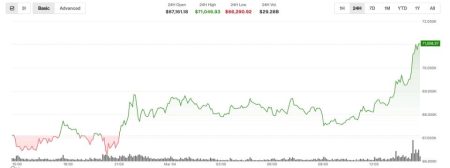

Cryptocurrency shares have declined significantly as Bitcoin moves back toward the $100,000 mark in conjunction with a selloff in the stock market on Thursday.

Key Takeaways

The recent downturn in crypto shares has contributed to the volatility in the market, with Bitcoin’s price fluctuating amid investor concerns. This movement reflects broader trends seen in the stock market, where various equities have also experienced declines, indicating a potential correlation between the markets.

As investors react to market conditions, Bitcoin’s approach to the $100,000 threshold has drawn attention from both cryptocurrency enthusiasts and analysts, who are monitoring the implications for future price movements. The interaction between cryptocurrency values and stock performance suggests that external economic factors may be influencing trading behavior across asset classes.

The current selloff in the stock market seems to be affecting investor sentiment within the cryptocurrency space. This environment may lead to increased caution among traders, impacting decisions about buying or selling assets in both markets.

Overall, the interplay between the decline in crypto shares and Bitcoin’s price trajectory underscores the dynamic nature of financial markets, where shifts can quickly alter investment strategies. The developments observed on Thursday may set the stage for future trading patterns as investors look for stability in an uncertain economic landscape.

Related: More from Bitcoin News | Trump Family backs ABTC: Expands Mining Fleet 12% in Bitcoin | BTC Surges to $68K Amidst Market Downturn in Bitcoin