Bitcoin Braces for Fed Balance-Sheet Shift as Liquidity Cycle Turns

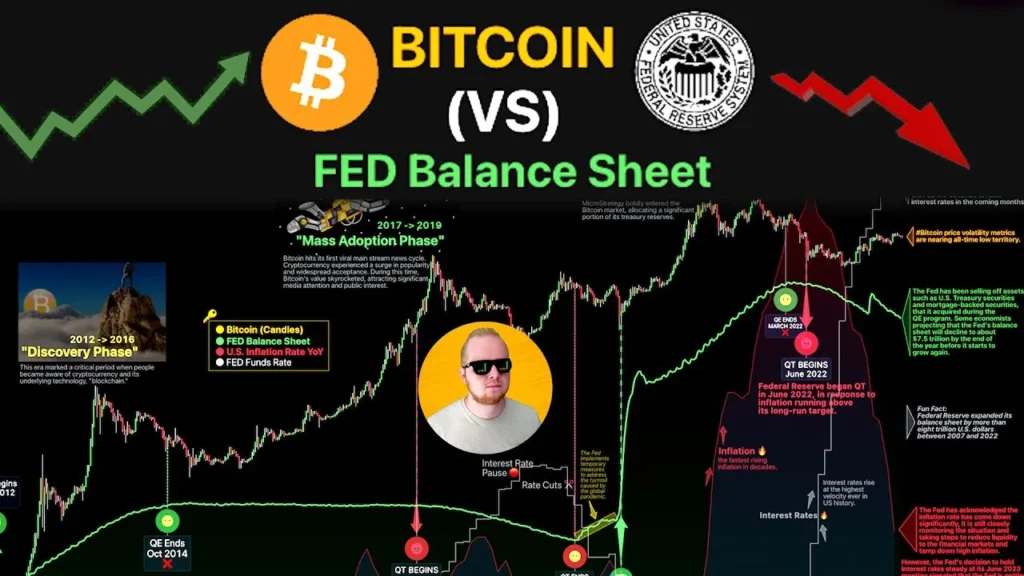

In the ever-evolving landscape of digital finance, one of the most significant factors influencing Bitcoin and other cryptocurrencies is the monetary policy enacted by the Federal Reserve. As the Fed plans to adjust its balance-sheet strategy, stakeholders in the cryptocurrency market are bracing for potential impacts.

Understanding the Fed’s Balance-Sheet Strategy

The Federal Reserve, the central banking system of the United States, plays a critical role in the country’s economic stability. It controls monetary policy, primarily through setting interest rates and managing its balance sheet, comprising assets like government securities bought to inject liquidity into the market.

During economic downturns, such as the COVID-19 pandemic, the Fed employed a strategy of quantitative easing (QE), buying a vast amount of securities to add more liquidity to the market. This increase in liquidity helped keep interest rates low, encouraging spending and investment. For cryptocurrencies like Bitcoin, this environment was favorable as investors sought high-return alternatives amidst low yields in traditional assets.

Shift in the Fed’s Strategy

In a bid to curb rising inflation and stabilize the economy post-pandemic, the Federal Reserve has signaled a shift in its balance-sheet policy. This change includes reducing its asset holdings, which essentially means pulling liquidity out of the market—a process often referred to as quantitative tightening (QT).

This shift marks the turning of the liquidity cycle and could have profound effects on various markets, including cryptocurrencies. The tightening could lead to higher interest rates, which typically make bonds and other fixed-income assets more attractive compared to riskier assets like stocks and Bitcoin.

Potential Impact on Bitcoin

Bitcoin, often regarded as a “digital gold” due to its finite supply and potential hedging against inflation, may face downward pressure as the liquidity cycle turns. Higher interest rates could dampen investor enthusiasm for Bitcoin as they pivot towards more secure yields from traditional assets. Historically, Bitcoin has shown sensitivity to policy shifts by major central banks, exhibiting declines when tightening policies are anticipated.

Moreover, as liquidity reduces, the overall appetite for risk diminishes. This sentiment could lead to reduced speculative trading in cryptocurrencies, influencing Bitcoin prices negatively. However, the inherent volatility of Bitcoin makes it a complex asset to predict, and while some investors may pull back, others might see any major dips as buying opportunities, believing in the long-term value proposition of decentralized digital currencies.

Broader Economic Implications

It’s important to note that the Fed’s balance sheet policy is just one of many factors that affect Bitcoin and the broader cryptocurrency market. Other economic indicators, geopolitical stability, technological advancements in blockchain, and regulatory changes also play critical roles.

Additionally, the global nature of Bitcoin means that while U.S. policies are influential, they aren’t solely determinative. Monetary policies from other central banks, such as the European Central Bank (ECB) and the People’s Bank of China, also impact the global flow of digital assets.

Conclusion

As the Federal Reserve shifts its balance sheet towards a tighter monetary stance, the effects on Bitcoin will be closely watched. While the tightening cycle suggests potential short-term declines due to reduced liquidity and a shift towards traditional assets, the long-term outlook for Bitcoin and other cryptocurrencies remains tied to broader technological adoption and regulatory frameworks.

Investors in Bitcoin should prepare for increased volatility and consider their positions carefully in light of changing economic tides dictated by the Federal Reserve’s policy shifts. What remains clear is that in the realm of digital finance, adaptability and a keen understanding of global economic cues are essential for navigating the future successfully.