Bitcoin Options Market Cautious as Traders Hedge Against Volatility

In recent months, the Bitcoin options market has displayed a cautious temperament, as traders increasingly seek to hedge against potential volatility. This trend highlights a significant shift in sentiment, reflecting concerns about economic uncertainties, regulatory changes, and technical factors impacting the cryptocurrency landscape.

Understanding the Bitcoin Options Market

Options are financial derivatives that provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as Bitcoin, at a predetermined price on or before a specific date. The Bitcoin options market has grown exponentially as both retail and institutional investors look for ways to manage risk while potentially capitalizing on Bitcoin’s price movements.

Factors Driving Hedging Behavior

-

Economic Uncertainties:

The global economy is still grappling with the fallout from the pandemic, rising inflation rates, and shifting monetary policies by central banks, including the U.S. Federal Reserve. These factors contribute to a volatile environment for all asset classes, including digital currencies like Bitcoin. -

Regulatory Changes:

The regulatory landscape for cryptocurrencies continues to evolve across different jurisdictions. Recent proposals and rulings in major markets like the U.S., Europe, and Asia have prompted traders to adopt a more defensive stance, using options to guard against any adverse impacts of regulatory decisions. - Technical and Market Factors:

Bitcoin’s inherent volatility can be attributed to various technical factors, including large-scale liquidations, changes in network hash rate, and shifts in investor sentiment driven by news and social media. Furthermore, historical precedence such as the Bitcoin halving events tend to affect the market’s direction and are closely watched by options traders.

Response of the Market

The observed caution in the options market is evidenced by specific trends and metrics:

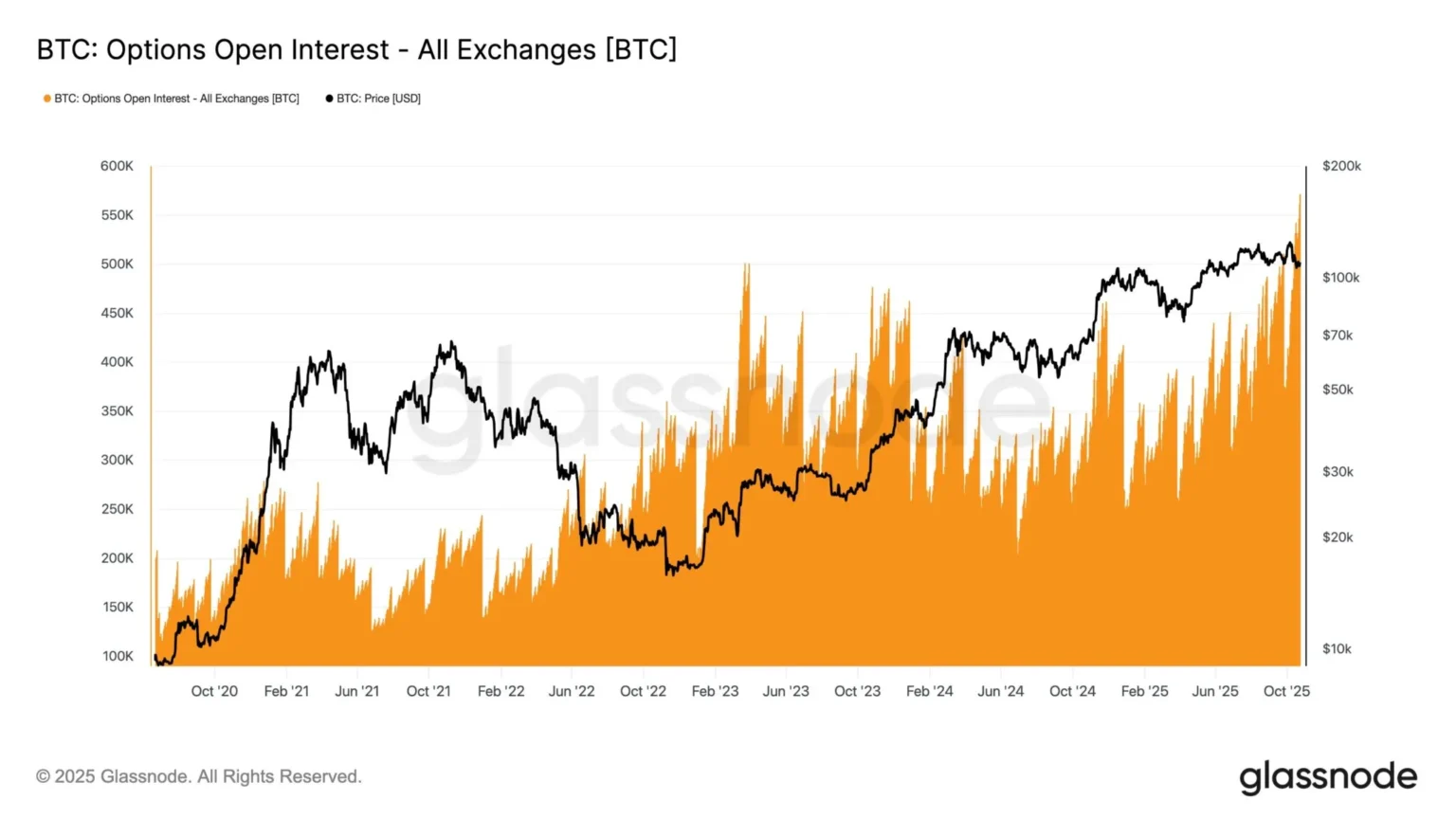

- Increase in Options Volume: There has been a notable increase in the volume of traded Bitcoin options, suggesting that more traders are flocking to these financial instruments to hedge their positions or speculate on future price movements.

- Higher Premiums on Options: The uncertainty and expected volatility have led to higher premiums on options contracts. This is especially true for put options, where the cost to secure a sell position has increased, indicating a defensive posture by investors.

- Interest in Far Dated Options: Traders are also showing increased interest in options with longer expiration dates. This shift reflects a strategy to manage risks associated with prolonged uncertainty rather than just short-term volatility.

Implications for Investors

For investors, the growing caution in the Bitcoin options market signifies a phase of heightened risk and potential reward. Those using options as part of their investment strategy should consider:

- Diversification: Using a mix of options, futures, and spot trading can help manage risks more effectively.

- Professional Advice: Especially for newer traders, consulting with financial experts who understand both the traditional and crypto markets can provide valuable guidance.

- Continued Education: Keeping abreast of market trends, regulatory news, and technical analysis is crucial.

Looking Ahead

As Bitcoin continues to mainstream and attract attention from various sectors, the role of derivative markets like options is expected to become increasingly critical. Traders and investors will likely continue to use these financial instruments to hedge their bets or speculate in an attempt to boost returns in a landscape that remains unpredictably dynamic.

In conclusion, the cautious stance in the Bitcoin options market is a reflection of broader market uncertainties and intrinsic volatility. While this may suggest a bearish outlook to some, for others, it represents an opportunity to strategize and possibly profit from the ongoing fluctuations. As always, the key will be in how well market participants can adapt to the continuously changing dynamics of the cryptocurrency world.