Headline: Swiss Franc Advances as USD/CHF Slips on Anticipated Tariff Rollback

The Swiss franc strengthened across currency markets on renewed hopes for a U.S.–Switzerland trade agreement that could ease tariffs, pushing USD/CHF to the weakest spot among major pairs. Traders are reacting to reports that tariffs on Swiss imports may be reduced from 39% to 15%, reversing part of the sharp hike implemented on August 1 under the administration’s “reciprocal tariff” policy.

The potential shift comes as the Supreme Court weighs key tariff-related challenges and the White House signals broader recalibration, including possible reductions on Indian imports currently near 50%. Switzerland’s enduring trade surplus with the U.S.—driven by exports of precision machinery, watches, and gold—has kept it in focus for trade policy. The prospect of a deal has boosted demand for the Swiss franc, adding fundamental support to the currency’s move.

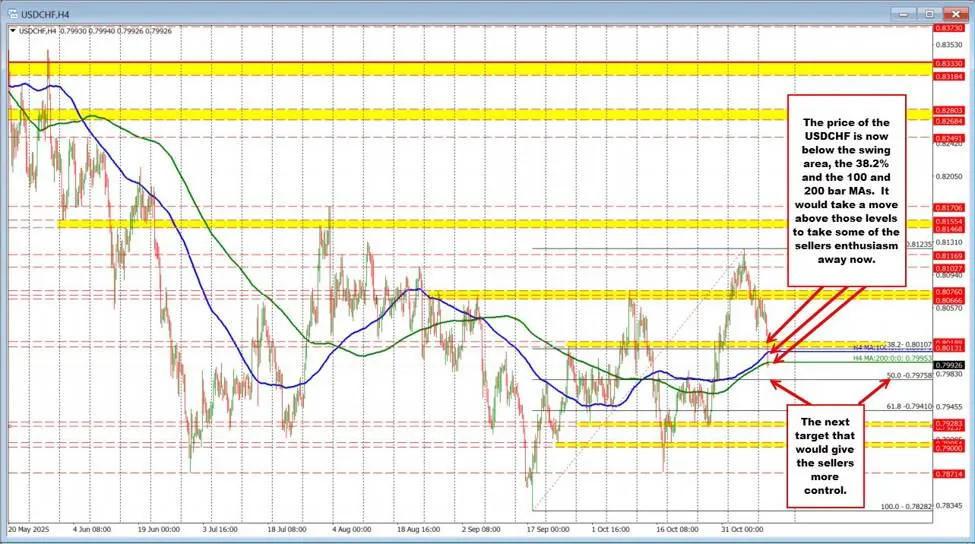

Technical signals reinforce the bearish tone for USD/CHF. The pair rejected the 200-hour moving average near 0.8061 in Asia, then slipped beneath a pivotal 0.8013–0.8019 zone, the 38.2% retracement of the recent upswing from the September low around 0.80107, and the psychological 0.8000 handle. On the 4-hour chart, price trades below the 100- and 200-bar moving averages at 0.8007 and 0.7995, respectively, keeping sellers in control and pointing toward the 50% retracement near 0.79758. For buyers to regain traction, a sustained recovery back above 0.8019 is needed.

Key Points – USD/CHF is the weakest major pair as the Swiss franc gains on trade headlines. – Reports suggest U.S.–Switzerland tariffs could be cut from 39% to 15%. – The 39% tariff level was introduced on August 1 under a reciprocal tariff strategy. – Supreme Court tariff cases and signals of easing on India add to policy recalibration. – Key technical breaks: 0.8013–0.8019, 0.8000; price sits below 0.8007/0.7995 moving averages. – Next downside focus: 0.79758 (50% retracement); recovery requires a move above 0.8019.