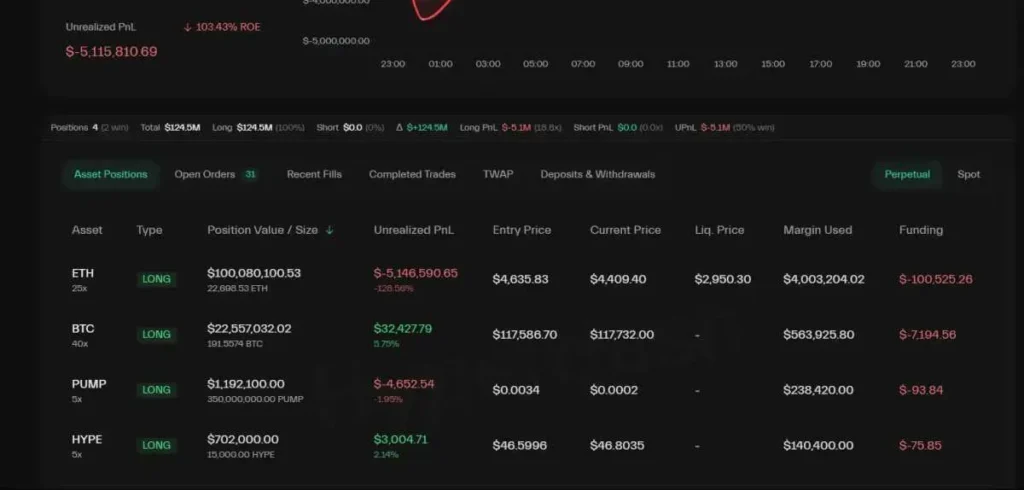

In the volatile world of cryptocurrency trading, fluctuations in market positions can lead to significant financial impacts. Recently, a notable trader known as “Buddy” has experienced a dramatic shift in his long position, with unrealized losses narrowing to $9.5 million. This is a remarkable recovery from a staggering peak loss that exceeded $20 million just weeks prior.

The cryptocurrency market is notorious for its rapid price swings, which can create both opportunities and risks for traders. Buddy’s situation exemplifies the challenges faced by many in the industry, where a single market movement can drastically alter one’s financial standing. Long positions, which involve buying assets with the expectation that their value will rise, can lead to substantial losses if the market moves in the opposite direction.

The recent narrowing of Buddy’s losses can be attributed to a slight rebound in the cryptocurrency market, as prices have shown signs of stabilization after a period of intense volatility. This recovery has provided some relief to traders who were previously facing dire financial situations. However, the market remains unpredictable, and the potential for further losses still looms.

As Buddy navigates this turbulent landscape, his experience serves as a reminder of the inherent risks in cryptocurrency trading. While the narrowing of losses is a positive development, it underscores the importance of risk management and strategic planning in the ever-changing market environment.