balance sheet normalization

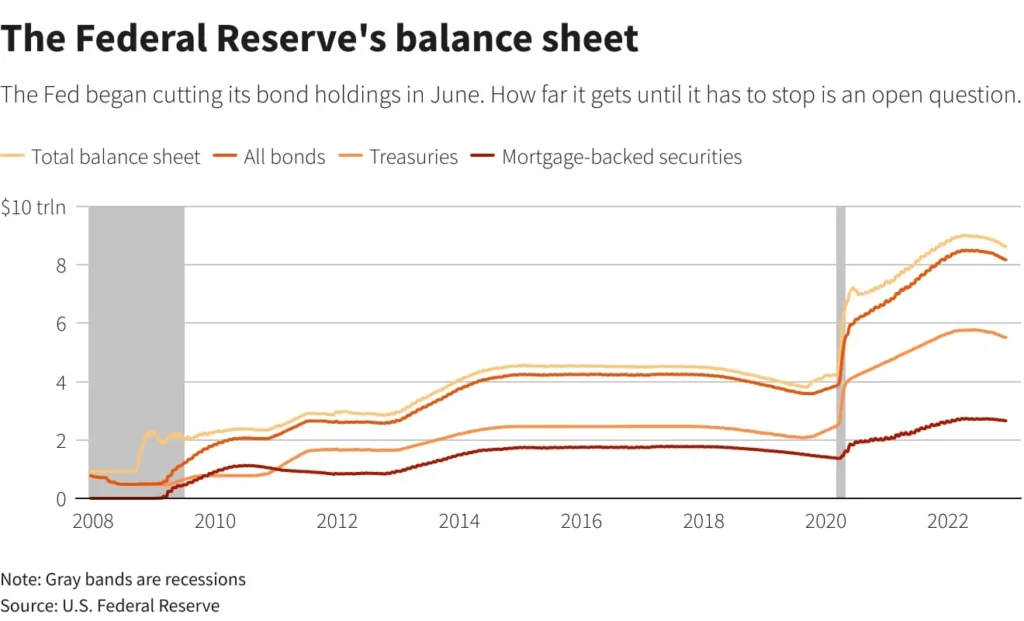

The Federal Reserve’s process of normalizing its balance sheet is nearing completion, while money markets are exhibiting signs of stress. This normalization process involves the Fed reducing its asset holdings, which were significantly expanded during previous economic interventions. As the Fed approaches the end of this phase, market participants are closely monitoring the implications for liquidity and interest rates. Recent indicators suggest that some segments of the money markets are feeling pressure, raising concerns about potential disruptions. Analysts are evaluating how these stress signals may affect broader financial stability as the Fed continues its course. The situation calls for vigilance as market dynamics evolve in response to the Fed’s actions.