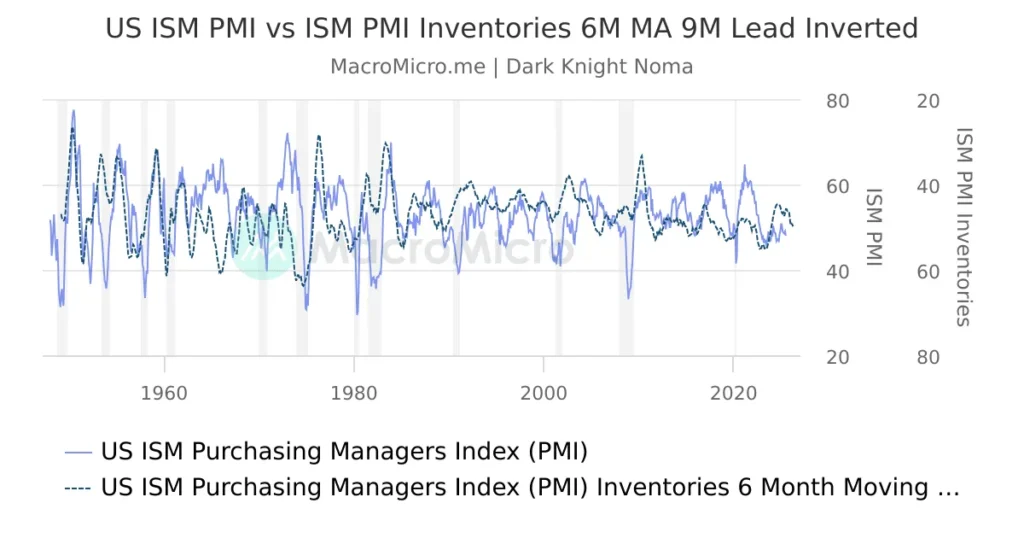

U.S. Services Sector Shows Resilience in October: ISM PMI Beats Expectations

In a somewhat encouraging sign for the U.S. economy, the Institute for Supply Management (ISM) reported that the Purchasing Managers’ Index (PMI) for the U.S. services sector came in at 52.4 in October, surpassing the expected figure of 50.8. This increase suggests a rebound in the services sector, which had been showing signs of strain under inflationary pressures and heightened economic uncertainties.

Overview of the ISM Services PMI Report

The PMI is a vital indicator of the economic health of the services sector, encompassing industries such as entertainment, hospitality, financial services, health care, and others. A PMI above 50 indicates expansion in the sector, while a score below 50 signals contraction. October’s reading of 52.4, therefore, points to growth, though modest, in the services economy.

Key Factors Driving the October Performance

Several factors contributed to the unexpected uplift in October’s services PMI:

-

Consumer Resilience: Despite ongoing challenges like inflation and the looming threats of economic slowdown, consumer spending in services has remained relatively robust. This resilience is crucial as consumer expenditure drives a significant portion of U.S. economic activity.

-

Employment Growth: The employment index, a component of the PMI, indicated growth, suggesting that businesses are still hiring, albeit cautiously. This is a positive sign that employers are optimistic about the future, given that employment levels can significantly impact consumer confidence and spending.

- Business Activity/Production: This component of the PMI also showed expansion. Increased business activity generally reflects higher demand for services, which in turn can stimulate more hiring and investment in the sector.

Implications for Economic Policy and Future Outlook

The stronger-than-expected PMI reading could influence the monetary policy decisions of the Federal Reserve, particularly with regards to interest rates. While the Fed has been on a rate-hiking path to combat inflation, sustained growth in the services sector might complicate this strategy. Policymakers will have to balance efforts to curb inflation without hampering growth.

Looking ahead, while the October PMI data brings a dose of optimism, the path forward remains fraught with challenges. Geopolitical tensions, supply chain disruptions, energy costs, and financial market volatility could all play crucial roles in shaping the economic landscape. Businesses and investors alike will need to remain vigilant and adaptable to these dynamics.

Conclusion

October’s ISM services PMI figure is a positive development for the U.S. economy, suggesting some underlying strength in the crucial services sector. While it’s too early to proclaim a definitive turnaround, the data adds to a complex yet hopeful picture of resilience amidst challenges. Stakeholders in the services industry and beyond will be watching closely to see if this improvement can be sustained as the final quarter of the year unfolds.