Bears Wait to Pounce on Solana Price Amid SOL ETF Buzz

As the crypto market experiences bursts of volatile trading, attention has turned towards Solana (SOL), a high-performance blockchain supporting decentralized applications and cryptocurrencies. While the burgeoning buzz around a possible Solana-based Exchange Traded Fund (ETF) has sparked excitement among investors, it has also queued a cohort of bears looking to capitalize on potential price swings.

The Catalyst: Solana ETF Speculations

Speculation around a potential Solana ETF started gaining traction following a series of successful implementations and academic endorsements of the blockchain’s speed and low transaction costs, which arguably position it as a strong candidate for institutional adoption. ETFs, which track an underlying asset or group of assets, provide a way for investors to buy into cryptocurrencies like Solana without the complexities of managing digital wallets or directly engaging with the blockchain.

The Bearish Perspective

Despite positive speculations, some market observers remain circumspect, believing that the enthusiasm could be premature. Analysts point out that ETFs, while providing exposure to cryptocurrencies in regulated markets, could also lead to increased price volatility. This finer point has not escaped bearish traders, who anticipate potential downturns amid the euphoria.

The bearish argument hinges on a few factors:

-

Regulatory Uncertainty: While Solana’s technology is promising, the regulatory landscape for crypto-based ETFs remains murky. Any delays or denials from regulatory bodies such as the Securities and Exchange Commission (SEC) could deflate Solana’s price.

-

Market Sentiment and Speculation: The current price of SOL might already account for the speculated ETF’s approval. If the fund materializes, it could lead to a “sell the news” event where prices fall as hype wanes.

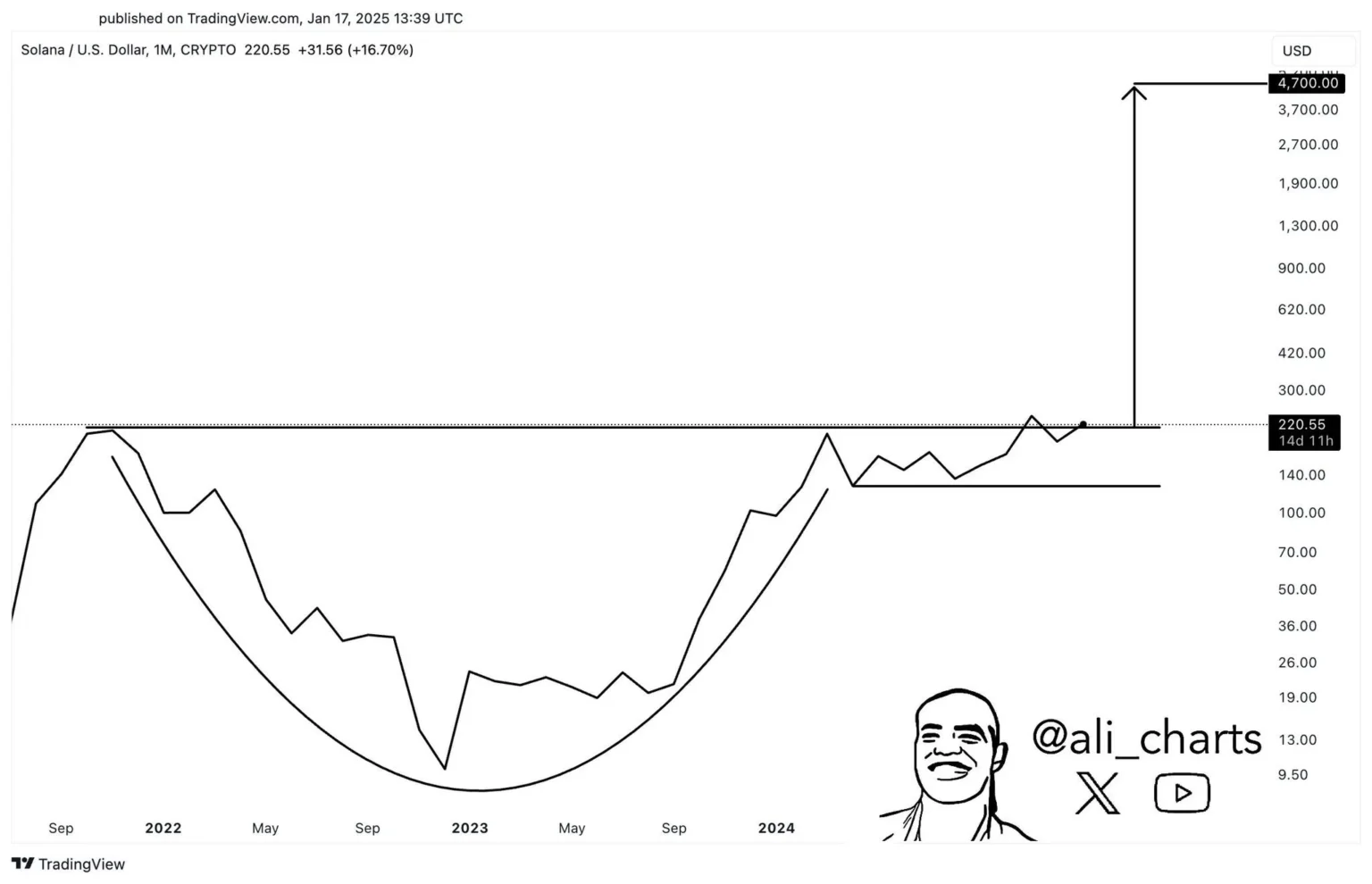

- Technical Resistance: From a technical standpoint, SOL’s price action is approaching a critical resistance, and without significant buying momentum, it might reverse course, providing an excellent entry for bears.

The Bullish Counterargument

On the other side of the spectrum, bullish investors are focusing on the potential mainstream adoption that an ETF could bring to Solana. Enhanced liquidity, broader exposure, and the reputational boost of an ETF listing are all seen as potential catalysts for an upward trajectory in SOL’s market value. Long-term supporters of Solana argue that the network’s fundamentals, including its scalability solutions and growing developer community, present a bullish case irrespective of short-term movements.

Market Implications

As the situation unfolds, the market awaits concrete developments regarding the Solana ETF with bated breath. The approval of such a fund could indeed be a significant milestone, validating the blockchain’s utility and attracting substantial institutional money into the ecosystem.

However, the volatility expected from such events suggests that both retail and institutional investors will need to stay vigilant. The increased interest may benefit the Solana platform and SOL token in the long run, but there could be numerous twists and turns in the short term.

For now, caution remains the watchword, with bears poised to pounce on any signs of weakness, and bulls ready to charge at signs of breakthrough, in the high-stakes environment of cryptocurrency investments. Whether this leads to a sustainable rally or a sharp correction will depend heavily on forthcoming regulatory and market developments. As always in the crypto world, unpredictability is the only certainty.