Bitcoin investment

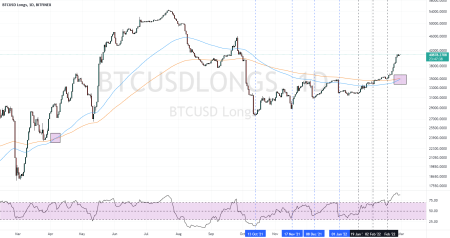

A mentor to Trump has made a significant investment of $653 million in Bitcoin, raising questions about Wall Street’s caution towards cryptocurrency.

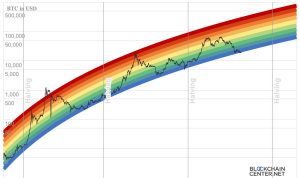

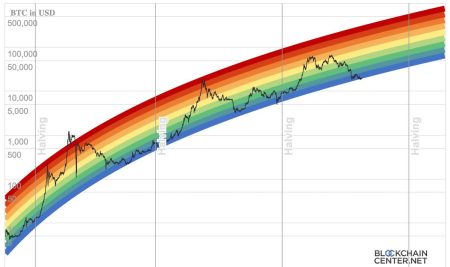

Despite the substantial bet, Wall Street has largely remained skeptical about the cryptocurrency market. Many traditional investors and financial institutions view Bitcoin and similar assets as volatile and risky. This reluctance to engage with Bitcoin could stem from various factors, including regulatory uncertainty and market fluctuations that make cryptocurrency a challenging investment.

The mentor’s investment comes amid increasing mainstream interest in cryptocurrencies, yet the hesitancy from established financial markets persists. While some investors are diversifying their portfolios with digital assets, others are sticking to conventional investments, fearing potential losses associated with the highly volatile Bitcoin market.

Crypto advocates argue that institutional investment could lead to greater legitimacy for Bitcoin. However, until a broader acceptance emerges from traditional finance, significant investments like this one may not change the overall sentiment in Wall Street.

In conclusion, despite the bold bet made by Trump’s crypto mentor, Wall Street’s cautious stance reflects the ongoing uncertainty surrounding cryptocurrency investments and their perceived risks.