Citigroup and Coinbase Partner to Expand Digital-Asset Payment Capabilities

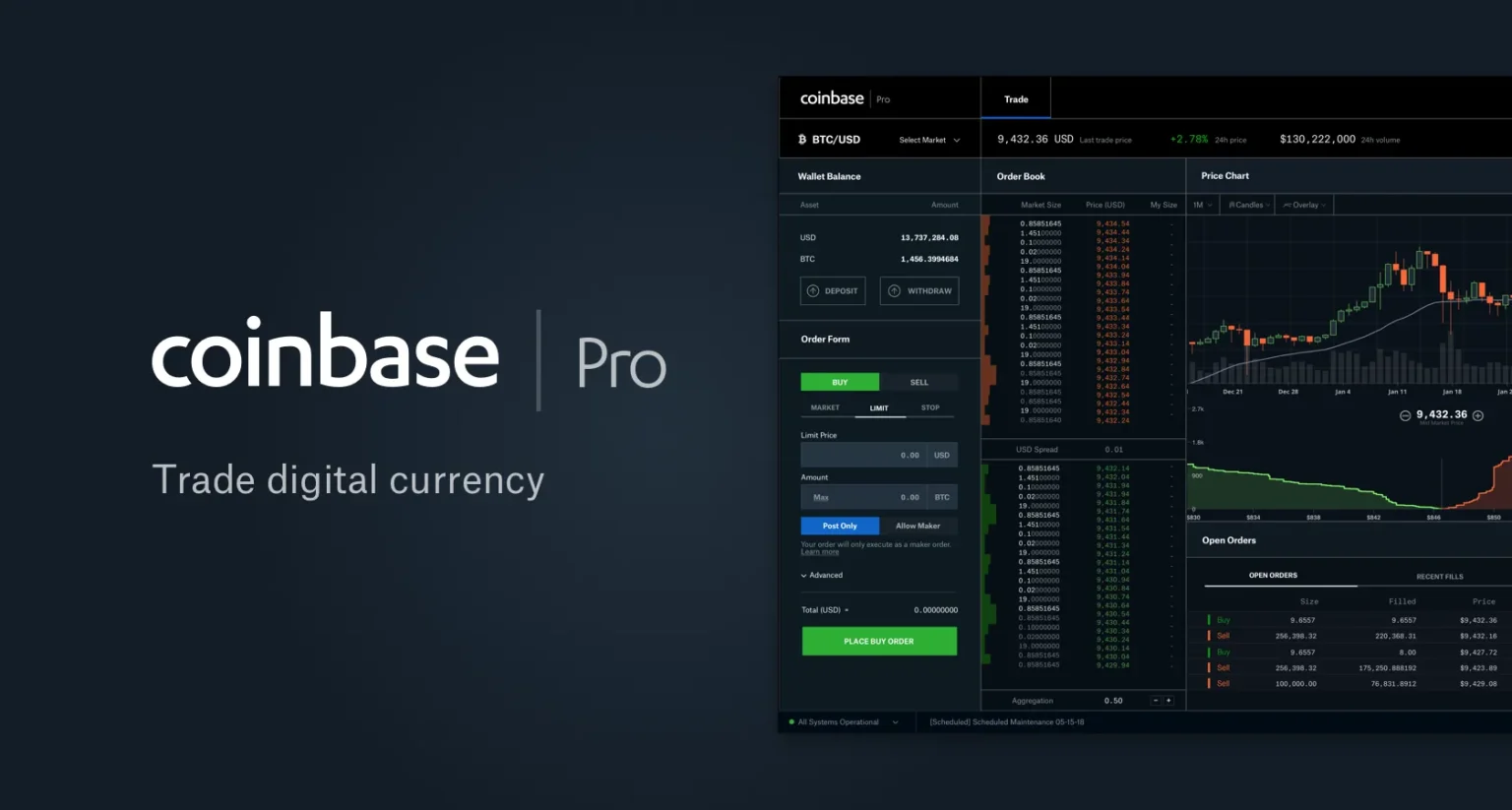

In a groundbreaking move, Citigroup, one of the leading global financial services companies, has partnered with Coinbase, a foremost cryptocurrency exchange platform. This collaboration, announced earlier this month, aims to enhance and expand digital-asset payment systems, demonstrating a significant step towards the integration of traditional banking with modern blockchain technology.

The Genesis of a New Financial Era

The partnership between Citigroup and Coinbase marks a historic point in the trajectory of digital assets. Citigroup, with its immense global infrastructure and deep roots in the financial industry, brings reliability and a broad customer base to the table. Coinbase, on the other hand, lends its cutting-edge technology and expertise in the blockchain space.

This fusion aims to make transactions with cryptocurrencies smoother, safer, and more accessible to Citigroup’s expansive clientèle, from individual consumers to large corporations. The primary objective is to allow these users to make seamless transitions between fiat and digital currencies, enhancing the liquidity and utility of cryptocurrencies as an everyday financial tool.

Key Features of the Partnership

-

Enhanced Payment Gateways: Building on Citigroup’s expansive network, the partnership aims to provide a robust platform for secure and efficient cryptocurrency transactions, reducing processing times and costs.

-

Regulatory Compliance: Both companies are committed to adhering to the rigorous regulatory standards that govern global financial transactions. This compliance will not only protect consumers but will also fortify the integrity and stability of the digital asset markets.

-

Innovative Financial Products: CoinJournal reports that the collaboration is set to introduce innovative products that could include cryptocurrency credit cards and integration of blockchain technology with traditional banking services.

- Education and Resource Sharing: Citigroup and Coinbase are dedicated to providing education and resources for their users. This initiative is expected to promote a greater understanding of digital assets, driving their adoption in mainstream financial practices.

Potential Impacts and Industry Reactions

This strategic partnership has been met with enthusiasm and optimism across the financial industry. Experts suggest that this alliance could pave the way for other major banks to explore similar collaborations, thereby further validating the role of cryptocurrencies in mainstream finance.

Clients and investors have expressed positive sentiments, foreseeing easier access and greater confidence in dealing with digital assets. Moreover, analysts predict this move could leverage both companies’ strengths, potentially increasing their market shares and influence in their respective domains.

Challenges and Considerations

While the partnership is promising, it also faces challenges such as fluctuating cryptocurrency values, security concerns, and the need for continuous adaptation to rapid technological advancements. Additionally, navigating the complex landscape of global financial regulations will require consistent efforts and innovation from both Citigroup and Coinbase.

Towards a Digital Future

The Citigroup-Coinbase partnership is more than just a business agreement; it’s a statement on the future of finance. It underscores the increasing acceptance of cryptocurrencies and opens up numerous possibilities for their use in everyday financial dealings. As digital assets continue to evolve, such collaborations will be crucial in shaping a financial ecosystem that is both inclusive and efficient.

In conclusion, this partnership not only represents a significant milestone for Citigroup and Coinbase but also for the broader financial industry. It signals a shift towards more integrated, technology-driven financial services that promise to redefine our understanding and usage of money in an increasingly digital world.