$ETH short position

An address has shorted 7,368.8 $ETH using 25x leverage, setting a liquidation price at $3,953.3. The strategy employed involves a significant amount of leverage, which can amplify both potential gains and risks. Shorting assets typically indicates a bet against their price, and in this case, the address anticipates a decline in the value of $ETH.

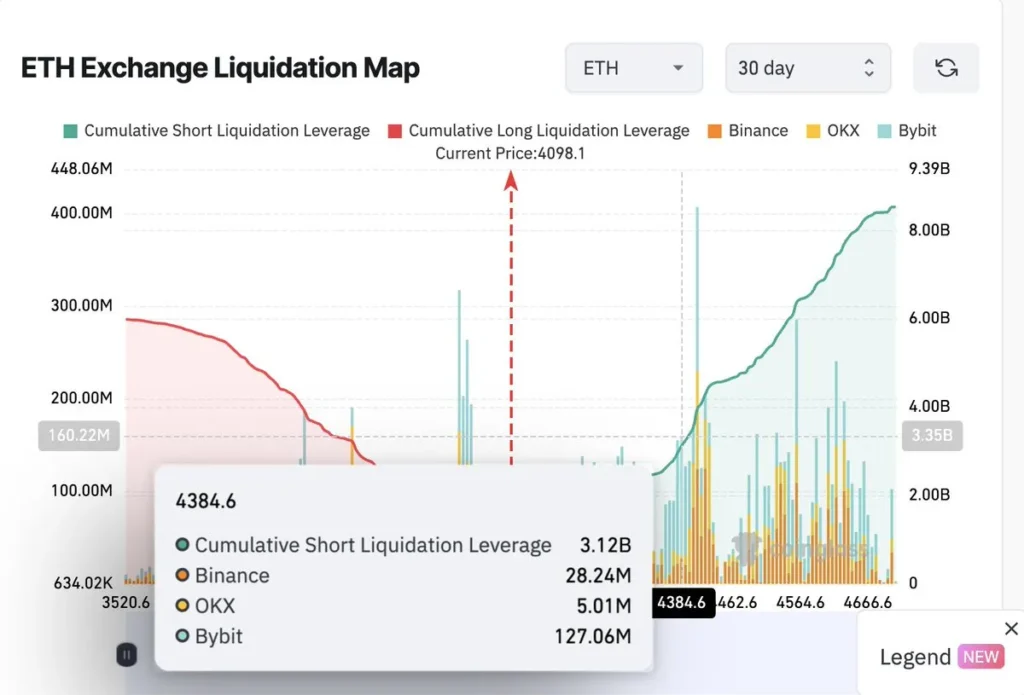

The liquidation price signifies the threshold at which the position would be forcibly closed to prevent further losses. If the price of $ETH rises above $3,953.3, the short position will be liquidated, resulting in a loss for the trader. This high leverage indicates a high-risk trading strategy, as even small price fluctuations can lead to significant financial implications.

Market participants often monitor such positions closely, as they can influence broader market trends. High leverage can lead to increased volatility, especially if many traders are utilizing similar strategies. The implications of this short position may extend beyond the individual trader, affecting overall market dynamics.

Understanding the risks associated with leveraged trading is crucial for investors. The potential for large losses makes it essential for traders to have a clear risk management strategy in place.