Title: US-China Trade Deal Marks the Biggest De-escalation Yet for Global Markets

In a significant turn of events, the United States and China have reached a landmark trade agreement, marking the most substantial de-escalation in trade tensions between the world’s two largest economies since the onset of the trade war. This breakthrough could potentially set a precedent for future international trade agreements and has had immediate bullish effects on global markets.

The Path to a Deal

The journey to this pivotal agreement has been fraught with challenges and economic uncertainties. The trade war commenced in 2018 when the US, under the leadership of President Donald Trump, imposed tariffs on Chinese goods, alleging unfair trade practices and intellectual property theft by China. In retaliation, China imposed tariffs on US products, impacting a wide range of industries including technology, agriculture, and manufacturing.

Years of negotiations, coupled with high-level meetings, finally culminated in a comprehensive trade deal under the administration of President Joe Biden. The two nations engaged in multiple rounds of dialogue, addressing core issues such as intellectual property rights, technology transfers, and tariffs.

Key Highlights of the Deal

The newly forged trade agreement between the US and China encompasses several critical elements:

-

Tariff Reductions: Both countries have agreed to significantly reduce tariffs on key goods. For the US, this means increased access to China’s vast market for agricultural and manufactured goods. For China, it means lower costs for the import of high-tech and agricultural machinery.

-

Intellectual Property Protections: China has agreed to enhance protections for US intellectual property rights, a longstanding issue that has been a central point of contention.

-

Technology Transfer and Market Access: The deal includes provisions that will prohibit forced technology transfers and improve access for US companies to China’s market, promoting a more balanced economic relationship.

- Enforcement Mechanisms: A robust enforcement mechanism has been established to ensure compliance with the agreement, addressing one of the critical concerns regarding previous engagements.

Impact on Global Markets

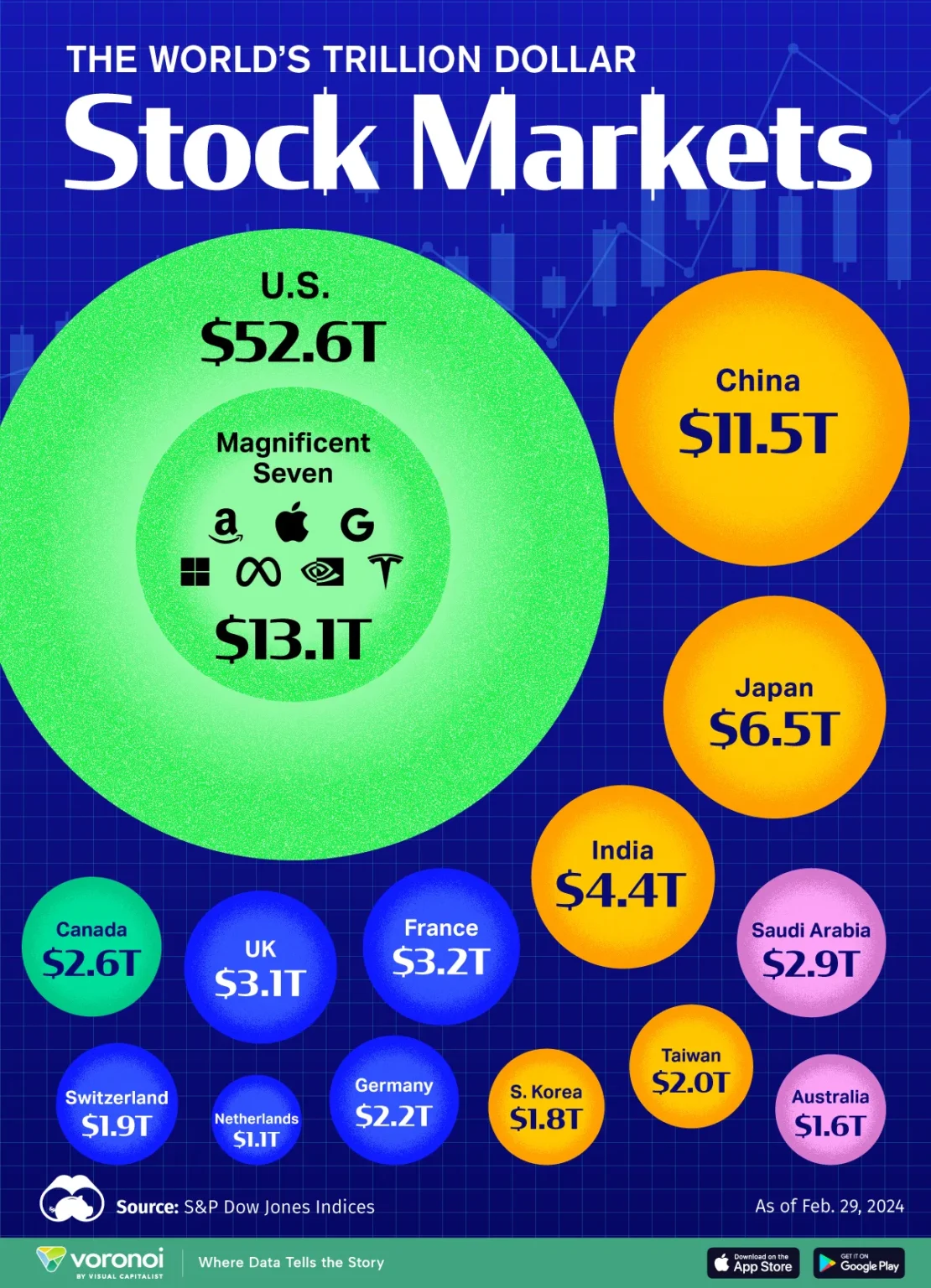

The announcement of the trade deal has been met with widespread optimism by global markets. Stock markets around the world rallied, with major indices in the US, Asia, and Europe posting significant gains. The agreement is perceived as a relief from the previously looming threat of an all-out trade war, which had caused market volatility and uncertainty.

Sector-Specific Implications

Agriculture: US farmers are set to benefit greatly from China’s commitment to purchase more agricultural products. This promises relief for a sector that had been particularly hit hard by the trade tensions.

Technology: Tech companies on both sides stand to gain from reduced tariffs and clearer rules around technology transfer and intellectual property rights.

Manufacturing: Manufacturers, especially in the automotive and machinery sectors, expect reduced cost burdens and better access to each nation’s market.

Looking Forward

While the deal represents a significant de-escalation in trade tensions and a substantial step toward normalized relations, analysts caution that some underlying issues remain unresolved. Nonetheless, the agreement lays a strong foundation for future negotiations and potential resolutions.

Conclusion

The US-China trade deal not only alleviates immediate economic and strategic tensions but also sets a hopeful precedent for international trade norms. It underscores the potential of diplomatic engagement in resolving conflicts and fostering global economic stability. As global markets respond with pronounced positivity, the international community remains watchful and optimistic about the enduring impact of this historic accord.