Is Tether Quietly Becoming a Central Bank Behind USDT?

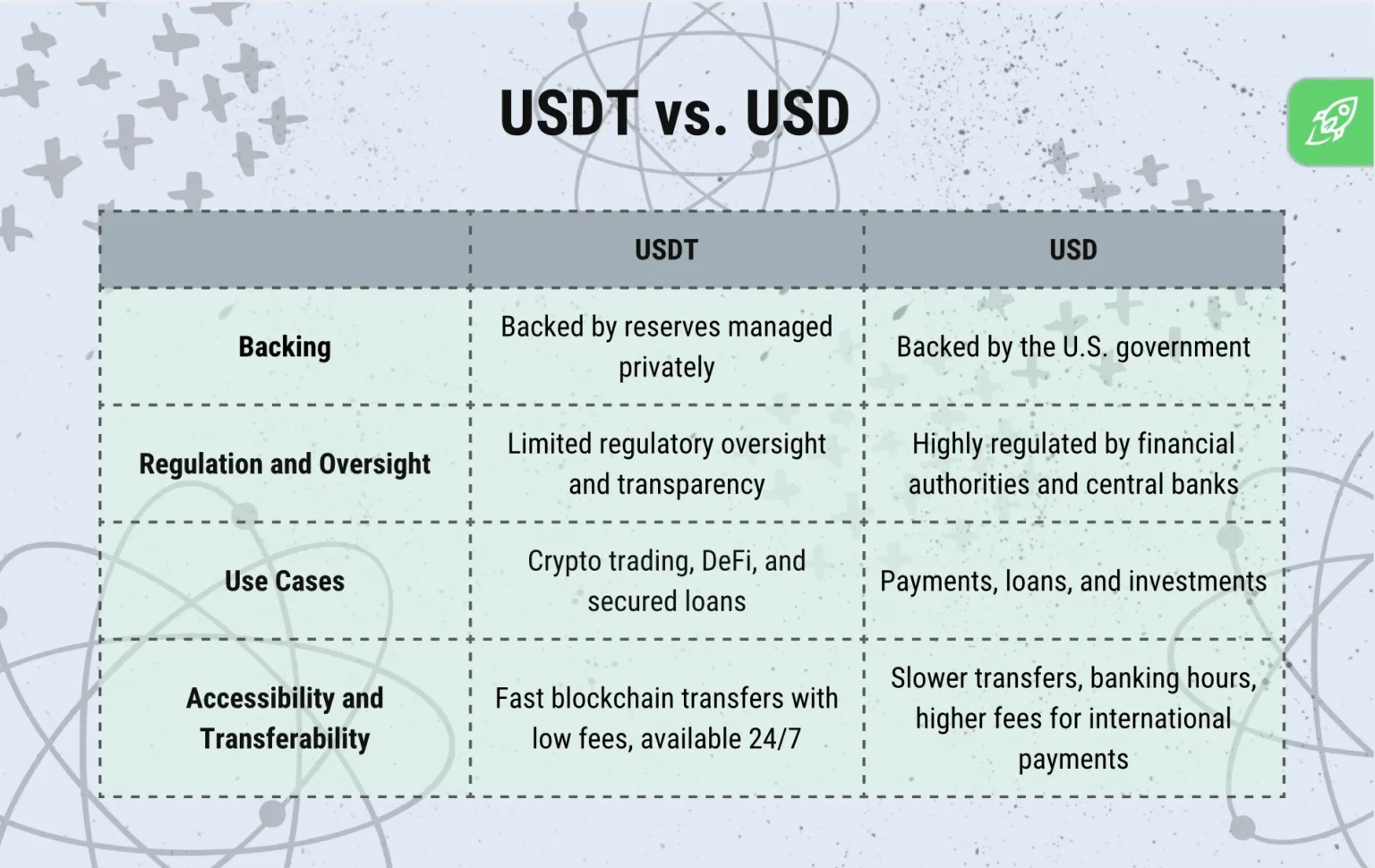

In the dynamic world of cryptocurrencies, Tether (USDT) stands out as one of the most intriguing entities due to its pivotal role in the ecosystem. As one of the first and most popular stablecoins—cryptocurrencies designed to minimize price volatility—USDT is pegged to traditional fiat currencies like the U.S. dollar and the Euro, providing a digital alternative to more volatile cryptocurrency options such as Bitcoin and Ethereum.

But beyond its function as a digital stand-in for fiat currencies, there’s an emerging discussion about whether Tether is starting to resemble a central bank for the digital age. This idea stems from its influence and operations in the cryptocurrency market, which bear some similarities to traditional central banking practices.

The Role of Tether

Tether was originally created to solve the problem of rapid price fluctuations in cryptocurrencies. By pegging its value directly to a stable fiat currency, Tether offers traders and investors a “safe harbor” during periods of high volatility, making it an important utility token in the crypto world. It allows for the easy transfer of real-world currency value between various platforms without the need for traditional banking infrastructure.

Central Bank-Like Functions

Here are a few ways in which Tether mimics a central bank:

-

Currency Issuance:

Similar to how central banks regulate the supply of money, Tether controls the issuance of USDT. When demand increases, Tether theoretically issues more tokens, which are supposed to be backed one-to-one by U.S. dollars or other equivalent assets held in reserve. -

Market Stabilization:

In the cryptocurrency market, Tether acts as a stabilizer by providing liquidity. In tumultuous markets, traders often pivot to USDT as a stable asset to avoid losing value, similar to how fiat currencies are perceived in traditional markets during crises. -

Reserve Management:

Tether claims that its reserves are backed by traditional fiat currencies, although these claims have been subjects of controversy and scrutiny. Managing these reserves to maintain parity with the U.S. dollar mirrors functions of a central bank, albeit without the same level of transparency and regulation. - Regulatory Interactions:

Like central banks, Tether has had its share of interactions with regulatory bodies. It has faced various lawsuits and investigations regarding its reserves and business practices, highlighting the challenges of maintaining a stablecoin’s peg in an unregulated market.

Controversies and Challenges

While Tether serves functions akin to those of a central bank, it does so in an entirely unregulated environment, which leads to a myriad of challenges. Critics argue that Tether has not been fully transparent about its reserves, raising suspicions and legal actions. In fact, in 2021, Tether and its associated exchange, Bitfinex, settled with the New York Attorney General’s office over allegations that they covered up losses and misrepresented the status of their reserves.

Conclusion

As the cryptocurrency market matures, the role of entities like Tether will undoubtedly come under greater scrutiny. Whether Tether is becoming akin to a digital central bank is a matter still up for debate. Such comparisons raise important questions about regulation, transparency, and stability in the digital currency space. As stablecoins continue to grow in popularity and use, the need for clear regulatory frameworks becomes increasingly apparent. This will ensure that these digital entities do not undermine the financial systems but rather complement them in a way that enhances overall market efficiency and security.