Forecasting Solana’s Valuation in the Era of Wall Street Adoption

In the rapidly evolving world of cryptocurrencies, Solana has distinguished itself as a high-performance blockchain platform known for its fast transaction speeds and low costs. With increasing interest from traditional financial institutions, there’s much speculation on how Solana’s valuation could soar if Wall Street adopts it more extensively. Let’s explore the potential impacts and mechanisms through which Solana’s incorporation into Wall Street mechanisms could boost its market valuation.

Understanding Solana’s Core Advantages

Before delving into potential valuations, it’s crucial to understand what makes Solana particularly attractive. Solana offers significant advantages in terms of scalability, speed, and transaction costs. Its proprietary proof-of-history (PoH) consensus combined with proof-of-stake (PoS) makes it capable of handling thousands of transactions per second, overshadowing many competitors. This technical proficiency can be a major draw for financial institutions that require high throughput and rapid execution.

Wall Street’s Migration to Blockchain Technology

Wall Street has shown increasing interest in blockchain technologies, primarily for their potential to streamline operations, reduce costs, and enhance transaction security. Major players in banking and financial services are exploring applications ranging from cross-border payments and clearing and settlement processes to fraud detection and risk management.

The Potential Impact on Solana’s Valuation

-

Increased Demand and Adoption: If Wall Street begins to implement Solana widely, the demand for SOL, Solana’s native token, would likely increase. This demand comes not just from the necessity to facilitate transactions, but also from the need for staking by institutions participating in its PoS consensus mechanism.

-

Institutional Investment: With broader adoption, Solana can attract significant institutional investments. Large funds and investment banks could see SOL as a viable asset, either for direct investment or as a part of diversified cryptocurrency portfolio offerings.

-

Strengthened Credibility and Stability: Partnership with established financial institutions would enhance Solana’s market credibility, potentially increasing its stability and making it more attractive to conservative investors.

-

Innovative Financial Products: There could be innovation in financial products built on Solana, such as derivative products, yield products, and more, potentially increasing the utility and value of SOL.

- Regulatory Clarity: As Wall Street engages more with Solana, it might prompt clearer regulatory frameworks specific to its use cases, which would alleviate some of the uncertainties that currently surround cryptocurrencies.

Projection and Speculation

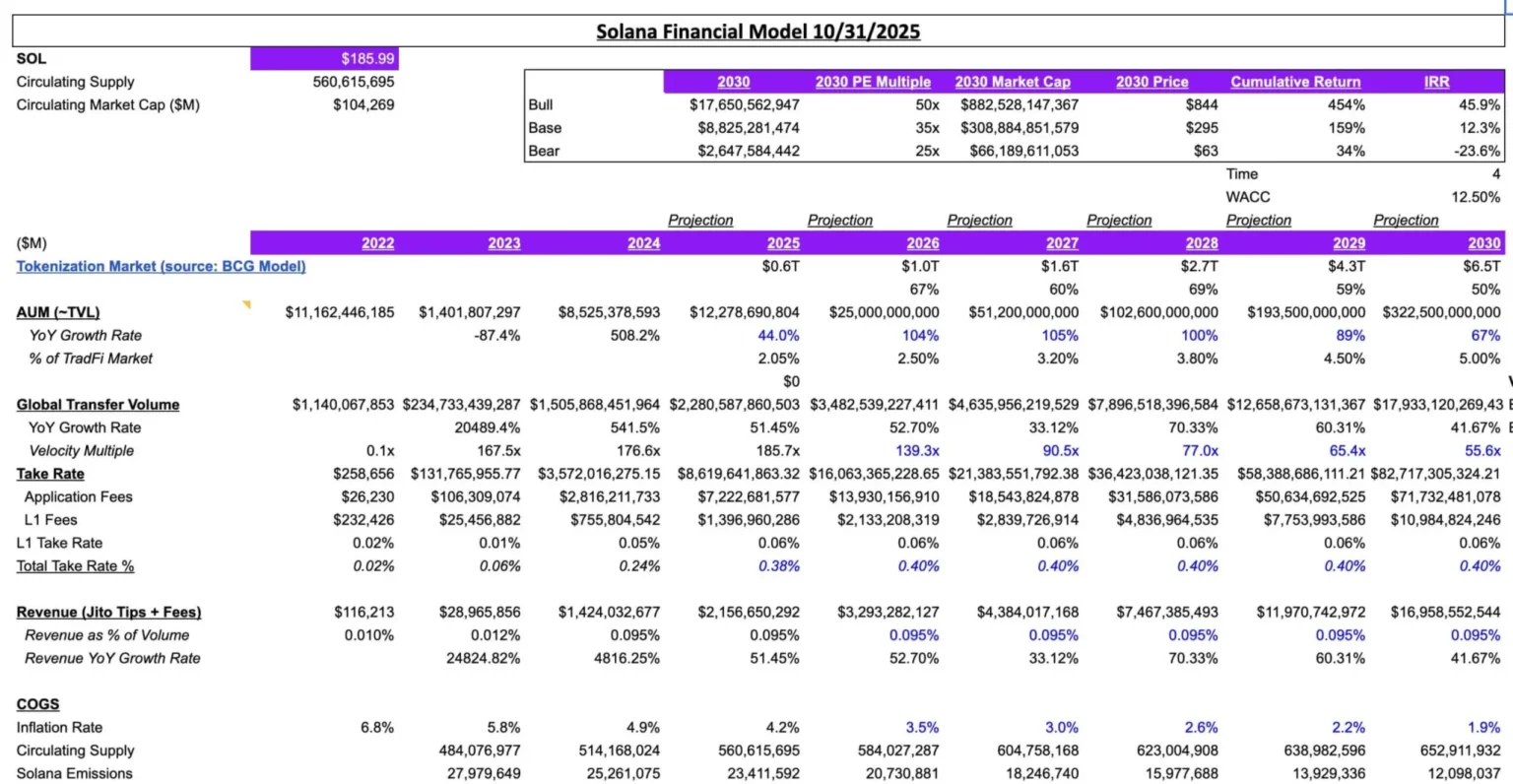

While the figures can vary widely, Solana’s full adoption by Wall Street institutions could potentially see its market capitalization reaching new heights, akin to or surpassing some of the largest tech and financial firms today.

Some conservative estimates might project a market cap increase to several hundred billion dollars, reflective of significant adoption without entirely displacing existing systems. More optimistic projections might suggest a trillion-dollar valuation, especially if Solana becomes a backbone technology for financial markets globally.

Challenges Ahead

Despite these optimistic scenarios, several challenges remain. Technical issues such as network outages that Solana has experienced could undermine confidence among traditionally risk-averse financial institutions. Moreover, broader market dynamics, regulatory changes, and competition from other blockchain platforms also pose significant risks.

Conclusion

Forecasting exact figures for Solana’s potential valuation with Wall Street’s adoption involves significant speculation. However, given its robust technological foundation and the growing interest from the financial sector, Solana seems well-positioned for substantial growth in its valuation. The intersection of finance and advanced blockchain technology, spearheaded by platforms like Solana, may well redefine the economic landscape in the coming years, presenting compelling possibilities for investors and financial entities worldwide.