Grayscale Bets Big on LINK Amid Market Slump

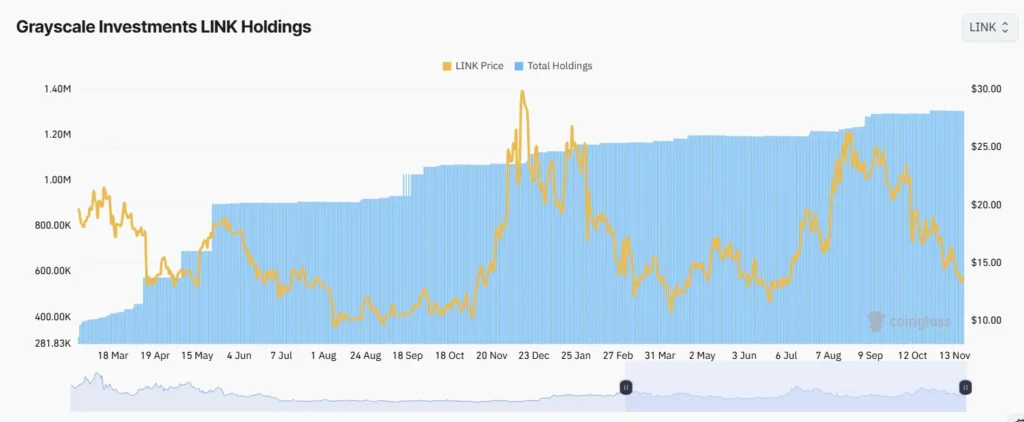

In a surprising move that has caught the attention of both market analysts and cryptocurrency enthusiasts alike, Grayscale Investments, the world’s largest digital currency asset manager, has made a significant investment in Chainlink’s native token, LINK. This decision comes at a time when the broader cryptocurrency market continues to witness a downturn, leading to widespread speculation and interest in Grayscale’s strategic move.

Understanding Grayscale’s Investment Strategy

Grayscale Investments is renowned for its bullish stances and significant holdings in major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). The firm’s investment vehicles allow institutional investors to gain exposure to digital assets without the complexities of direct ownership, storage, and security of cryptocurrencies.

The recent purchase of a substantial amount of LINK, the digital asset linked to the Chainlink network, suggests a strategic pivot or diversification in Grayscale’s investment portfolio. This move could potentially signal Grayscale’s confidence in the utility and future applicability of Chainlink’s technology.

What is Chainlink?

Chainlink is a decentralized oracle network designed to provide real-world data to smart contracts on the blockchain. Chainlink oracles act as data feeds that connect cryptocurrencies to off-chain resources like databases, web APIs, and real-world events. This capability is vital for the execution of smart contracts that need to interact with external systems to function effectively.

The value proposition of Chainlink lies in its ability to securely and reliably feed this external data into various blockchains, which can help facilitate and escalate the use of smart contracts across different industries, creating more scalable and useful applications.

The Potential Behind LINK’s Appeal

The rationale behind Grayscale’s investment might be rooted in the broader applicability and potential growth of the Chainlink network. As the cryptocurrency market matures and more complex financial products and services integrate blockchain technology, the need for reliable real-world data becomes increasingly crucial. Chainlink’s protocol provides an essential service by connecting blockchains with trusted external data sources, which are necessary for the practical deployment of smart contracts.

Market Reaction and Future Outlook

Despite the prevailing market slump, which has seen major digital assets slump by considerable margins, Grayscale’s investment has sparked a renewed interest in LINK. Following the announcement, LINK’s price experienced a noticeable uptick, reflecting positive market sentiment towards Grayscale’s decision.

This strategic acquisition could also suggest a more widespread institutional interest in alternative cryptocurrencies (altcoins), which may be perceived as undervalued or having significant potential for growth and integration in digital finance.

Conclusion

Grayscale’s sizable investment in LINK during a market downturn not only underscores the firm’s commitment to diversifying its portfolio but also highlights its belief in the future of decentralized oracle networks like Chainlink. Whether this move will spur other institutional investors to broaden their cryptocurrency horizons remains to be seen, but for now, Grayscale continues to pave the way in institutional digital asset investment, signaling possibly a new trend in the investment landscape amid challenging market conditions.

In the coming months, it will be crucial to monitor how this investment influences the broader adoption and valuation of Chainlink, as well as its impact on the trajectory of the cryptocurrency market overall.