When Will MicroStrategy Buy Bitcoin Next? Michael Saylor Drops a Hint

In an environment where cryptocurrency investment patterns have become increasingly integral to digital asset market dynamics, all eyes are often on corporate giants and how they navigate the crypto space. Among those giants, MicroStrategy has established itself as a frontrunner in corporate Bitcoin investments. The avid and outspoken supporter of Bitcoin, Michael Saylor, the co-founder of MicroStrategy, recently hinted at the company’s future purchasing plans concerning the cryptocurrency, stirring discussions and speculations in investment circles.

MicroStrategy, under Saylor’s leadership, has long been bullish about Bitcoin, turning heads with its aggressive buying strategies. As of the latest updates, the company holds an impressive cache of Bitcoin, making it one of the largest corporate holders worldwide. This strategy, while risky, has placed MicroStrategy at the center of attention concerning Bitcoin investment trends.

Saylor’s Strategy and His Latest Hint

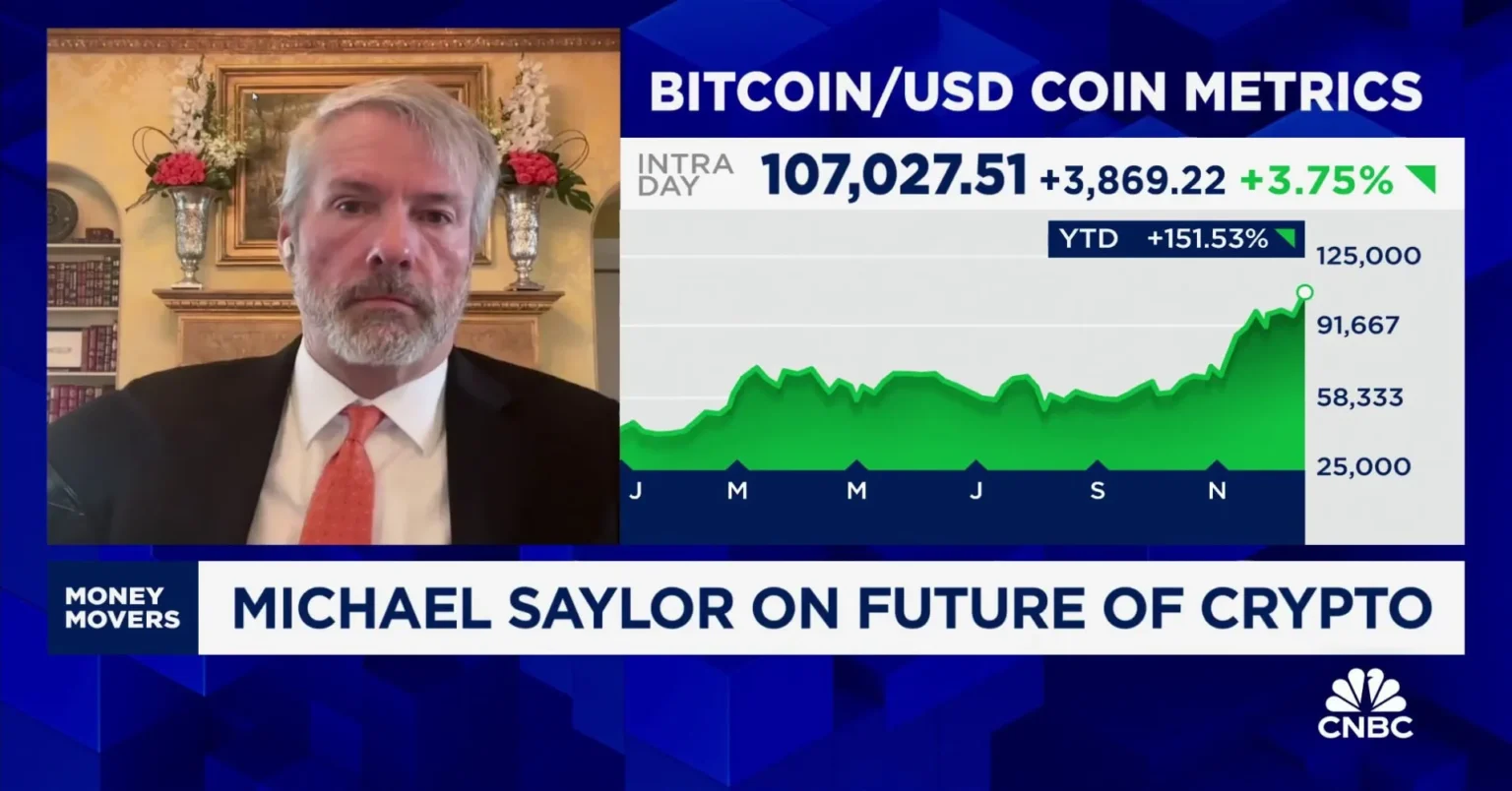

Saylor’s strategy for Bitcoin has always been clear–he views the digital asset as a compelling inflationary hedge and a cornerstone for the new digital economic structure. His latest comments in an interview with a well-known financial news outlet suggest that MicroStrategy’s appetite for Bitcoin is far from satiated.

During the interview, when questioned about the timing for the next Bitcoin purchase, Saylor gave a hint that left much room for analysis. He mentioned that the company continuously monitors the market for favorable conditions and that their next significant investment would likely align with certain macroeconomic adjustments and a favorable regulatory climate. Though he didn’t specify an exact date or condition, this suggests that MicroStrategy’s future investments in Bitcoin are thoughtfully timed and are not merely impulsive decisions.

Decoding the Hint

Saylor’s comments can be decoded to mean that MicroStrategy is looking for a stable or lower price point combined with regulatory clarity before making another significant purchase. This aligns with past behavior where the company has capitalized on price dips to increase its holdings substantially.

Investors and analysts closely watch such indicators, including regulatory news and Bitcoin’s price volatility, to predict MicroStrategy’s next move. The broader implication of Saylor’s hint suggests that while the company remains bullish on Bitcoin, it is also strategically cautious, ensuring that its investment moves align with both internal financial health and external market conditions.

The Broader Impact

MicroStrategy’s purchase strategies not only affect its stock but also tend to influence the Bitcoin market itself. Given the size and visibility of MicroStrategy’s investments, the company’s buying actions often create positive sentiment, driving up prices due to the perceived increase in institutional trust and validation of Bitcoin.

On the flip side, the timing and scale of MicroStrategy’s investments are viewed under the lens of broader economic indicators. This makes Michael Saylor’s comments and hints particularly impactful for market watchers and individual investors alike, providing insights not just into MicroStrategy’s strategies but also reflecting larger economic sentiments and trends.

Conclusion

As we anticipate MicroStrategy’s next move, Michael Saylor’s recent hint suggests a calculated approach, balancing between macroeconomic indicators and regulatory developments. This not only underscores the evolving and maturing landscape of corporate investments in cryptocurrencies but also highlights the critical role played by influential corporate figures like Saylor in shaping market perceptions and confidence in digital assets like Bitcoin.

Investors, whether in the stock market or the crypto space, would do well to keep an eye on MicroStrategy’s movements, as they could potentially signal broader shifts in the digital asset landscape, influenced by one of its most prominent corporate backers.