Title: Monad v MegaETH, Shutdown Fakeout, UNI Switch! A Week of High Stakes and High Drama in the Crypto World

Introduction:

This week in the cryptocurrency domain has been nothing short of a rollercoaster ride. We witnessed several pivotal events that caused notable ripples in the crypto lake, including the escalating competition between Monad and MegaETH, a surprising turn-around with the anticipated government shutdown, and an intriguing development involving Uniswap. Here’s a deep dive into these compelling episodes:

Monad vs. MegaETH: The Battle of the Titans

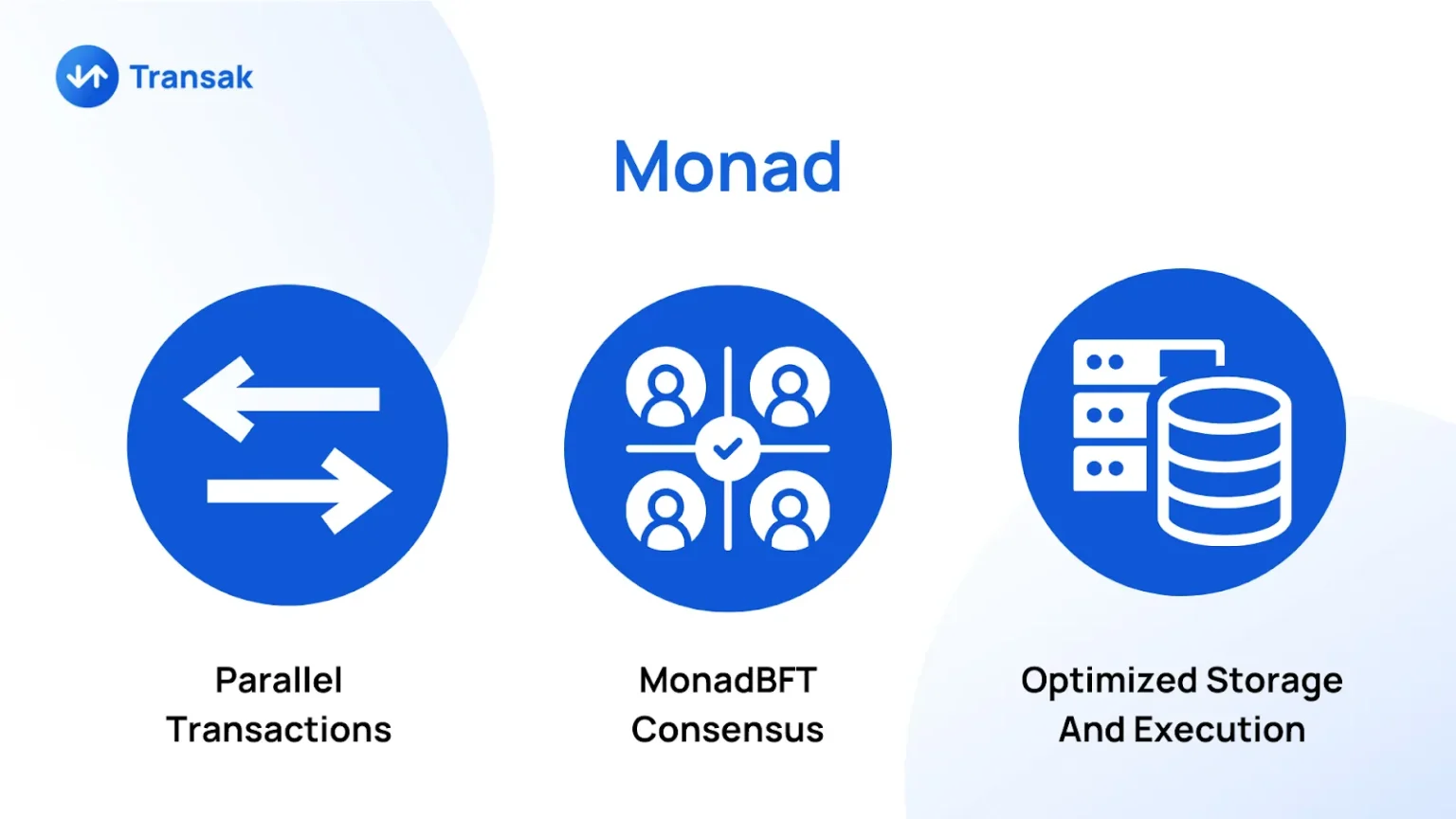

The crypto community has been abuzz with the latest developments in the competition between two Ethereum-based projects – Monad and MegaETH. The rivalry intensified this week as both platforms rolled out significant updates aimed at attracting developers and investors.

Monad, a relatively new player in the field, has been making waves with its innovative approach to Ethereum scaling and security. Its latest upgrade introduces “TurboSound,” a feature enhancing transaction speed and reliability, thus tackling two of Ethereum’s most critical pain points. The Monad team hopes this could be a game-changer and a solid foundation for future decentralized applications.

MegaETH, on the other hand, has not been idle. In response to Monad’s updates, MegaETH unveiled its “HyperCharge” protocol, which promises a dramatic improvement in transaction throughput. By utilizing a layered blockchain approach, MegaETH could potentially handle thousands more transactions per second than its current capacity, making it a formidable opponent against not only Monad but also against more established players in the space.

Shutdown Fakeout: The Crisis That Wasn’t

This week also saw the crypto community bracing for the potential impacts of a U.S. government shutdown. The shutdown loomed large due to disagreements in Congress over budget allocations and debt ceiling increases. Cryptocurrency markets often react to such political instability with increased volatility.

However, in a surprising last-minute turn of events, Congress reached a deal that appeared to prevent the shutdown, much to the relief of traders and investors around the globe. The fakeout resulted in a temporary spike in Bitcoin and Ethereum prices, as confidence briefly surged back into the market.

UNI Switch: Uniswap’s Strategic Pivot

A significant shakeup occurred with Uniswap, one of the leading decentralized exchanges. In a gutsy move, Uniswap announced a major shift in its core strategies — transitioning from Ethereum to a nascent blockchain tailored towards improving scalability and decreasing transaction costs. This decision, dubbed “UNI Switch” in the community, underscores the pressing issue of high fees and slow speeds on the Ethereum network.

Uniswap’s strategy is seen as a bid to retain its dominance in the DEX sector by adopting a faster, more cost-effective blockchain that could potentially attract a larger user base. The response from the Uniswap community and industry observers has been mixed, with some applauding the boldness of the move and others expressing skepticism about the execution and impact.

Conclusion:

The past week in the cryptocurrency universe has been fraught with drama, excitement, and significant strategic plays. While Monad and MegaETH continue their technological arms race, improving the foundations of decentralized technologies, the political brinkmanship of a potential government shutdown added to market uncertainties. Meanwhile, Uniswap’s strategic pivot could be a game-changer in how decentralized exchanges operate, potentially setting a new trend in the industry.

Moving forward, these developments are not merely episodes but could very well shape the contours of the crypto landscape in the years to come. The competition, innovations, and strategic shifts we observe today are pivotal, setting the stage for the next generation of blockchain technology and its applications in our digital world.