Crypto Treasuries Take Massive Damage As Bitcoin Falls

The recent plummet in Bitcoin prices has sent shockwaves through the financial markets, but none have felt the impact more acutely than companies with significant holdings in cryptocurrencies. Over the course of a few days, treasuries invested heavily in Bitcoin (BTC) witnessed massive reductions in value, marking an uncomfortable period for investors and companies who bet big on BTC remaining a stable or appreciating digital asset.

The Fallout of Bitcoin’s Decline

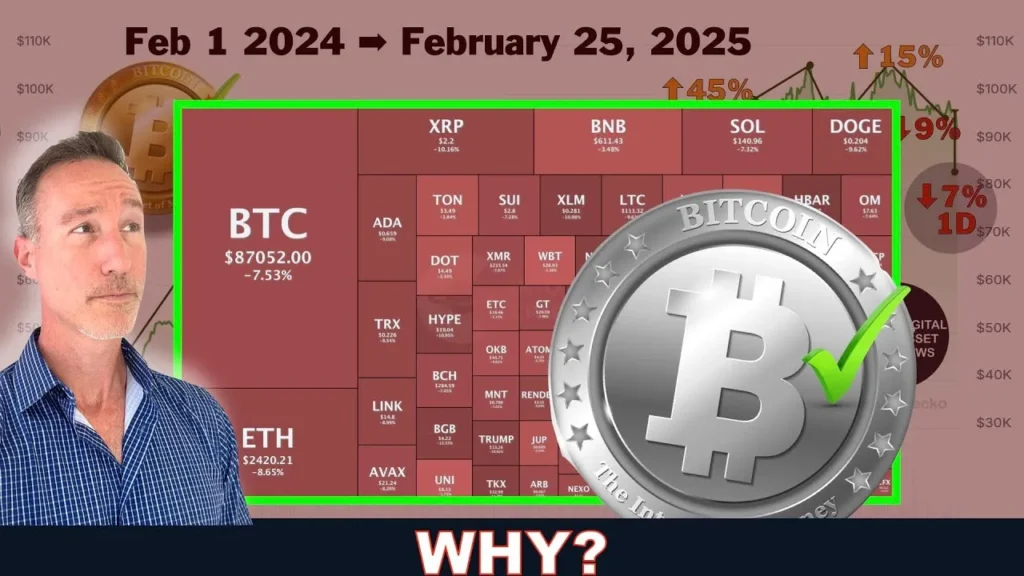

Bitcoin’s value has seen considerable fluctuations since its peak in late 2021, with recent events triggering one of the most significant drops yet. The impact of this decline has been felt across various sectors that had invested in Bitcoin as a reserve asset. Corporate treasuries, in particular, have seen alarming depreciation in assets under management due to the drop, raising concerns over their financial health and overall investment strategies.

Notable Companies Affected

Several high-profile companies with substantial crypto holdings have reported considerable losses. For instance, MicroStrategy, a leader in business intelligence with one of the largest corporate-owned Bitcoin portfolios, disclosed that the declining market had vastly diminished the value of its holdings. This exemplifies the high-stakes nature of substantial cryptocurrency investments, underlining the potential financial peril of such strategies when market conditions swing unfavorably.

Tesla, another big player that had previously purchased $1.5 billion in Bitcoin, has also felt the pinch. Although the company had trimmed down its holdings last year, the decrease in Bitcoin prices continues to impact its remaining cryptocurrency assets’ worth. This development poses new challenges for these firms, pushing them to reassess their investment strategies amidst growing uncertainties.

Industry Reactions and Adaptations

In response to the plunging prices, crypto treasuries and financial strategists are revisiting the drawing board to amend their policies. Risk management has become a priority, with diversified portfolios being strongly considered to reduce the vulnerability to similar incidents in the future. Meanwhile, some firms remain steadfast in their belief in cryptocurrencies as the future of monetary exchanges and continue to hold substantial amounts despite the risks highlighted by the current market situation.

Moreover, several companies are leveraging this downturn to buy more Bitcoin, speculating that the current low prices offer a valuable entry point that could lead to substantial gains should the market recover. This bullish approach underscores the ongoing debates within financial circles about the viability and stability of cryptocurrencies as a long-term investment.

Broader Implications

The recent turmoil in Bitcoin prices not only affects corporate balance sheets but also casts a shadow over the broader adoption of cryptocurrencies as mainstream financial instruments. Skeptics of digital currencies point to these events as proof of their inherent volatility and unreliability as stores of value. However, proponents counter-argue by highlighting the potential for high returns and revolutionary impacts on traditional financial systems, underscoring the divided opinions on this issue.

Moving Forward

As the market continues to navigate these turbulent times, the future of corporate crypto treasuries hangs in a delicate balance. Companies are now tasked with making crucial decisions that could either mitigate their risks or position them advantageously for potential market recoveries. The evolving landscape of blockchain technology and potential regulatory changes will also play critical roles in shaping the trajectory of Bitcoin and its acceptance in corporate finance.

In conclusion, the fall in Bitcoin prices serves as a critical reminder of the volatility inherent in cryptocurrency investments. As companies and investors learn from the current situation, the coming months will likely see more cautious, strategically diversified approaches to crypto investments. These developments will undoubtedly contribute to the ongoing maturation of the cryptocurrency market, making it an interesting space to watch for both avid investors and casual observers alike.