In the ever-changing landscape of global economics, three macroeconomic factors stand out as particularly critical to watch: liquidity, inflation, and economic cycles. Understanding these elements is crucial for both investors navigating financial markets and policymakers shaping fiscal and monetary policies. Collectively, this trio influences everything from asset prices to consumer spending and can offer insights into future economic conditions.

Liquidity: The Oil in the Economic Engine

Liquidity refers to how easily assets can be bought or sold in the market without affecting their price. High liquidity tends to stimulate economic activity by facilitating easier trading and lending, which in turn can boost consumer spending and business investments. Central banks play a pivotal role in managing liquidity, primarily through monetary policy tools including interest rates and quantitative easing programs.

In periods of economic uncertainty or stress, such as the global financial crisis of 2008 or the COVID-19 pandemic onset in 2020, central banks have often responded by injecting significant liquidity into the financial system. These actions can avert market crashes and stabilize economies. However, excessive liquidity can also lead to asset price bubbles as too much money chases too few opportunities, increasing the risk of future financial corrections.

Inflation: The Balancing Act

Inflation, the rate at which the general level of prices for goods and services is rising, is a double-edged sword. On one hand, moderate inflation is typically a sign of a healthy economy, indicating strong consumer demand. On the other hand, high inflation can erode purchasing power and savings, leading to cost-of-living challenges for individuals and competitiveness issues for businesses.

Central banks, such as the Federal Reserve in the United States or the European Central Bank in Europe, often have an inflation target (commonly around 2%). Achieving this target is a delicate balancing act requiring careful manipulation of interest rates and other monetary tools. Recent global events have underscored the complexities of managing inflation, with factors such as supply chain disruptions, varying energy costs, and changing labor markets introducing new inflationary pressures that are challenging to predict and control.

Economic Cycles: The Predictable Yet Unpredictable Waves

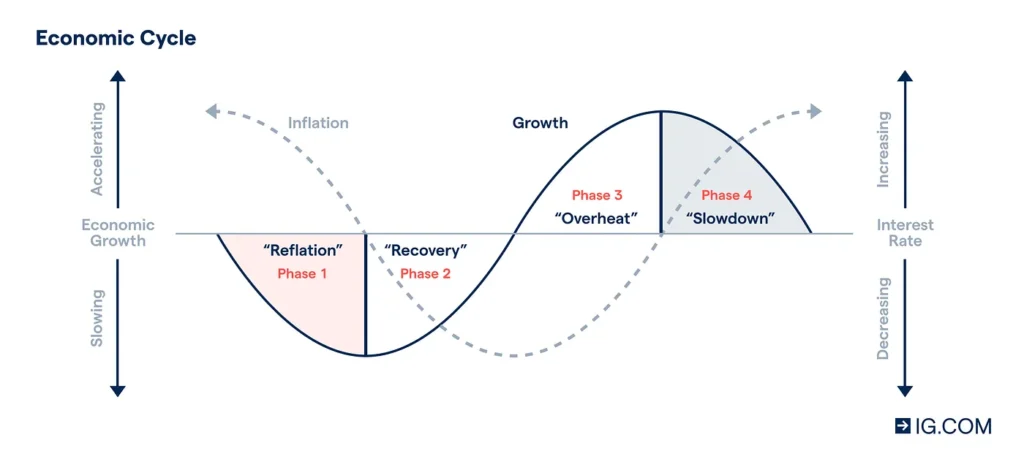

Economic cycles — consisting of expansion, peak, contraction, and trough — affect nearly all aspects of an economy. Knowing where an economy is in its cycle is crucial for making informed financial and business decisions. During expansions, businesses grow, employment rises, and consumer spending increases. Conversely, during contractions, output declines, unemployment increases, and recession risks rise.

Predicting the turning points in these cycles can be extraordinarily profitable but also incredibly challenging. Economists use leading indicators such as stock market returns, housing starts, and consumer confidence indices to predict these turns. However, global interconnectivity and unforeseen black swan events, like the pandemic, can disrupt even the most thorough forecasts.

Implications and Strategies

For investors, understanding the interplay between liquidity, inflation, and economic cycles is key to choosing the right asset allocation. For instance, during high liquidity phases, stocks typically perform well, whereas bonds might be more appealing during periods of low liquidity and high inflation.

Policymakers, meanwhile, must tailor their strategies to manage these macroeconomic factors effectively, considering both domestic conditions and global economic trends. The challenge is to stimulate growth without triggering uncontrollable inflation or creating liquidity traps that could lead to long-term economic stagnation.

Conclusion: A Macro Trifecta in Motion

As we navigate through 2023 and beyond, watching the macro trifecta of liquidity, inflation, and economic cycles becomes not just a matter of financial acumen but a necessity. The dynamics of these factors will determine the economic landscape of the future, influencing policy decisions, investment strategies, and even everyday economic transactions. Whether you’re a stakeholder in policy, investment, or simply a consumer, staying informed about these key indicators will provide essential insights that drive smarter decisions in turbulent economic times.