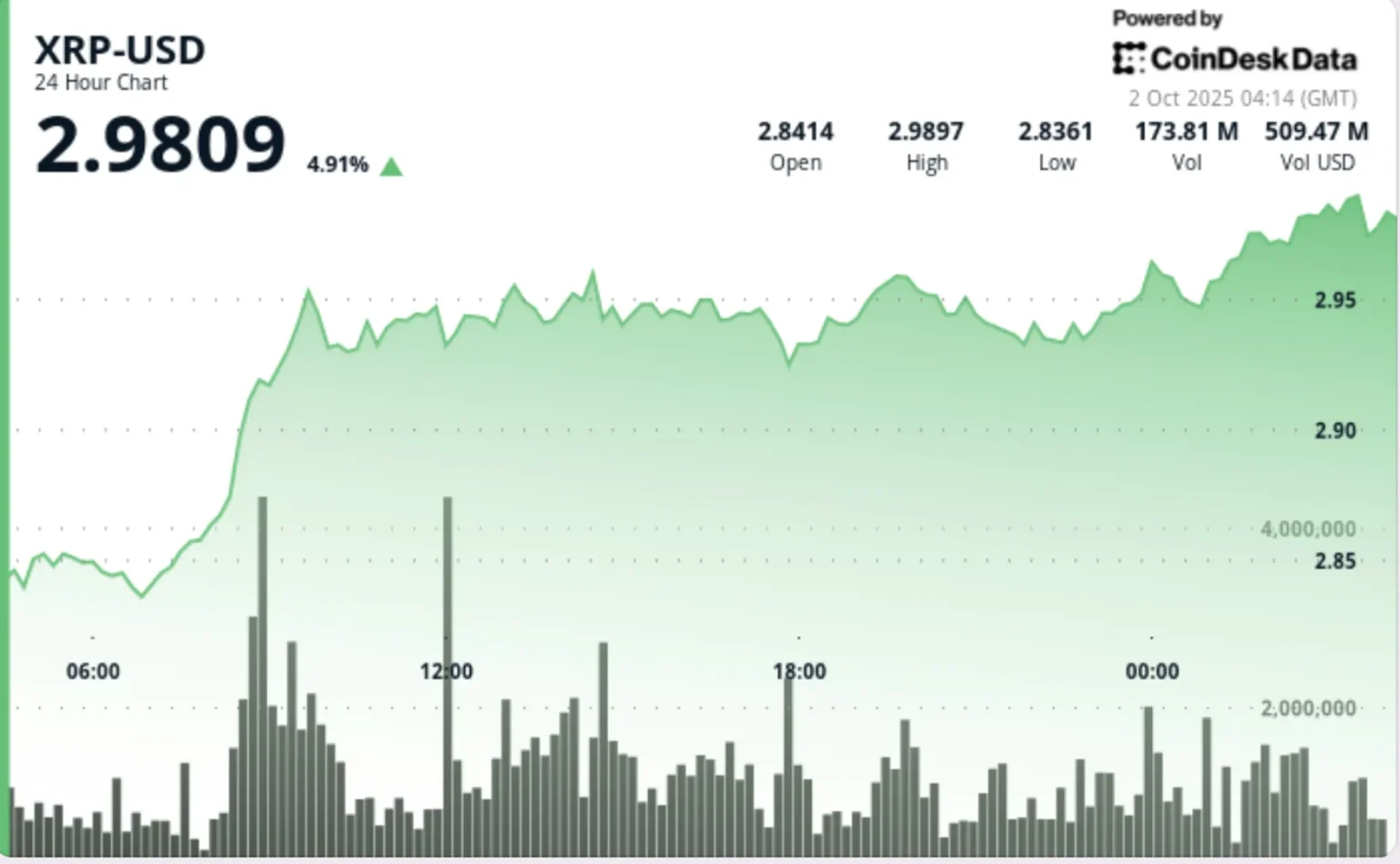

In a significant market movement, XRP, the digital asset associated with Ripple, has surged by 5%, driven by two key developments: the launch of the SBI Lending Program and the countdown to a potential exchange-traded fund (ETF) approval. This uptick in value reflects growing investor confidence and interest in the cryptocurrency landscape.

The SBI Lending Program, initiated by SBI Holdings, aims to enhance liquidity and accessibility for XRP holders. By allowing users to lend their XRP, the program not only incentivizes holding but also fosters a more robust trading environment. This initiative is part of a broader strategy by SBI to integrate cryptocurrencies into mainstream finance, thereby attracting more institutional and retail investors.

Simultaneously, the anticipation surrounding the potential approval of a cryptocurrency ETF has been a hot topic in the financial world. An ETF would allow investors to gain exposure to XRP without directly purchasing the asset, making it more appealing to traditional investors who may be hesitant to navigate the complexities of cryptocurrency exchanges. The countdown to a decision on this ETF is fueling speculation and excitement, further contributing to XRP’s recent rally.

As the cryptocurrency market continues to evolve, developments like the SBI Lending Program and the ETF countdown are pivotal in shaping investor sentiment. With XRP’s recent price jump, it appears that the market is responding positively to these initiatives, signaling a potentially bullish trend for the future of digital assets.