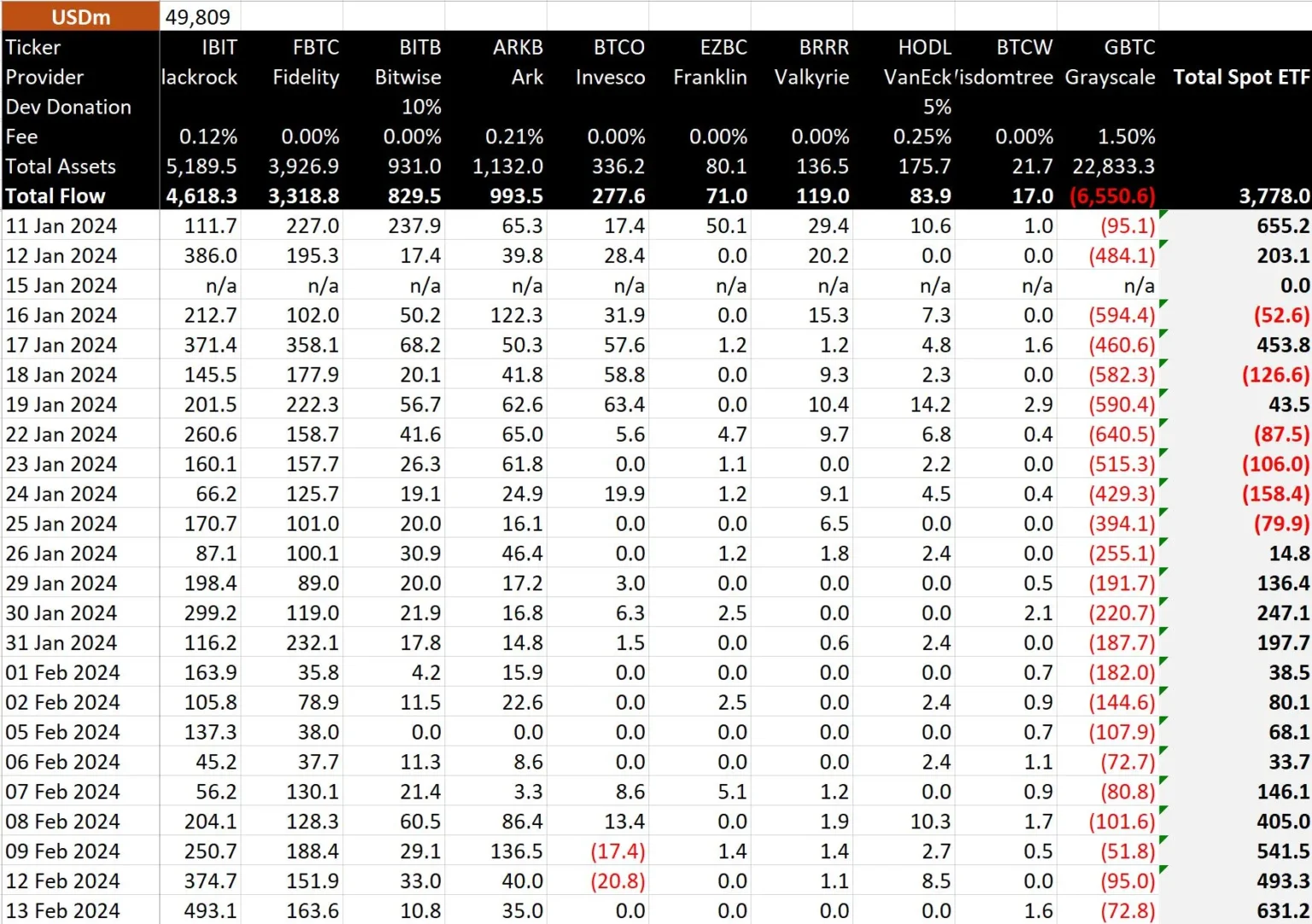

In a significant development for cryptocurrency investors, the Bitcoin Spot Exchange-Traded Fund (ETF) has recorded a remarkable net inflow of $676 million yesterday. This marks the third consecutive day of positive net inflows, signaling a growing confidence in Bitcoin as an investment vehicle.

The rise of Bitcoin ETFs has been a game-changer in the cryptocurrency market, allowing traditional investors to gain exposure to Bitcoin without the complexities of direct ownership. ETFs are investment funds that are traded on stock exchanges, much like stocks, and they hold assets such as commodities or currencies. The Bitcoin Spot ETF specifically tracks the price of Bitcoin, making it an attractive option for those looking to invest in the digital currency without the need for wallets or exchanges.

The recent inflows can be attributed to several factors, including increased institutional interest and a more favorable regulatory environment. As more investors recognize Bitcoin’s potential as a hedge against inflation and a store of value, the demand for Bitcoin ETFs has surged. This trend is further supported by the growing acceptance of cryptocurrencies in mainstream finance, with major financial institutions beginning to offer Bitcoin-related products.

As the market continues to evolve, the sustained inflows into Bitcoin ETFs could indicate a bullish sentiment among investors. If this trend persists, it may pave the way for further innovations in the cryptocurrency space, potentially leading to even more investment opportunities.