often unpredictable nature of cryptocurrency investments, highlighting the need for robust risk management practices.

In conclusion, FG Nexus’s recent actions are a telling indicator of the challenges and strategic recalibrations facing Ethereum treasury firms. How the broader community and other institutional investors react to these shifts will be critical in shaping Ethereum’s trajectory in the coming months and years.