X402 Trading Volume Drops 90% — Is the Trend Over?

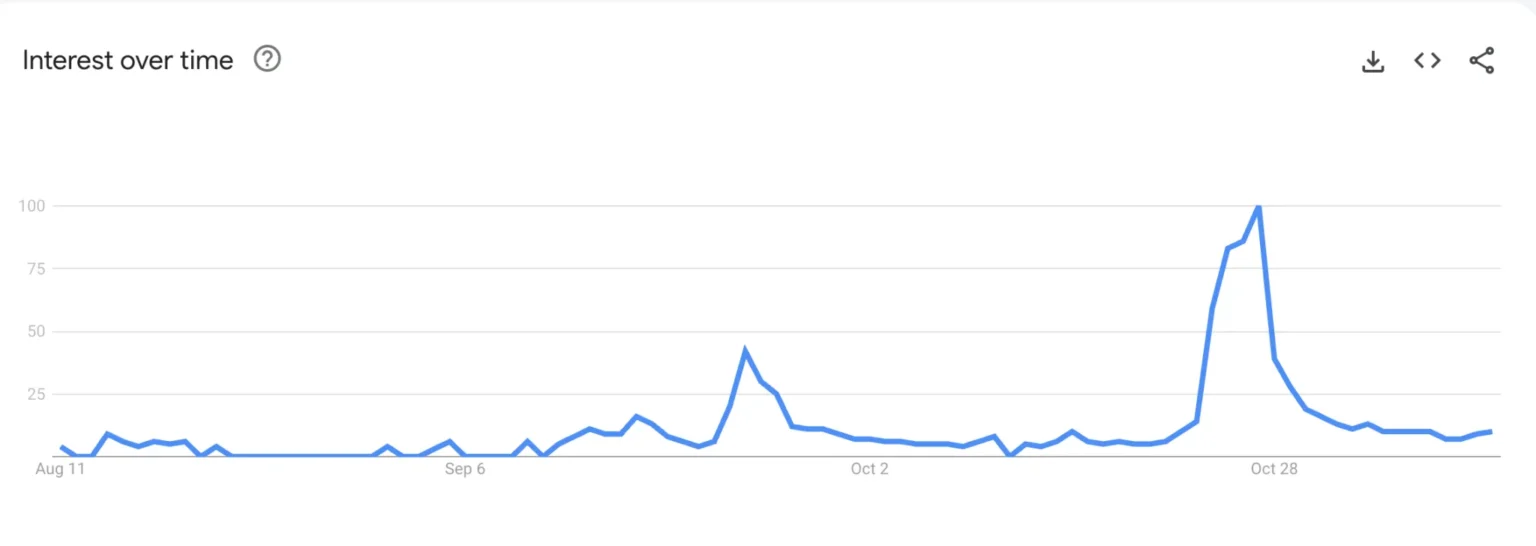

In what many traders and analysts are saying marks a significant shift in market sentiment, X402, the once-celebrated digital asset, has seen its trading volume plummet by an astonishing 90% over the last quarter. This sharp decline has left many investors wondering whether the buzz surrounding X402 is finally coming to an end.

A Meteoric Rise

X402 burst onto the financial scene just over a year ago, billed as a revolutionary financial tool that brought together unique features of blockchain technology with real-world utility. The excitement was palpable, and its innovative approach drew in both seasoned traders and newcomers, driving its value up exponentially in a matter of months.

Financial forums and social media platforms buzzed with optimistic predictions and speculative commentary, making X402 one of the most talked-about assets in recent times. Its market capitalization soared, quickly making it one of the top digital assets globally.

The Factors Behind the Drop

The reasons behind the sharp decrease in trading volume for X402 are multi-fold. Initially, market saturation might be one contributing factor. As more players entered the space with similar offerings, the novelty of X402 began to wear off, leading to reduced trading activity.

Regulatory concerns have also played a significant role. In regions that were once open to digital assets, new restrictions and guidelines have put a damper on trading activities. Investors, wary of potential legal complications, might be opting to liquidate positions in riskier assets like X402 in favor of more stable investments.

Economic factors must also be considered. With the global economy facing uncertainty from multiple fronts, including inflation rates and geopolitical tensions, investors are becoming increasingly risk-averse. This shift in investor sentiment generally leads to decreased volumes in higher-risk assets like X402.

Technical Analysis

From a technical standpoint, the price action on X402 charts paints a somewhat bleak picture. Key support levels have been broken, and resistance levels now sit far above current trading prices. Trading volumes often precede price, and with such a dramatic fall in volume, the concern is that prices may continue to drop.

Is the Trend Over?

While it’s impossible to predict with absolute certainty, several indications suggest that the trend may indeed be over for X402. The loss of investor confidence, coupled with increased competition, regulatory challenges, and unfavorable market conditions, suggest that recovery might be a long, uphill battle.

However, it’s not all doom and gloom. Markets are cyclical, and what goes down must come up, albeit not always in the same form. X402 might find new life through pivots in strategy or technology. Rebranding, partnerships with larger financial entities, or adoption by a major corporation could revive investor interest.

Conclusion

In conclusion, while the immediate future for X402 looks challenging, the ever-evolving nature of digital assets could mean new opportunities could arise. Investors should keep a keen eye on any changes in the regulatory landscape or significant shifts in technology and strategic partnerships that might breathe new life into this once-thriving asset. Meanwhile, the current downturn in trading volumes and prices might suggest that being cautious and researching thoroughly before investment would be wise.