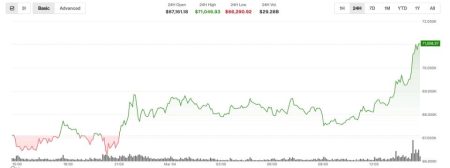

Can Bitcoin End Q4 on a Positive Note? Here's What the Experts Think

As the fourth quarter of 2023 approaches, investors and enthusiasts within the cryptocurrency markets are keenly watching Bitcoin’s performance. After a year of significant volatility, market analysts and crypto experts are weighing in on whether the world’s leading digital currency can close out the year on a high note. Here’s a deep dive into the factors influencing Bitcoin’s trajectory and expert insights on its potential Q4 outcome.

Key Takeaways

Economic Conditions and Their Impact

The macroeconomic landscape plays a pivotal role in dictating Bitcoin’s price movements. This year, the global economy has been grappling with high inflation rates, shifts in interest rate policies by central banks, and geopolitical tensions. These factors significantly influence investor sentiment and risk appetite, thereby affecting Bitcoin’s valuation.

According to Alex Kuptsikevich, a senior financial analyst at FxPro, “Bitcoin’s responsiveness to inflation rates and its perceived role as a hedge against inflation could be crucial in its Q4 performance. Positive movements may be tied closely with higher inflation data across major economies.”

Technological and Institutional Developments

Bitcoin’s infrastructure continues to see substantial advancements, with improvements in scaling technologies and increased adoption by institutional players. The launch of various Bitcoin ETFs and financial instruments has also made it more accessible to a broader audience, potentially boosting its price.

Crypto strategist Chloe White from Genesis Block Analytics points out, “Adoption by more institutional investors could lead to increased demand and higher prices. However, regulatory headwinds in major markets like the United States could pose challenges.”

Regulatory Environment

Regulatory developments are among the top concerns for Bitcoin investors. The stance that key economies such as the USA, EU, and Asia take on cryptocurrency regulation can significantly impact the market. Positive regulatory news can reassure investors, while strict regulations can lead to market pullbacks.

Market analyst, Jordan Hiscott mentions, “The market is on edge about regulatory decisions, particularly from the U.S. Securities and Exchange Commission, which is expected to deliver some clarity on its approach to cryptocurrencies by the year’s end.”

Sentiment and Speculative Interest

Market sentiment and speculative interest are crucial driving factors behind Bitcoin’s price. The excitement generated by positive market news can lead to price spikes, while negative news can cause crashes. The role of social media and news outlets in shaping public perception cannot be underestimated.

“Bitcoin is increasingly correlated with tech stocks, which have had a turbulent year. Any recovery in tech could potentially lead to a positive spillover effect on Bitcoin,” says Emma Todd, a seasoned market analyst from MMH Blockchain Group.

Expert Opinions

Despite the hurdles, some experts remain optimistic about Bitcoin’s Q4 performance. Dr. Sally Eaves, a renowned technologist and blockchain author, asserts, “Given the increasing recognition of Bitcoin’s technological underpinnings and the growing validation from institutional entities, we are likely to see a strong Q4, barring any major economic upheavals.”

Conversely, other experts caution about optimism. Eric Turner, VP of Market Intelligence at Messari warns, “Investors should be cautious. The landscape is fraught with regulatory and macroeconomic risks that could temper any significant gains.”

Conclusion

Ultimately, whether Bitcoin can end Q4 on a positive note will depend on a confluence of factors including macroeconomic indicators, technological advancements, regulatory news, and market sentiment. Investors should remain vigilant and informed to navigate the potential ups and downs. As always in the crypto world, preparedness and adaptability are key.

Related: More from Bitcoin News | Trump Family backs ABTC: Expands Mining Fleet 12% in Bitcoin | BTC Surges to $68K Amidst Market Downturn in Bitcoin