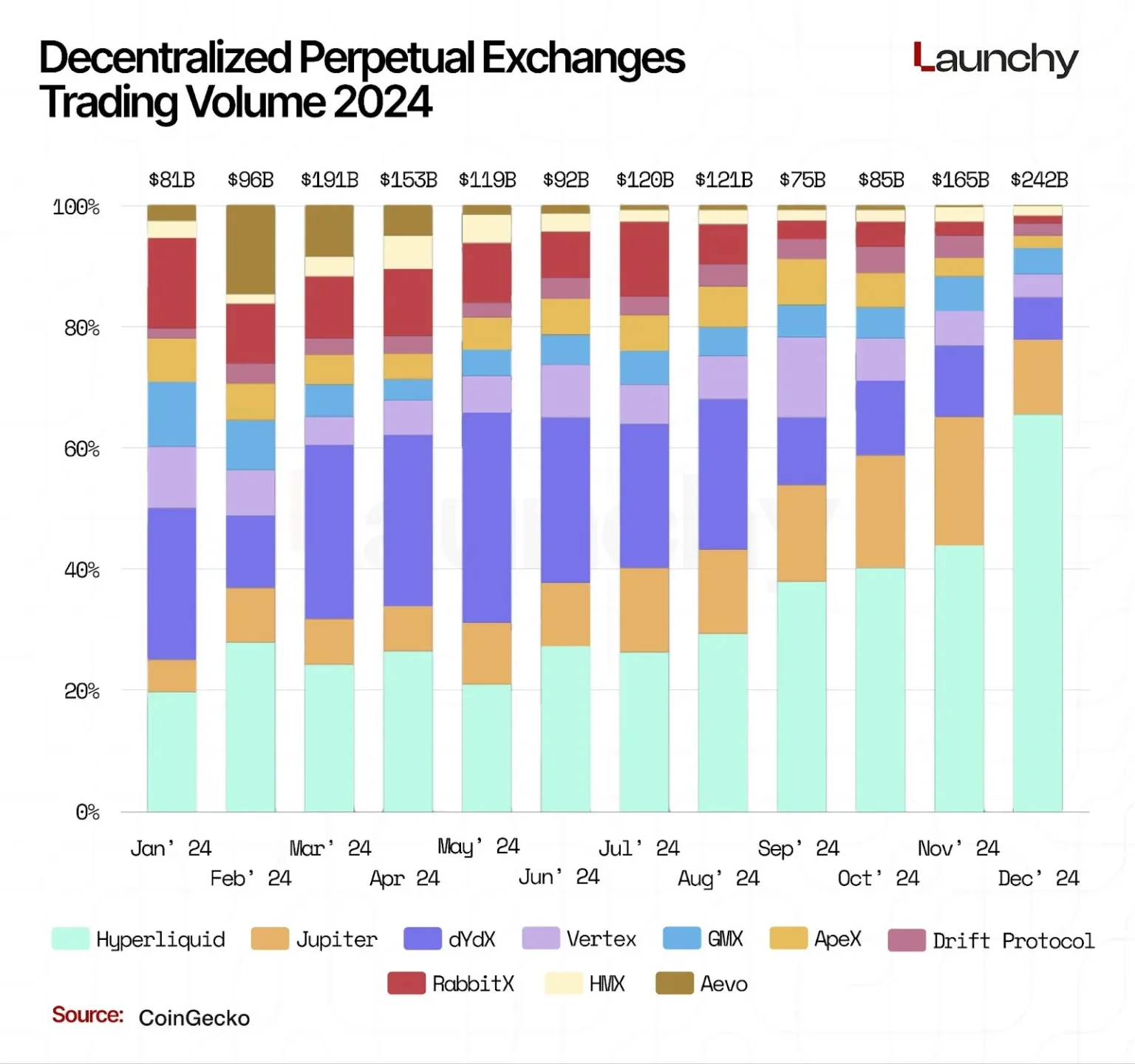

Lighter’s trading volume has shown a steady increase, reaching a total of $11.2 billion, while Hyperliquid ranks second in volume among decentralized exchanges.

The growth of trading volume for Lighter marks a significant development in the decentralized exchange (DEX) landscape. This rise indicates increasing user activity and interest in the platform. As traders explore alternatives, the appeal of DEXs continues to gain traction.

Hyperliquid’s position as the second-largest player illustrates the competitive nature of the DEX market. While Lighter leads, Hyperliquid’s performance signals robust participation in decentralized trading.

Market trends suggest that decentralized platforms are becoming increasingly integral to the trading ecosystem. As traders seek more control over their transactions, the adoption of DEXs like Lighter and Hyperliquid could signify a shift away from traditional exchanges.

Overall, the data reflects a growing trend towards decentralized finance solutions, with significant implications for how trading is conducted in the future.