Title: Unraveling the Recent Selloff: Why Bitcoin ETFs Experienced $1.34 Billion in Outflows in Just Four Days

Key Takeaways

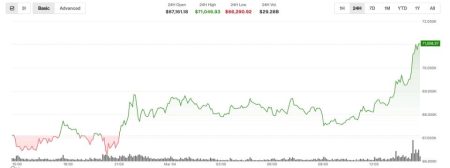

In a surprising shift for cryptocurrencies, Bitcoin exchange-traded funds (ETFs) witnessed a significant outflow of funds, totaling approximately $1.34 billion over a span of four days. This rapid withdrawal has raised eyebrows and prompted investors and analysts alike to probe into the underlying reasons for this exodus. The repercussions of these outflows extend beyond the immediate loss in investment, reflecting deeper economic, regulatory, and market trends that could have lasting impacts on the cryptocurrency landscape.

Reasons for the Outflows

Increased Regulatory Scrutiny:

One of the primary catalysts for the recent sell-off in Bitcoin ETFs has been the heightened regulatory scrutiny by financial watchdogs across the globe. In the United States, the Securities and Exchange Commission (SEC) has increased its oversight of cryptocurrency-related investment products, instilling a sense of uncertainty among investors. The fears of stringent regulations and potential bans have caused many to reconsider their investments in Bitcoin ETFs, leading to the observed outflows.

Market Volatility:

The inherent volatility of cryptocurrencies has always been a dual-edged sword, attracting investors with the promise of high returns, while simultaneously posing significant risks. Recently, this volatility has been exacerbated by macroeconomic factors such as rising interest rates, inflation concerns, and geopolitical tensions which have all destabilized the economic outlook. As a result, risk-averse investors seem to be pulling back from Bitcoin ETFs, preferring to wait out the period of turbulence.

Profit-Taking:

With Bitcoin having experienced a significant rally prior to this selloff, some analysts suggest that the outflows may be partially due to investors cashing in on their gains. This profit-taking, while normal in most bullish markets, can lead to accelerated drops as seen recently, particularly when large volumes are withdrawn in a short period.

Technological and Security Concerns:

Recent hacks and security breaches in various cryptocurrency platforms have also played a part in denting investor confidence. While ETFs are generally considered safer than dealing directly with cryptocurrencies, the fear of association with broader technological risks has led some investors to pull out.

Implications of the Outflows

Impact on Bitcoin Price:

The immediate impact of the large-scale outflows from Bitcoin ETFs is a drop in Bitcoin prices, as the sell-off increases supply relative to demand. This price adjustment can trigger further panic selling, initiating a vicious cycle of declining prices and outflows.

Investor Sentiment:

Investor sentiment, particularly among institutional investors, may take a hit due to these outflows. If major players view these outflows as a lack of confidence in Bitcoin or cryptocurrency ETFs as a stable investment vehicle, this could delay the wider adoption of cryptocurrencies in institutional portfolios.

Future of Cryptocurrency ETFs:

Despite the recent setbacks, it’s essential to consider the role of Bitcoin ETFs in providing a bridge between conventional investment mechanisms and the newer cryptocurrency market. Analyzing how these financial instruments bounce back from this episode will be critical in assessing their viability and resilience as a sustainable investment option.

Conclusion

The recent $1.34 billion outflow from Bitcoin ETFs over just four days has underscored the volatility and uncertainty inherent in the cryptocurrency market. As investors and regulators continue to navigate these turbulent waters, the future of crypto ETFs hangs in a delicate balance. Observing these movements provides crucial insights into market dynamics and investor behavior, offering valuable lessons for future financial strategies in the evolving world of cryptocurrencies.

Related: More from Bitcoin News | BTC Surges Above $71K Amidst Middle East Tensions in Bitcoin | Bitcoin ETF Inflows Fail to Boost Price: Analyst Explains Why