In a significant move to modernize the financial landscape, Swift has announced its plans to integrate a blockchain ledger into its infrastructure. This development aims to facilitate 24/7 cross-border payments for global financial institutions, marking a pivotal shift in how transactions are processed internationally.

Historically, cross-border payments have been fraught with delays, high fees, and a lack of transparency. Traditional banking systems often operate on limited hours, which can hinder timely transactions and create inefficiencies. Swift, known for its messaging services that connect banks and financial institutions worldwide, recognizes the need for a more streamlined approach to international payments.

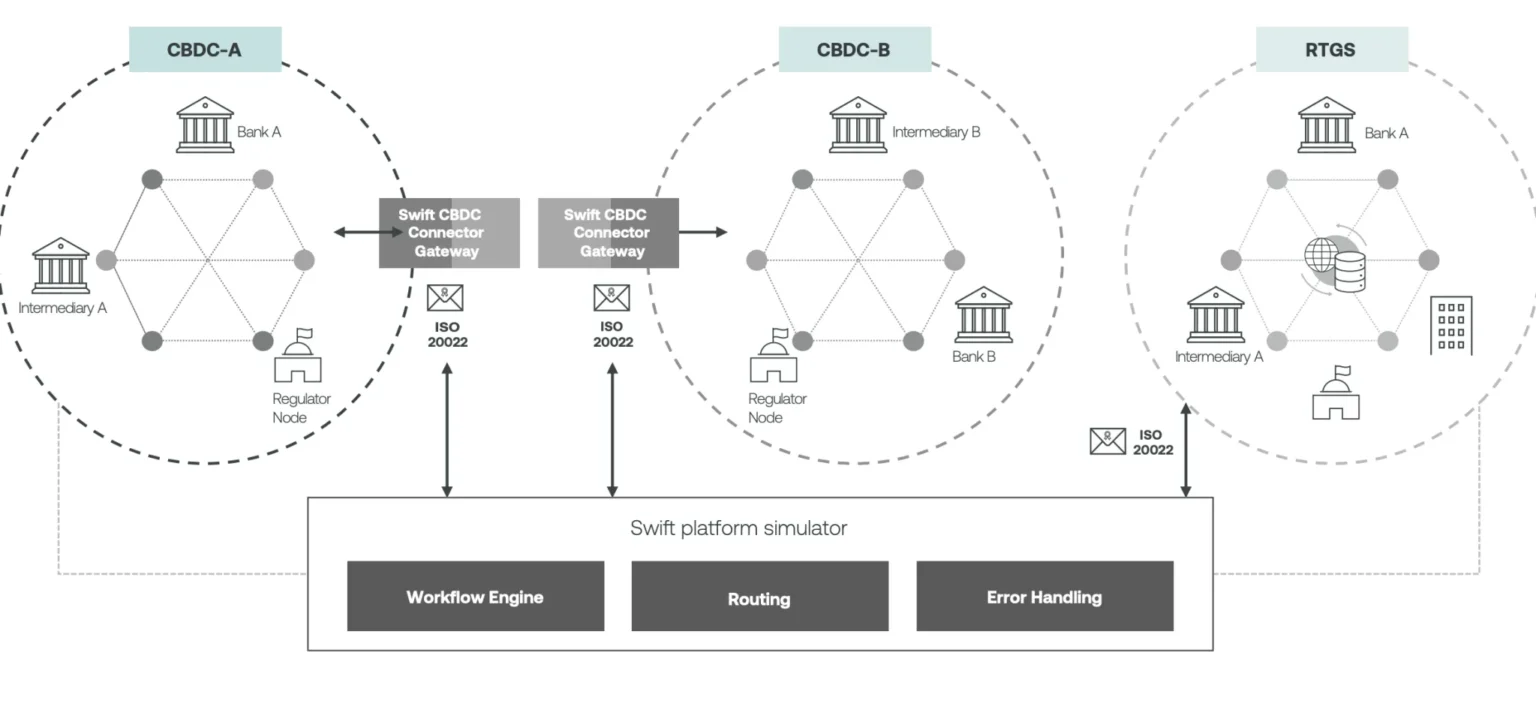

By leveraging blockchain technology, Swift intends to provide a decentralized ledger that enhances the speed and security of transactions. This innovation is expected to reduce the time taken for payments to settle, allowing institutions to operate more efficiently and cater to their clients’ needs around the clock. Moreover, the transparency offered by blockchain can help mitigate fraud and enhance trust among parties involved in cross-border transactions.

As financial institutions increasingly seek to adapt to a digital-first world, Swift’s initiative represents a crucial step forward. The integration of blockchain not only promises to revolutionize payment processing but also positions Swift as a leader in the evolving landscape of global finance. With this move, Swift is set to redefine the future of cross-border payments, ensuring that financial institutions can operate seamlessly and efficiently in an interconnected world.