In the ever-volatile world of cryptocurrency, market movements can significantly impact traders’ positions, particularly those with substantial investments, often referred to as “whales.” Recently, one prominent whale has experienced a notable shift in their trading outcomes. Their long position, which had recently incurred an unrealized loss of $4.8 million, has now transitioned into a more favorable scenario with their Ethereum long position becoming an unrealized gain of $3.14 million.

This transformation highlights the dynamic nature of the cryptocurrency market. Long positions—trades betting that a cryptocurrency’s price will rise—can fluctuate dramatically based on market conditions. A decrease in the unrealized loss indicates that the market may be stabilizing or recovering, allowing traders to re-evaluate their strategies.

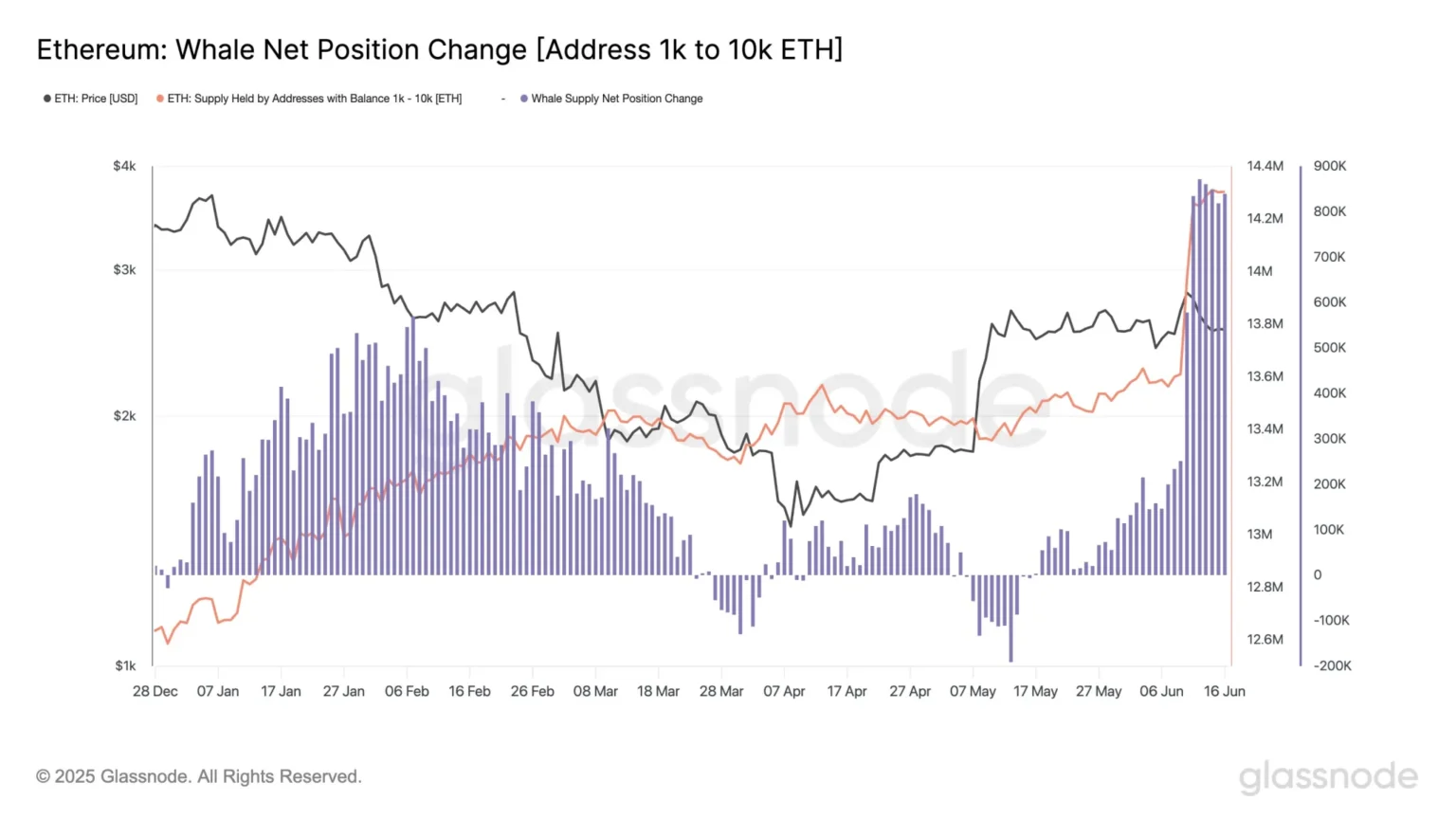

Ethereum, the second-largest cryptocurrency by market capitalization, has seen significant price movements in recent weeks, drawing the attention of investors looking for opportunities. This whale’s shift from loss to gain demonstrates the potential for recovery and profitability, even after a period of uncertainty.

The juxtaposition of the unrealized loss in one area and the gain in another serves as a reminder of the importance of diversification in trading strategies. As the cryptocurrency market continues to evolve, traders must remain vigilant, adapting to new information and market changes. The ability of traders, particularly whales, to navigate these turbulent waters can lead to significant financial outcomes, underscoring the unpredictable yet thrilling nature of cryptocurrency trading.