Nonfarm Payrolls Set to Show Moderate Job Gains: Analyzing the Implications for the Economy

As the upcoming nonfarm payroll report approaches, economic analysts anticipate moderate job gains, signaling a continuation of the steady but cautious growth trajectory seen in recent months. This nuanced increase is reflective of a balancing act between burgeoning sectors and ongoing economic recalibrations influenced by various domestic and global factors.

Key Takeaways

Understanding Nonfarm Payrolls

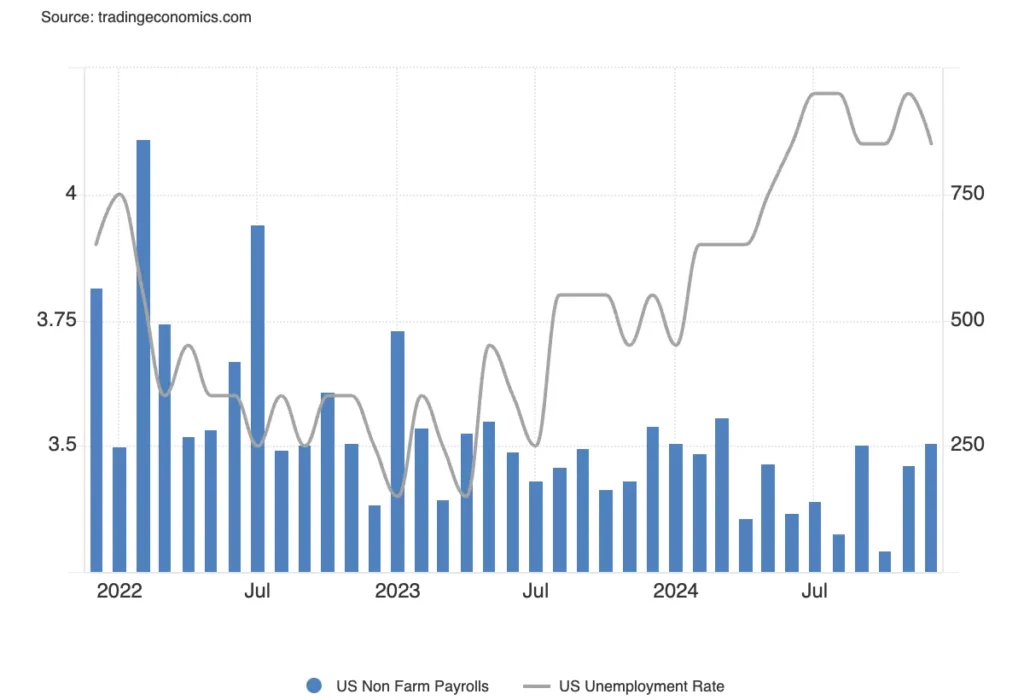

Nonfarm payrolls, a critical economic indicator included in the U.S. Employment Report, measure the number of jobs added or lost in the U.S. economy over the previous month, excluding farm workers and certain other job classifications. Financial markets and policymakers closely watch this indicator as it provides insight into the health and direction of the economic activity.

Expected Trends and Their Origins

The anticipated moderate increase in job gains can be attributed to several interlinked factors:

-

Service Sector Resilience: As the backbone of the U.S. economy, the service industry continues to expand, buoyed by consumer spending and gradual economic reopening post-pandemic setbacks. Sectors like health care, education, and professional services are likely to have contributed significantly to the job numbers.

-

Manufacturing and Construction Slowdown: Despite the resilience in services, manufacturing and construction sectors might display slower growth. Supply chain disruptions, along with global economic uncertainties—partially due to geopolitical tensions and trade adjustments—have tempered growth in these industries.

-

Technological Adaptations: Many industries have rapidly integrated new technologies to enhance efficiency and adapt to changing market conditions. While this trend boosts productivity, it also moderates the pace of job creation, as fewer workers are required for certain tasks.

-

Government Policies and Fiscal Stimulus: Current fiscal policies and any recent stimulus measures also play a critical role in shaping job growth. Legislative changes affecting taxation, minimum wage adjustments, and industry-specific regulations can either hinder or facilitate employment creation.

Sector-Specific Outlook

The report is likely to present a varied picture across different sectors:

- Retail and Hospitality: Expected to show some recovery as consumer confidence remains steady and tourism picks up slowly.

- Technology and E-Commerce: Continues to grow, although at potentially slower rates than during the peak pandemic months, with job gains primarily in tech hubs.

- Energy Sector: May see limited growth impacted by fluctuating oil prices and a global push towards renewable energy sources.

Macroeconomic Implications

Moderate job gains suggest a mixed economic environment:

- Interest Rates: The Federal Reserve might see this as a validation for a cautious approach towards interest rate changes, aiming to avoid stifling growth while keeping inflation in check.

- Inflationary Trends: Employment growth impacts consumer spending, which in turn influences inflation. A stable job growth rate could help maintain a balance between preventing runaway inflation and encouraging consumer expenditure.

- International Impact: As the U.S. job market goes, so often goes the global economy, particularly in consumer goods and technology markets. Moderate growth in U.S. employment could influence global economic strategies, from central bank policies to foreign direct investment decisions.

Looking Ahead

Investors, policymakers, and the public eagerly await the nonfarm payroll report, which will provide deeper insights into the economic trends and undercurrents influencing job creation. While moderate job gains do not signify a booming economy, they suggest a sustainable growth path that might help in long-term stabilization and development. The nuances of this report will be critical for forecasting the near-term economic outlook and adjusting strategies accordingly to navigate the complexities of a post-pandemic economic landscape.