Reevaluating Bitcoin’s Predictive Models: The Power Law in the Spotlight Post-2025

In the ever-evolving world of cryptocurrency, predictive models have been crucial for investors and enthusiasts to forecast trends and prices. Amongst various models, the Stock-to-Flow (S2F) model once reigned supreme, purporting significant accuracy in predicting Bitcoin’s price based on its scarcity. However, as we moved into the year 2025, the S2F model faced unexpected deviations from its projections, leading to questions about its viability and prompting the crypto community to look for alternative predictive tools. One such model, the Bitcoin Power Law, has gained the spotlight.

Understanding the Bitcoin Power Law Model

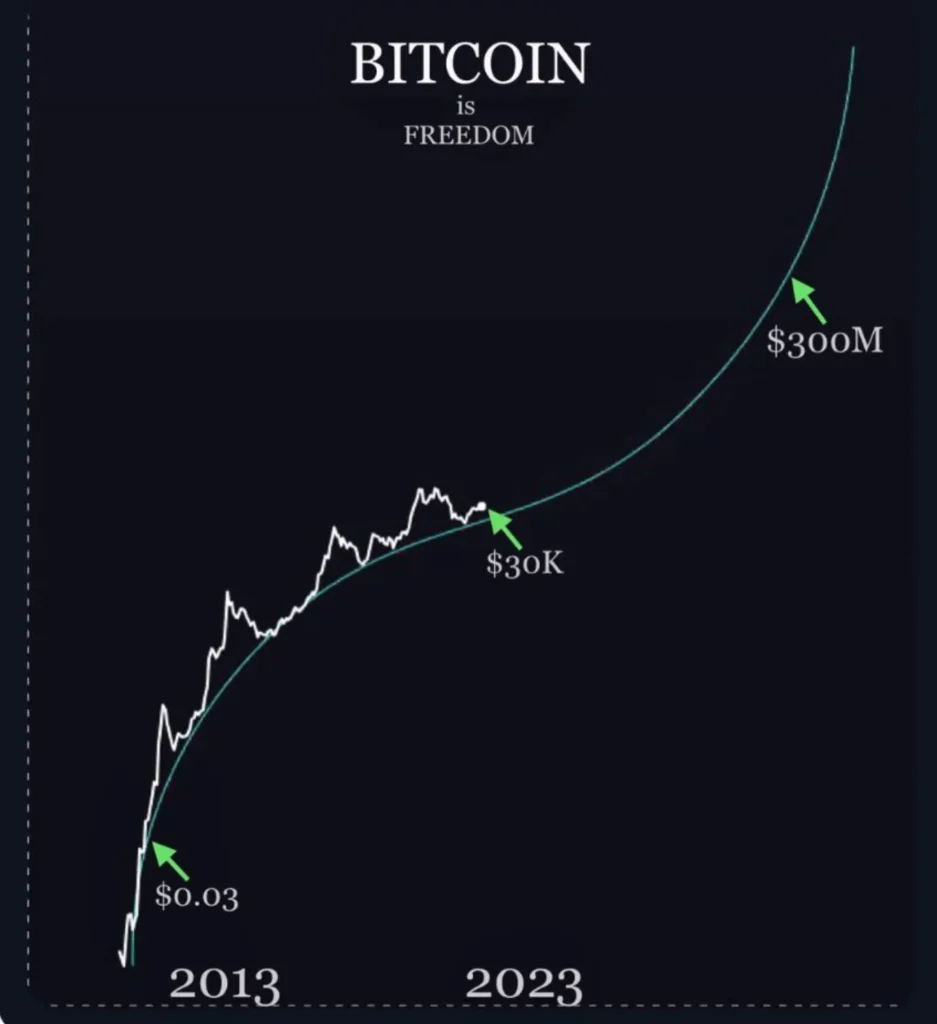

The Bitcoin Power Law model correlates Bitcoin’s market progression to a power law trajectory. Simplified, the model suggests that Bitcoin’s market capitalization grows at a rate that can be mathematically defined by a power function over a long-term horizon. This approach, unlike S2F, isn’t directly tied to the events like halvings (which reduce the rate at which new bitcoins are created) but rather follows a broader historical growth trend based on market dynamics and adoption curves.

Mathematical Representation:

[ P(t) = A cdot t^k ]

Where ( P(t) ) is the price of Bitcoin at any given time ( t ), ( A ) is a constant, and ( k ) is a coefficient determined empirically.

Analyzing the Model’s Validity in 2025

As of 2025, the Bitcoin ecosystem has undergone significant transformations. The halving of May 2024, initially expected to lead to substantial price increases as per S2F, resulted in less dramatic growth than anticipated, putting S2F’s reliability into question. In contrast, the Bitcoin Power Law model continues to align more consistently with long-term growth patterns.

Several factors contribute to its ongoing relevance:

-

Institutional Adoption: More companies and financial institutions are incorporating Bitcoin into their asset management strategies, broadening the market base beyond individual speculators and enthusiasts.

-

Technological Enhancements: Improvements in blockchain technology, scalability solutions like the Lightning Network, and enhanced privacy features in Bitcoin transactions continue to foster trust and increase its attractiveness as an investment and transaction medium.

- Regulatory Environment: Clearer regulations in key markets have begun providing a safer environment for both retail and institutional investors, helping mitigate some of the extreme volatility historically associated with Bitcoin.

Comparative Analysis with S2F Failures

The Stock-to-Flow model, which divides the total stock of bitcoins (mined so far) by the flow of new bitcoins (mining rate), indicated an increase in value tied to perceived scarcity. However, post-2024, the price movements diverged noticeably from S2F predictions. This discrepancy could be attributed to unforeseen market forces, such as regulatory changes and macroeconomic conditions, which can dilute the impact of scarcity on price.

The Power Law model, with its less rigid approach to growth (not tying directly to mining rates or perceived scarcity), seems to account more holistically for the unpredictable waves of technological and social change influencing market dynamics.

Is the Power Law Model Sustainable Beyond 2025?

While no model can predict future prices with complete accuracy due to inherent market uncertainties, the Power Law model has pleasantly surprised many with its resilience and adaptability. It encapsulates broader market behavior trends and less immediate shocks, unlike S2F and its focus on mining-driven scarcity.

Future viability will depend heavily on continued adoption, technological progress, and stable regulatory frameworks. However, the signs as of now point to the Power Law model maintaining a steady course, offering a valuable tool for those navigating the complex seas of Bitcoin investment.

Conclusion

The failure of the S2F model after 2024 has prompted the Bitcoin community to reconsider other predictive frameworks. The Power Law, emphasizing long-range growth trends and broader market forces, appears to be a more adaptable and enduring model, reflecting the nuanced and multifaceted nature of Bitcoin’s ecosystem as we continue forward into the decade. Whether for academic study or investment strategy, understanding and developing such models remains crucial to grasping Bitcoin’s future trajectory.