On-chain Moves Don’t Tell the Full Story: Why OG Bitcoin Whales May Not Be Cashing Out

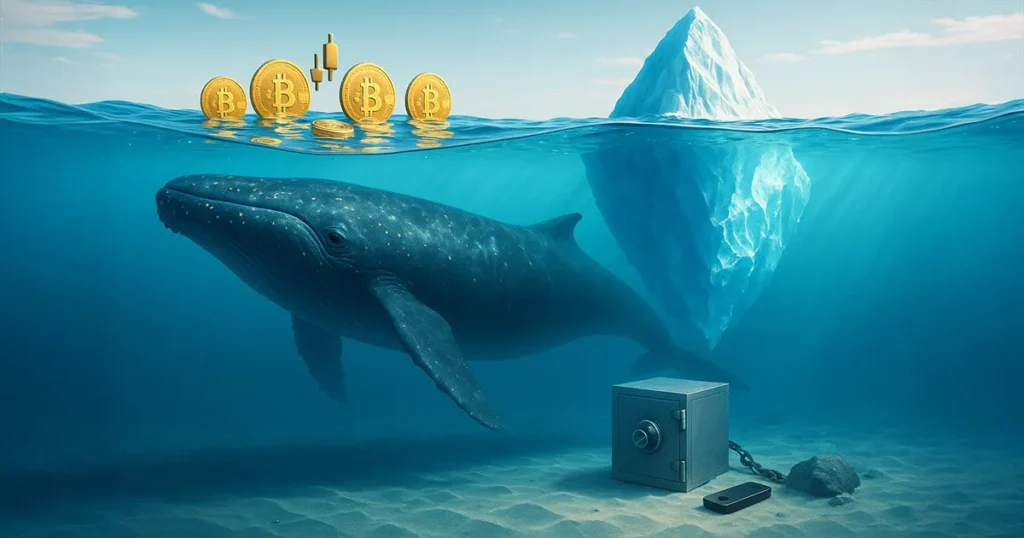

In the volatile universe of cryptocurrency, Bitcoin stands as the pioneering digital asset, ushering in a wave of innovation and a flurry of investment activities. As such, the activities of Bitcoin “whales” — holders of large amounts of BTC — are often closely scrutinized under the assumption that their transaction behaviors provide clear market signals. However, the recent surge in on-chain movements associated with longstanding Bitcoin wallets has stoked fears that these original gangster (OG) whales might be gearing up to cash out, potentially leading to market instability. But is this truly the case, or does the context of these on-chain movements suggest a different narrative?

Understanding the OG Whales

OG Bitcoin whales refer to the early adopters of Bitcoin, many of whom mined or purchased the cryptocurrency during its nascent years (2009-2012). These individuals and entities not only hold substantial amounts of Bitcoin but have also demonstrated a propensity for long-term holding, rather than speculative trading. Throughout Bitcoin’s history, their actions have often been perceived as leading market indicators. However, their underlying motivations and strategies might be more intricate than the surface data suggests.

Unpacking On-Chain Data

On-chain data provides a transparent look at transaction histories, wallet balances, block details, and much more. It’s a forensic tool that illuminates the movements of Bitcoin across addresses. A large transaction from a dormant whale’s wallet can trigger speculative reactions from the market, driven by tools that alert traders and analysts to these movements.

Nonetheless, these on-chain moves, especially from OG whales, do not necessarily equate to selling pressure. Several alternate explanations could elucidate why these old wallets are activated:

-

Security Measures: As Bitcoin’s value has soared, so too has the incentive to secure these assets. Transitioning funds to more secure wallets incorporating updated cryptographic standards is a prudent strategy frequently employed by large-scale holders.

-

Estate Planning or Transfer Among Holders: As Bitcoin holders age, considerations regarding the inheritance or legal transfer of their assets can necessitate wallet transactions. These moves might involve transferring Bitcoin to trusts or new wallets controlled by different parties within the original holder’s circle.

- Strategic Reallocation: Whales might reallocate funds for diversification or investment in new blockchain ventures without necessarily converting to fiat currencies or traditional assets. These transactions might represent shifts within the cryptocurrency space rather than an exit from it.

The Psychological Impact of Large Transactions

The reactions to whale movements also often reflect broader market sentiment and can psychologically impact the trading behaviors of other market participants. The visibility of these transactions can lead to overreactions that temporarily affect market prices, despite no real change in fundamental market conditions or the long-term intentions of the whales.

Conclusion

While on-chain metrics are invaluable tools for understanding the flow of digital assets and can indicate trends, they do not always tell the full story behind the individual decisions of Bitcoin holders. Particularly for OG Bitcoin whales, whose engagements with the asset are characterized by low time-preference and strategic patience, the apparent activity might not signal an intention to cash out but rather a nuanced strategy within the digital asset space.

Interpreting these moves requires not just a technical analysis of on-chain data but also an understanding of historical context, long-term holding patterns, and the broader economic landscape in which these whales operate. As the cryptocurrency market matures, achieving this level of analysis will be crucial for traders, investors, and observers aiming to glean actionable insights from high-value Bitcoin movements.