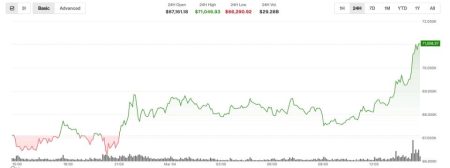

Can Bitcoin End Q4 on a Positive Note? Here's What the Experts Think

With the fourth quarter of 2023 already in motion, investors and cryptocurrency enthusiasts are keenly watching Bitcoin’s performance amid fluctuating market conditions and broader economic uncertainties. Historically, Bitcoin has shown a trend of dramatic shifts during the final months of the year. But can it end this Q4 on a positive note? Experts in the field have varied predictions based on several influencing factors, ranging from macroeconomic indicators to regulatory developments. Here’s a detailed look into the possible trajectories Bitcoin could take as the year draws to a close.

Key Takeaways

Economic Indicators and Bitcoin’s Trend

The global economy plays a significant role in determining the direction of cryptocurrencies, especially major ones like Bitcoin. This year, investors are particularly wary of inflation rates and interest rate hikes which generally push investors away from riskier assets, including digital currencies.

According to financial analyst Dr. Rebecca Harding, “When traditional markets experience turmoil or uncertainty, we often see a flight to safety among investors, which traditionally did not benefit cryptocurrencies. However, the perception of Bitcoin as a digital gold in times of inflation could temper this effect.”

Technological and Market Developments

Bitcoin’s intrinsic technological improvements, such as upgrades in scalability and security, could play a crucial role in boosting its market perception and performance. The upcoming deployment of the Schnorr/Taproot upgrade promises significant changes to improve privacy and efficiency, which might encourage bullish sentiment as Q4 progresses.

Moreover, the adoption rate of Bitcoin by mainstream finance, as seen with previous integrations into payment systems and the establishment of Bitcoin ETFs, will likely provide more stability and increase investor confidence. Fintech expert Simon Taylor mentions, “The integration of Bitcoin into more ETFs and as a payment mode by major corporations could uplift the market sentiment massively.”

Regulatory Climate

Regulatory news has always been a trigger for Bitcoin’s price volatility. Recent developments in major economies in cryptocurrency legislation and the increasing interest of governments in creating a regulatory framework for digital assets could either hinder or boost Bitcoin’s market performance during Q4.

Cryptocurrency lawyer Diana Stern states, “Positive regulatory frameworks, clear tax guidelines, and the acceptance of cryptocurrencies as a legitimate asset class in more countries could provide enough confidence in the market to push prices upward.”

Sentiment and Speculative Interest

Bitcoin is somewhat sentimental and driven by speculative interest. Elena Moreno, a cryptocurrency researcher, highlights that “While fundamentals are improving, a significant part of Bitcoin buying in Q4 will be speculative, driven by sentiments and influenced heavily by media narratives around traditional economies and the crypto space. Positive news tend to boost speculative buying.”

Expert Predictions

Given these considerations, expert predictions for Bitcoin closing Q4 on a high note are cautiously optimistic. While the underlying risks due to economic uncertainties cannot be ignored, the overall progression towards better technological infrastructure, positive regulatory approaches, and growing mainstream acceptance suggests that Bitcoin could indeed experience a strong finish to 2023.

In conclusion, Bitcoin’s journey through Q4 is expected to be dynamic and influenced by a mixture of economic indicators, regulatory developments, technological advances, and market sentiment. Investors should remain vigilant, considering both the risks and opportunities that lie ahead. As always, the cryptocurrency market’s inherent volatility calls for a strategic and informed approach to investment.

Related: More from Bitcoin News | Trump Family backs ABTC: Expands Mining Fleet 12% in Bitcoin | BTC Surges to $68K Amidst Market Downturn in Bitcoin