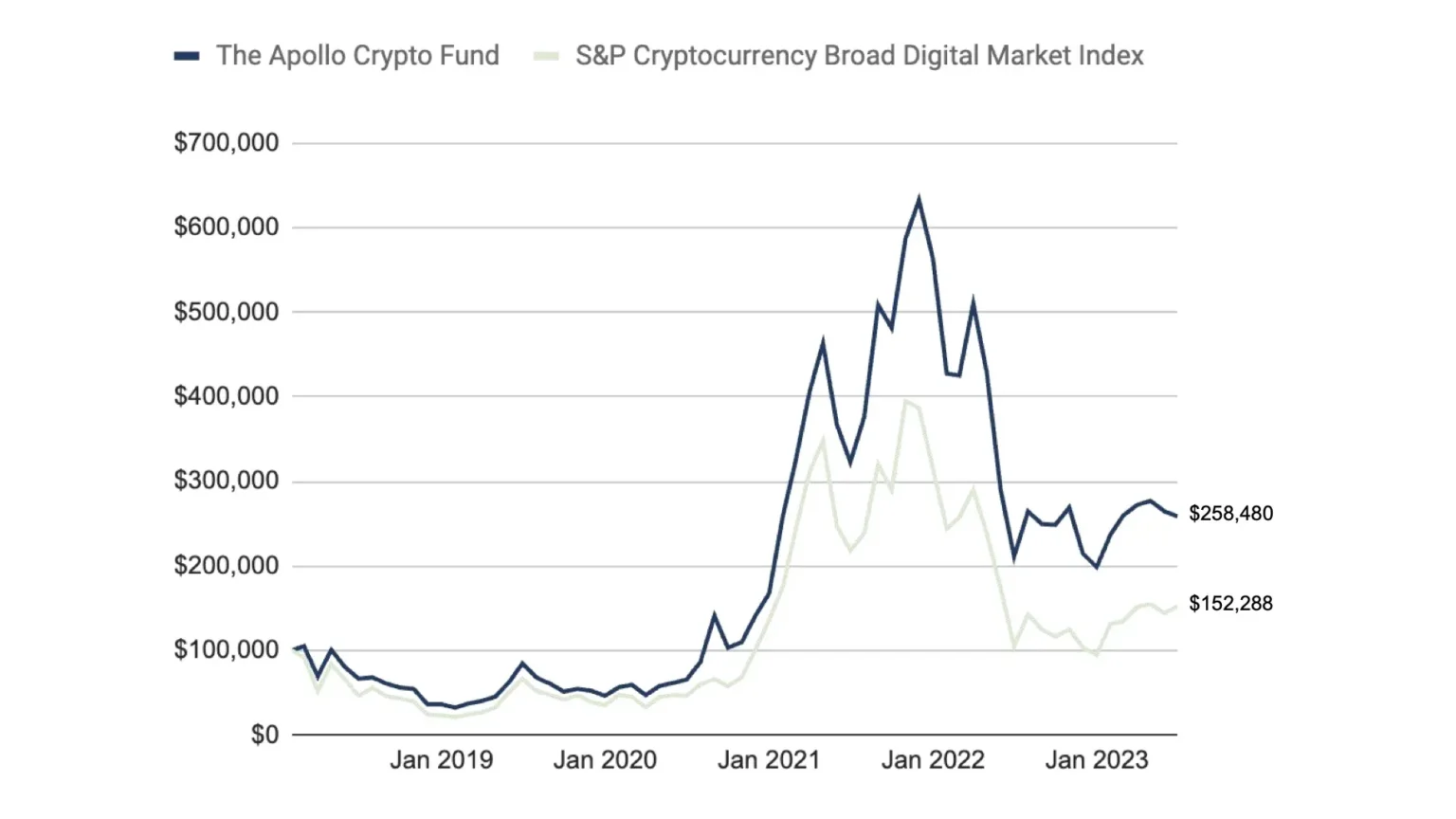

Crypto indices provide a way for financial advisors to track the performance of various cryptocurrencies. These indices aggregate data from multiple digital assets, offering a comprehensive view of market trends. By utilizing crypto indices, advisors can make informed decisions based on the collective performance of cryptocurrencies rather than individual assets. This approach helps in managing risk and diversifying investment portfolios. Additionally, crypto indices can serve as benchmarks for evaluating the performance of specific cryptocurrencies against the broader market. As the cryptocurrency landscape continues to evolve, understanding these indices becomes increasingly important for advisors looking to navigate this complex environment effectively.

This update was auto-syndicated to Bpaynews from real-time sources. It was normalized for clarity, SEO and Google News compatibility.