Headline: Japan Shifts to Multi‑Year Fiscal Framework, Drops Annual Surplus Target

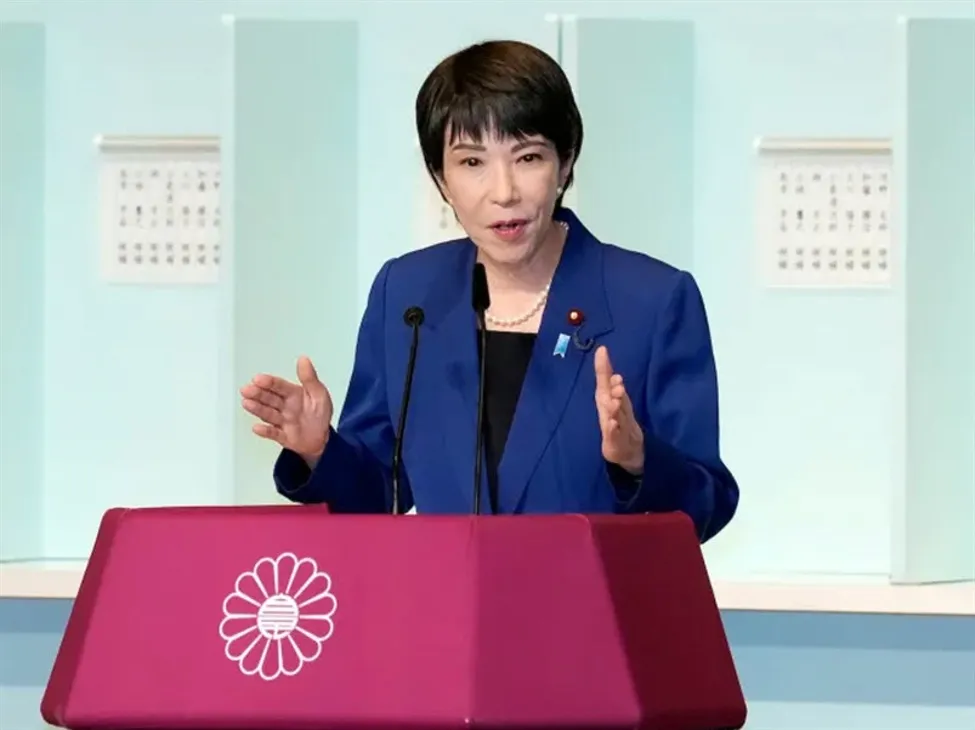

Introduction: Japan is reshaping its fiscal playbook. Prime Minister Sanae Takaichi signaled the end of the government’s annual primary budget surplus target, opting instead for a multi‑year approach to measuring progress. The pivot points to a more expansionary fiscal policy designed to support growth while navigating persistently high public debt.

In remarks to parliament, Takaichi said fiscal performance will be assessed over several years rather than judged on a single-year benchmark. The change dilutes the long‑standing focus on an annual primary balance and reflects a broader shift toward flexibility in fiscal consolidation. It also marks a break from previous administrations that leaned on the annual surplus goal as a marker of discipline.

The government is preparing a new stimulus package aimed at easing cost‑of‑living pressures and channeling investment into growth industries and defense. While Japan’s public debt remains more than twice the size of its economy—among the highest in advanced markets—the administration is prioritizing economic expansion over rapid budget tightening. The move could bolster domestic demand but may weigh on the Japanese yen and add volatility to government bonds.

Takaichi has criticized the annual primary balance metric as overly restrictive and out of step with international practice. By adopting a multi‑year fiscal roadmap, the government is signaling continued support for investment and resilience, even as investors watch for details on timelines, targets, and the implications for the broader fiscal consolidation path.

Key Points: – Japan will abandon its annual primary budget surplus target in favor of a multi‑year fiscal framework. – Prime Minister Sanae Takaichi outlined the shift in parliament, emphasizing flexibility in measuring fiscal progress. – A new stimulus package is planned to address living costs and boost investment in growth sectors and defense. – The policy tilt prioritizes growth despite public debt exceeding twice the size of GDP. – Markets may view the move as supportive for demand but potentially negative for the yen and government bond stability. – The change represents a clear departure from past fiscal discipline practices centered on annual targets.