US Crypto News: Bitcoin ETFs Deliver 100% Returns Since Launch

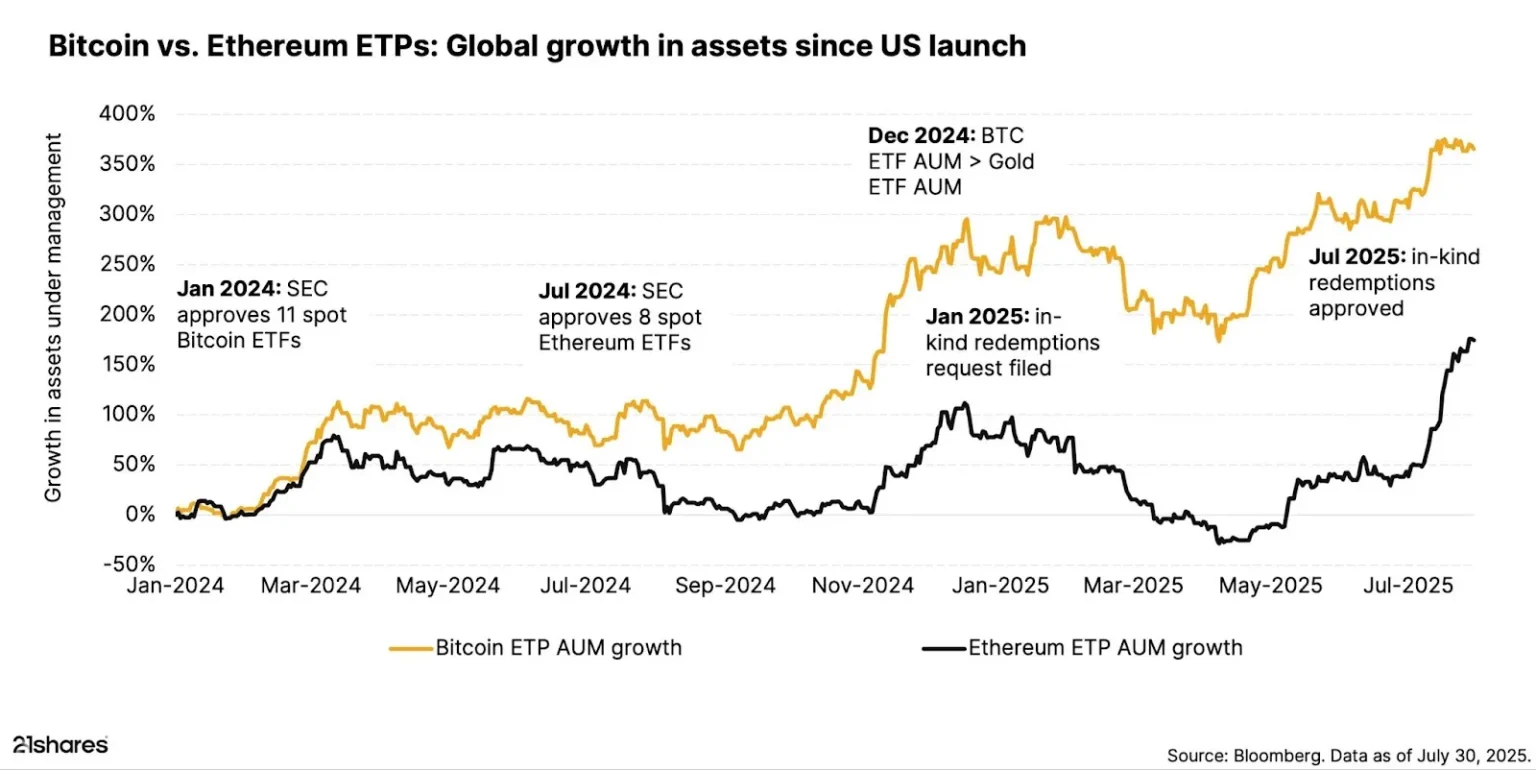

In a remarkable testament to the burgeoning acceptance and success of cryptocurrencies as mainstream investment assets, several Bitcoin Exchange-Traded Funds (ETFs) in the United States have reported phenomenal performance, delivering 100% returns since their respective launches. This milestone signifies a major win for the crypto industry and portrays the increasing investor confidence in digital assets.

Key Takeaways

Rise of Bitcoin ETFs

Bitcoin ETFs are investment funds traded on stock exchanges, much like stocks. They track the price of Bitcoin and allow investors to trade and invest in Bitcoin without needing to deal with the technical aspects of buying and storing the cryptocurrency. The introduction of these ETFs into major U.S. stock exchanges was met with significant anticipation and excitement, stemming from their potential to bridge the gap between traditional finance and the crypto world.

Performance Since Launch

Since their launch, Bitcoin ETFs have garnered enormous interest from both retail and institutional investors. Their ability to replicate the performance of Bitcoin while offering the added securities of a regulated financial instrument has contributed largely to their success. Reporting 100% returns is indicative of both the volatile nature of Bitcoin, which saw substantial price increases over the past months, and the growing appetite among investors for crypto products.

Market Implications

The success of Bitcoin ETFs carries broader implications for the crypto market. Firstly, the high returns validate the crypto market to skeptical investors and traditional financial institutions, potentially leading to increased investments. Secondly, the performance of these ETFs highlights the competence of fund managers in navigating the volatile crypto markets, thereby reassuring investors who might be concerned about the risks associated with cryptocurrency investments.

Moreover, these ETFs serve as a significant step towards further legitimization and integration of cryptocurrencies into the financial landscape. As ETFs continue to perform well, they aid in increasing Bitcoin’s liquidity by bringing more players into the crypto market, potentially stabilizing its price in the long term.

Regulatory Environment

The regulatory environment in the U.S. has been cautiously evolving with respect to cryptocurrencies. The launch and success of Bitcoin ETFs have played a crucial role in shaping regulatory perspectives, demonstrating that digital assets can be part of regulated and traditional financial systems. Regulators are increasingly recognizing the importance of providing a legal framework that ensures safety yet fosters innovation within the crypto sector.

Future Prospects

Looking ahead, the success of Bitcoin ETFs is likely to spur the launch of more crypto-based ETF products, not just in the U.S. but globally. As more ETFs are introduced to the market, it could lead to increased competition and potentially better management fees for investors. Furthermore, this could also encourage the launch of ETFs based on other cryptocurrencies, which would diversify the options available to investors.

Conclusion

The ability of Bitcoin ETFs to deliver 100% returns since their launch is not just a win for their investors but also a landmark achievement for the crypto industry as a whole. As these financial products continue to bridge the gap between traditional investment mechanisms and the digital currency space, the future for both Bitcoin and other cryptocurrencies looks increasingly promising. This success story will likely act as a catalyst for more innovations and acceptance in the crypto space, heralding a new era in digital asset investment.

The remarkable achievements of Bitcoin ETFs symbolize a maturing market that is increasingly aligning with mainstream financial systems, pointing to a future where crypto is as ubiquitous and regulated as traditional securities. As investments continue to pour in, the landscape of financial investments is unequivocally evolving to be more inclusive of digital assets, reshaping the fabric of global financial practices.